The U.S.-Mexico border gets all kinds of attention, czar or not, record numbers of immigrants streaming over the border or not. This has political implications when it comes to talking about northbound foot traffic.

There is a better situation with U.S. crop exports to Mexico, but it is also, in part, a troubling story that has exposed issues crossing into that country.

Mexico is important to U.S. crop exports

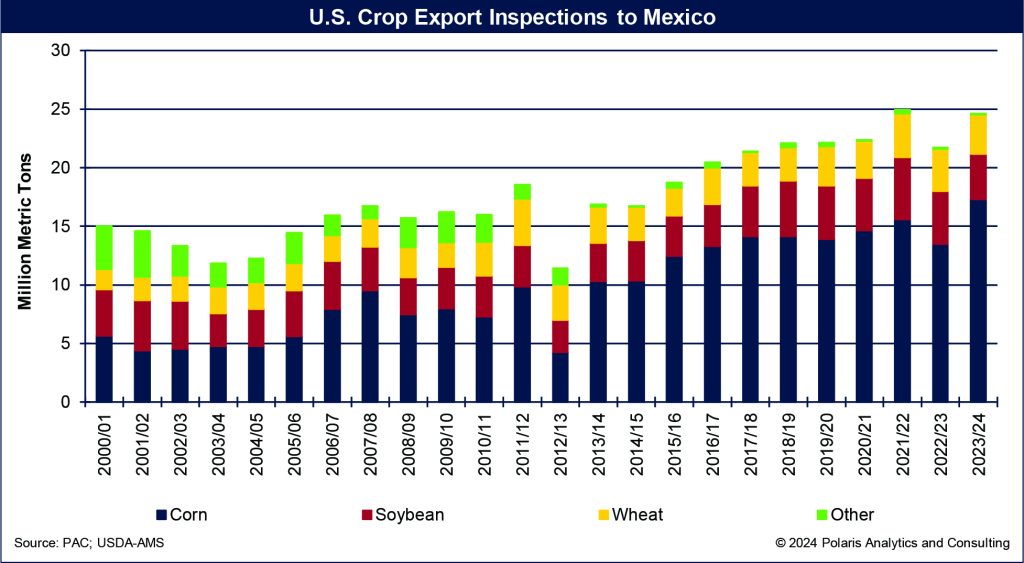

Missing out in the border discussion is how much moves southbound over the border. Mexico is the largest buyer for U.S. corn and wheat, by a long shot. Mexico supplanted Japan as the number one buyer of U.S. corn in 2015-16 and wheat in in 2016-17 and has not looked back.

The volume of U.S. soybeans flowing to Mexico is not too shabby either. Yes, it’s a distant second to China, but it’s well ahead of any other country and slightly more than wheat volumes. Mexico is an important market that relies on U.S. crops for its food and feed security, and most of the crops Mexico buys originate from the High Plains. U.S. crop export inspections to Mexico are shown in the following figure.

Problems getting trade to Mexico

Getting exports into Mexico has become problematic the past two years. Last year’s rampant migrant movement closed various key border crossings for several days, which disrupted trade. However, there are many other ongoing issues leading to increased delays crossing the U.S.-Mexico border. Some issues raised by industry include the ever exciting yet important sanitary and phytosanitary, fumigation and paperwork matters.

Last month, U.S. Wheat Associates convened a rail workshop in Mexico City to foster open discussion on how best to address various issues. I was invited to discuss the rail situation and outlook for the U.S. rail sector through 2024 into 2025. Rail is important for U.S. wheat exports with between 70% and 80% of all volumes shipped by rail.

As a commodity association representing the interests of U.S. wheat producers, USW is working to ensure the safe and timely delivery of wheat to the Mexican market. Mexico relies on U.S. wheat for its food industry to make breads, snack foods and pasta.

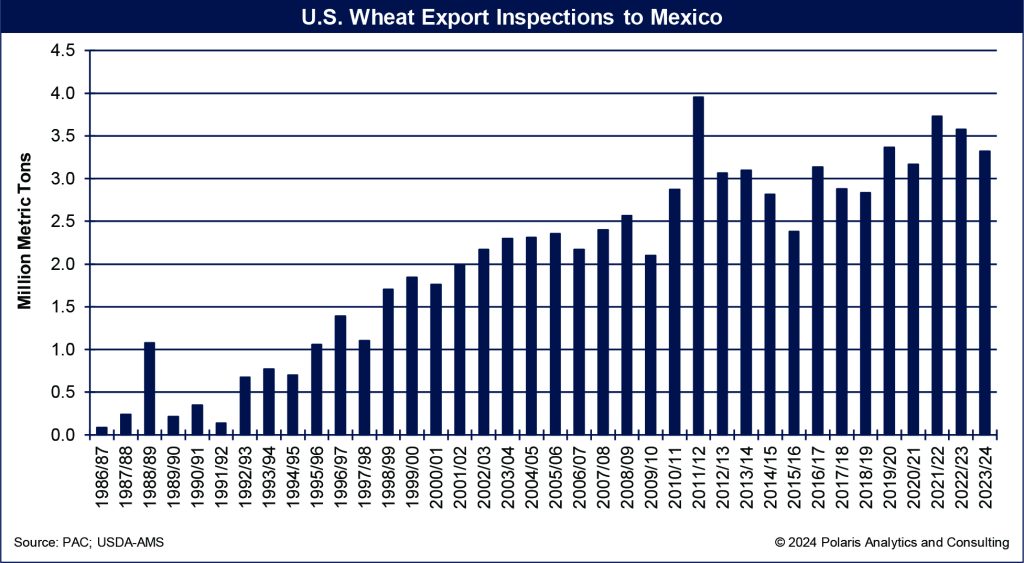

U.S. exports of wheat to Mexico have steadily increased, nearly doubling since the early 2000s to more than 3.7 million metric tons in 2021-22 before delays slowed trade. U.S. wheat export inspections to Mexico are shown in the following figure.

In Mexico, there are 90 wheat-milling locations. The millers who own those operations buy a high proportion of their wheat from the United States. Although there are 57 shuttle train facilities (capable of receiving trains with more than 100 railcars) in Mexico, only seven are used for wheat.

Nearly three-quarters of the U.S. wheat railed into Mexico enters through the Laredo and El Paso, Texas, U.S. Customs districts. The El Paso crossing has seen steady growth, taking volumes from the Laredo crossing.

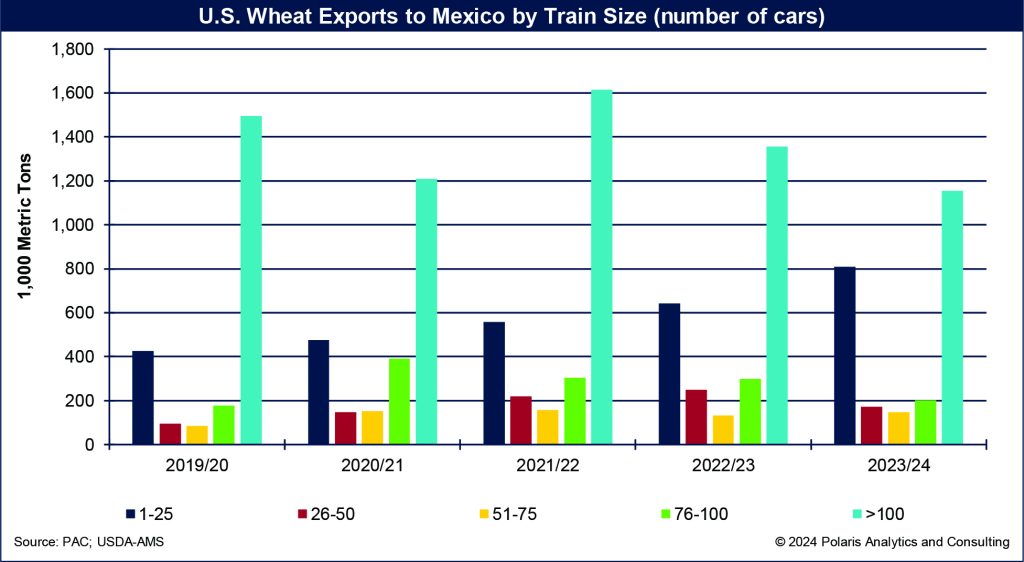

By train size, U.S. wheat exports are moved in lots of 1-25 cars or 100 cars or more. Shipping wheat in train sizes of 100 cars or more is considered a “shuttle train” move, which allows for efficiency and cost benefits, if certain loading and unloading requirements are met. The volume of U.S. wheat exports by train size is shown in the accompanying chart.

Mexico millers sound off, welcome support

Listening to the millers, most of them experienced rail delays receiving U.S. wheat during 2023 and 2024, and the delays are trending higher. They indicated the delays have mostly been headaches. However, some millers bought wheat from other suppliers or ran out.

Because of the delays receiving U.S. wheat, the more alarming concern is that some Mexican wheat buyers decreased U.S. wheat purchases and bought elsewhere. Some millers bought the same amount of wheat but used ocean vessels to avoid the land border. The situation in buying from the U.S. has become dire, and Mexican wheat buyers are seeking alternatives to secure necessary supplies of wheat.

Keeping trade flowing to Mexico

The attendees at the workshop represented the wheat supply chain, millers, railroads, traders, commodity and industry associations and government agencies. The attendees appreciated the open discussion and desire to see border crossings improved. The challenge for U.S. wheat and other crop exports moved by rail is they compete for capacity with other products and commodities that demand rail service with Mexico.

Being able to keep the dialog open and transparent is crucial, and sharing data is important to address the issues. USW is striving to see more U.S. wheat access Mexico, protecting the flows moving now. Doing so will require a team approach to keeping the border fluid and open for trade.

Ken Eriksen can be reached at [email protected].