Arkansas loses a cotton gin in 2023, reflecting larger trend

The gins that remain can process much higher volumes than in past years, thanks to innovations from field to gin. One of those includes compacting harvested bolls into rectangular or round modules to improve storage and transport.

At first glance, the loss of a cotton gin in Arkansas seems to reflect the waning number of cotton acres in any given year, but the picture is a little more complex, said Scott Stiles, extension economics program associate for the University of Arkansas System Division of Agriculture.

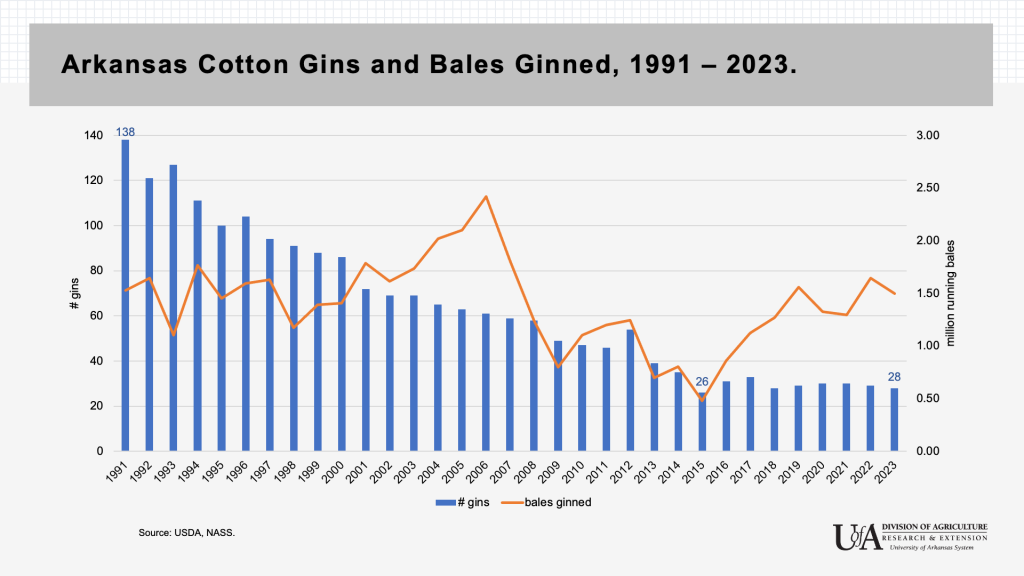

An annual report of gin numbers from the U.S. Department of Agriculture’s National Agricultural Statistics Service found that 28 gins were operating in Arkansas in 2023, one less than the previous year. NASS does not indicate the specific gin that closed. The number of gins in Arkansas has dropped from 138 in 1991 to 28 in 2023.

There are 14 counties with gins, most of them nearer the Mississippi River. One is closer to central Arkansas in White County.

“This reflects a larger trend that has been underway since the early 20th century,” Stiles said.

“Due to increasing yields, the number of bales ginned in Arkansas has been very similar in recent years to what it was in the early 1990s,” he said. “However, the number of gins available to process the state’s cotton has decreased significantly.”

The gins that remain can process much higher volumes than in past years, thanks to innovations from field to gin. One of those includes compacting harvested bolls into rectangular or round modules to improve storage and transport.

“Every component of the ginning has evolved over the years to be faster and more efficient, from the module feeding system, to the gin stands — the machines that separate the fiber and seed — to the bale press,” Stiles said. “There’s also an emphasis on turning out a ‘cleaner,’ more contamination-free bale of cotton. It’s very high tech.”

In 1991, total bales ginned in the state was just under 1.53 million bales putting the average bales per gin at about 11,075 bales. By 2022, with just 29 active gins, Arkansas processed roughly 1.64 million bales, or about 56,691 bales per gin. However, about 9 percent of that was from out of state, mostly from Mississippi and Missouri.

By comparison, in 2023, the average volume per gin dropped a bit to 53,402 bales, but so did acres planted in Arkansas. That year, Arkansas cotton acres declined by 130,000.

“In recent years we’re seeing more cotton modules being hauled in from neighboring states,” he said. “Over the last five years, gins in the state have brought in 108,000 bales per year on average from across state lines. This is another by-product of the module and the ability to transport seed cotton greater distances.

“The module and the ability to haul these over a great distance has also contributed to the continued decline in gin numbers,” Stiles said.

Acre volatility

Between 1991 and 2023, the number of cotton acres harvested in Arkansas has swung from a low of 207,000 in 2015 to a high 1.16 million in 2006 and everywhere in between. These acreage swings are driven largely by the commodity markets.

“Over the past 30 years, our growers discovered they could grow high-yielding corn, soybeans, and more recently peanuts and many discontinued the centuries-old practice of monocrop cotton in the Delta counties and grain bins replaced gins,” Stiles said.

“These wide swings in cotton acreage really began in the early to mid-90s as we irrigated a higher percentage of the crop acres in the state and changes to farm programs gave growers more flexibility to respond to markets.

With 86 percent of the world’s cotton being produced outside of the U.S., “it’s very much a global market to compete in and the U.S. relies almost exclusively on being able to export cotton,” Stiles said. “Brazil and Australia are increasingly taking a larger share of the Chinese market, which has historically been our primary destination for cotton.”

He said that with “irrigation, growers in the state can respond to market signals and grow what the market wants and thus choose the crop that’s most profitable. Irrigation, along with the climate and the soil, all combine to expand our crop options here in the Delta.

An additional upside is that “cotton can be easily rotated with corn, soybeans, and peanuts with much of the same equipment being used prior to harvest,” Stiles said “We can grow not only corn and soybeans, but cotton, peanuts, rice, and other crops. I’d say our cotton acres are volatile for that reason.”

PHOTO: A decline in Arkansas cotton acres is part of the story behind the decline in the number of cotton gins. (U of A System Division of Agriculture file photo)