Farm economy experts at the recent Ag Forum in Austin told attendees to expect much debate on the shaping of a new farm bill that will most likely be written with little or no increases to commodity program funding.

The 2014 Farm Bill was adopted during times of record commodity prices and expires at the end of September. The new farm bill discussions are coming at a time when farm revenue has declined 50 percent over the last four years—the largest drop since the Great Depression.

And special interest groups are targeting agriculture spending.

“They would like to eliminate commodity program payments and revenue insurance, have no safety net for farmers at all,” said Joe Outlaw, Texas A&M AgriLife Extension Service economist and co-director of the Agricultural and Food Policy Center at Texas A&M University in College Station. “I don’t think we will see those extremes, but there are groups out there that have this philosophical way of thinking.”

That’s in stark contrast to the $6.79 trillion economic output the U.S. food and agriculture industries contribute to the nation’s economy. Texas’ major commodity association leaders emphasized at the Austin meeting how important federal funding is to major crops to help cover rising production costs during times of low prices—as has been the case the past four years.

“There’s only so much money to go around in funding the farm bill and everyone wants the best safety net that producers can get,” Outlaw said.

The outlook for higher commodity prices is not in the cards anytime soon, according to several economists who gave outlook projections.

For livestock, more beef cows continue to be added to U.S. inventory, adding more beef to an already growing supply chain and pressuring prices.

“We’ve got reason to be pessimistic on the demand side,” said Scott Brown, agricultural markets and policy economist, University of Missouri. “We have more cattle throughout the system. We are going to have a lot more cattle supplies for the next two to three years. When we put more meat supplies in front of consumers, prices fall.”

Farm income levels are projected to remain flat, according to Pat Westhoff, Food and Agricultural Policy Research Institute director, University of Missouri.

“We are looking at a bit of an increase in net farm income, but when you factor in inflation, overall things are projected to be relatively flat,” he said.

The good news for farmers trying to keep production costs in check is that natural gas prices are forecast to hover around $3 per million cubic feet, Westhoff said.

“That keeps costs low for drying grains and producing fertilizer as a result of these projected low natural gas prices,” he said. “There’s not a lot of projected changes for either fertilizer or fuel.”

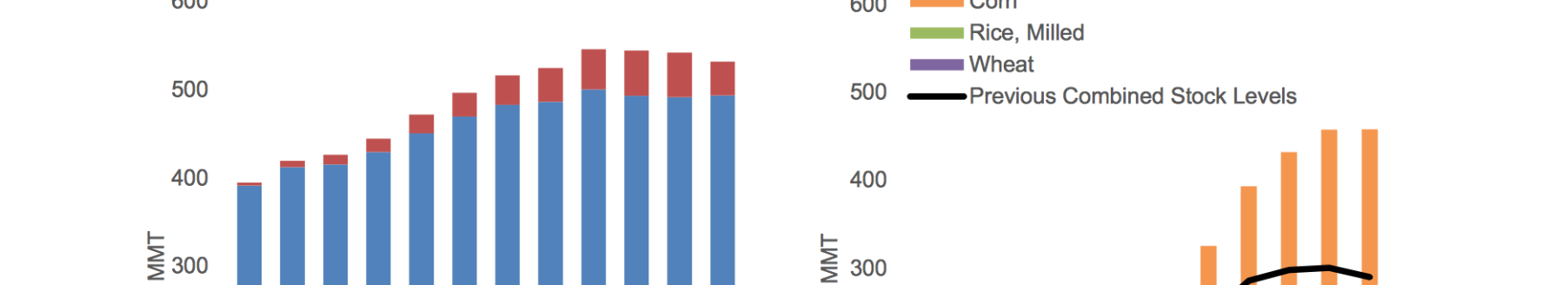

World production of the four major crops—wheat, corn, rice and soybeans—has jumped dramatically over the last decade, a result of technological advances and favorable weather.

“Wheat, corn, rice and soybean production has increased 52 percent in 14 years time; it’s just amazing what has happened in terms of production,” he said. “The growth is due to a combination of higher yields and expansion in areas such as China and India where there’s been double and triple cropping. Overall, there’s just lots of supply out there.”

To work off large supplies of major commodities, such as corn, Westhoff said increase in per capita consumption needs to occur in the biofuels sector.

“U.S. corn is used in these ethanol plants,” he said. “China uses corn and soybean meal for feed. China is up to 160 million in metric tons of corn used and that’s projected to grow as their ethanol use would require more importing of corn. That’s one area to watch carefully.”

The corn marketing year average is projected at $3.55 a bushel, Westhoff said. While those prices may cause harm for farmers needing $4 a bushel to break even, the livestock sector would benefit from low grain prices in the feedlots.