Is the cow jumping over the moon more moonshot or nonsensical?

The nursery rhyme “Hey Diddle Diddle” includes whimsical imagery that has captivated the minds and imaginations of children for centuries. Perhaps the most well-known line is “The cow jumped over the moon.”

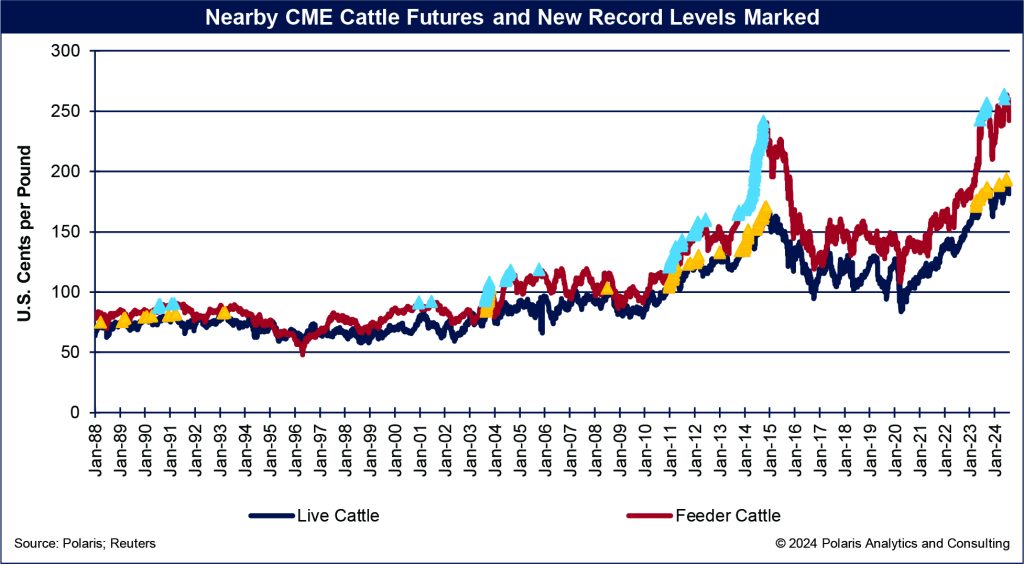

There is no imagination with today’s cattle market, although it is captivating. The cattle futures markets have been leaping for the moon through all of 2023 and into 2024. But is leaping more nonsensical or a moonshot? By nonsensical is it irrational? By moonshot is it ambitious?

The live cattle futures, for example, achieved record highs five times during 2024, posting a record of 194.2 cents per pound on June 27. The feeder cattle market hit two records this year, pegging 246.6 cents per pound on May 28.

Records made to be broken

Included on the live and feeder cattle futures chart are markers that reflect when the respective cattle contract achieved a new record throughout their histories. The records of the past two years are remarkable, taking off like a moonshot, but they had to surpass the impressive price runs from 2013 to late 2014, when the cattle market last leapt. (The live cattle peaked at 171.0 cents per pound on Nov. 17, 2014, while feeder cattle peaked at 242.3 cents per pound on Oct. 8, 2014.)

Prices reflect the historic low inventories of all cattle and calf levels of 87.2 million head as of January 2024. (USDA-NASS discontinued publishing the July inventory numbers for this year, so the January count must suffice.) If the July inventory count of all cattle and calves were available, it most likely would be a historical low as well. If history is the guide and given the change in inventory levels from January to July, then inventory levels for July of this year are likely to be less than 94 million head.

For more analysis on the cattle cycle, see the Horizons column from May 6, “Cattle cycle bottoms to historic low. Will peak be historic low?”

‘High prices cure high prices’

As Adam Smith, the grandfather of classical economics, discussed, and as my former employer Willard Sparks espoused, “High prices cure high prices.” Look back to the chart that was just discussed. When prices surged to record levels in late 2014, what happened from 2015 through 2021? Feeder cattle prices collapsed and mostly hovered between 125 to 150 cents per pound as cattle and calf inventories rebounded. The inventory rebound brought more supply to the market, compared to demand for products.

The record cattle prices of 2023 through 2024 are ambitious and captivating, but as the cow that jumped over the moon experienced, it returned to earth. These prices could have more room to run until the reality of improved inventories are upon the market. Remember, it was in October and November 2014 when the prices peaked and turned lower. Inevitably, irrational levels of these prices will return lower, and supply and demand, or economics, does its work. More importantly, it is the cattle farmer who endures the various price environments, raising cattle and sending them to market.

Damage has been done

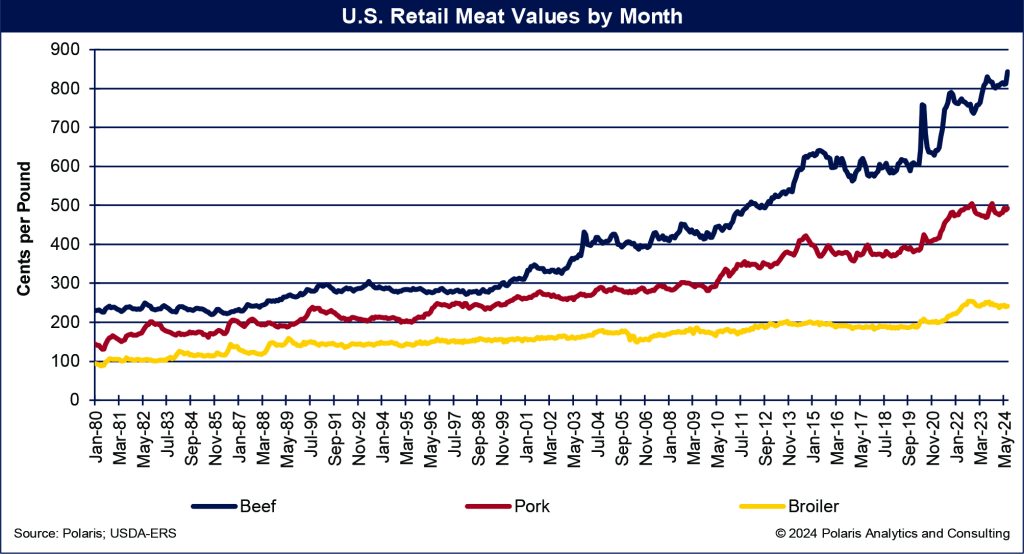

These high cattle prices are one side of the equation. The other side is what has happened farther downstream in the supply chain. The prices that consumers pay at retail for beef products are also at record levels. On Aug. 14, the Economic Research Service at USDA released its monthly “Meat Price Spreads,” and they showed a disconcerting trend: higher prices. That is something politicians are discussing with all types of solutions, but that is another column for another day.

The retail price that consumers paid for beef during July was record high at 843.3 cents per pound, a monthly increase of nearly 4% while up 1.5% from the previous July. These beef prices are nonsensical to consumers, who have choices in what they buy and where they buy food, especially their protein purchases.

Compared to beef, pork and broiler prices are cake walks. Pork prices were up nearly 1% in July to 492.2 cents per pound, which was 4.6% above the price from the previous July. The price of broiler meat during July was up 0.3% from June, while down 3.6% from prices in July 2023.

While the “Hey Diddle Diddle” rhyme may defy logic, consumers are not defying the choices they have. In economics, this is called the substitution effect. As prices rise for one item, consumers look for something comparable at a lower price. Consumers have switched from beef to poultry and continue to do so. This was featured in the May 18 column, “What the Beef is Going On?” The bottom line is this, when beef prices rise, consumers eat less beef.

There is another economic phenomenon called hysteresis that describes situations where there is interruption, such as higher beef prices that lead to the substitution effect of consumers eating other lower priced meat. The thought is, once the interruption is resolved, beef prices relax, consumers return to what they did before the interruption, and in the case of beef, eating what they once did.

However, what happens is that the interruption allowed the substitute or alternative to gain favor. Looking at high beef prices in the past, consumers did reduce beef consumption, but once prices relaxed, the consumer did not return to the same consumption pattern and kept eating more chicken instead.

That the cow jumped over moon is nonsensical. So too it is that consumers will return to eating beef like they used to. Overcoming this challenge requires an ambitious beef industry to attract the imagination and appetite of the consumer to eat more beef. I, for one, have no illusion of how much I enjoy eating beef. It’s what’s for dinner!

Ken Eriksen can be reached at [email protected].