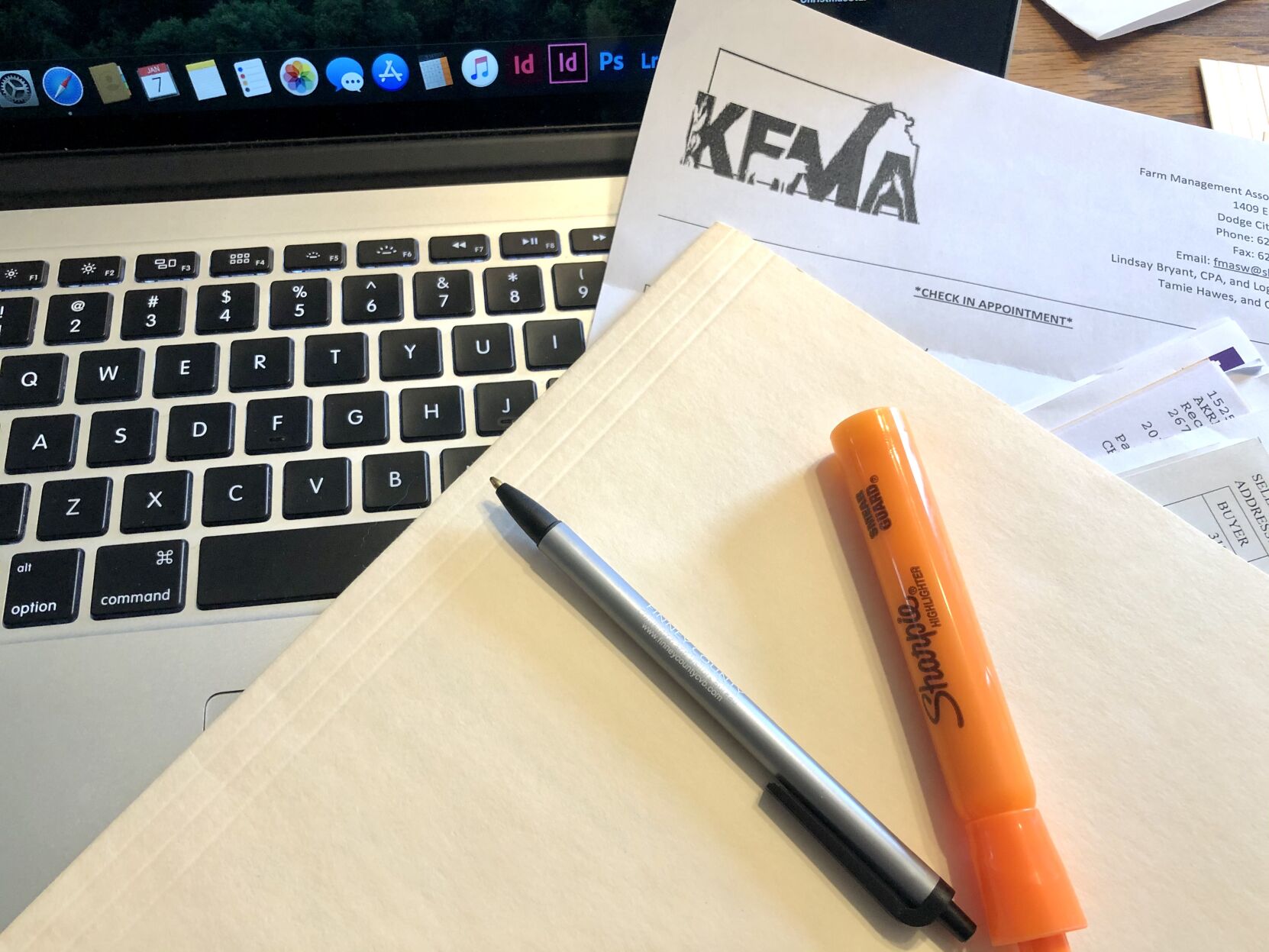

A few weeks ago a letter came from the Kansas Farm Management Association reminding me to schedule a year-end meeting if we wanted an income tax estimate and to get our paperwork in order.

I don’t know about you, but it just seems like we JUST finished the 2019 stuff. The tax filing deadline was extended because of COVID in 2020, but we managed to get them done on time without any delay.

I get incredibly anxious gathering all the necessary information for our tax professional to look over. The first year we managed to get a good refund and it felt like we were able to get ahead on the feed bill and bank notes. A three years ago we had to pay, and let me tell you that was stressful.

I had a few vacation days during the last weeks of December, so I emailed our economist and asked if I could still get an estimate in before the deadline. I could, but it would have to be done that afternoon. As I sat down at my computer to gather what I needed to give her, I evidently had more work ahead of me than I really thought. Needless to say, I didn’t make it in time, but now my records are more in order than they were before I started.

Just like I’ve been trying to work on gathering and compiling our records, I’ve been trying to write a blog post about this process. Initially, I started this post in the middle of December. More than once I came back to it and changed and rearranged my words. When I would complete a thought, I’d get stuck and move on to something else of more importance.

Same thing happened with my financial records. I couldn’t find something I needed so I moved on to something else. Then I got to a point where I was frustrated and didn’t come back to it until it was too late. Two weeks is not good enough to get a year’s worth of records in order, especially when you think you can spend half a day compiling numbers in a spreadsheet for her.

You’d think I would have learned my lesson having to pay the IRS a few years ago, and do all I can to not have to pay. That lesson remains unlearned for me, but I’m just going to blame one more thing on COVID.

So I’m sure there’s someone out there who has a better system than I do. Can you share your hints, tips and tricks to keeping track of household and farm expenses, and how you compile them for your tax professionals? It’s got to be better than my file folders, spreadsheets, and hours spent finding everything.