Fall 2018 fertilizer prices turn mostly higher

Given current soybean prices, many producers will consider planting additional acres of corn, wheat and cotton in 2019. While final spring 2019 planting decisions are months away, fertilizer, and especially nitrogen, are a significant share of the crop budgets for these crops. This column reviews current fertilizer prices and the upturn in prices in recent months.

Fertilizer mostly higher

For most products, prices in September were higher than in the spring (April through May). Urea and diammonium phosphate prices have both increased 6 percent in recent months. Liquid nitrogen prices are up 28 percent and potash prices are also higher, up 2 percent.

Anhydrous ammonia prices, so far, have been contrarian and turned lower since spring, down 4 percent.

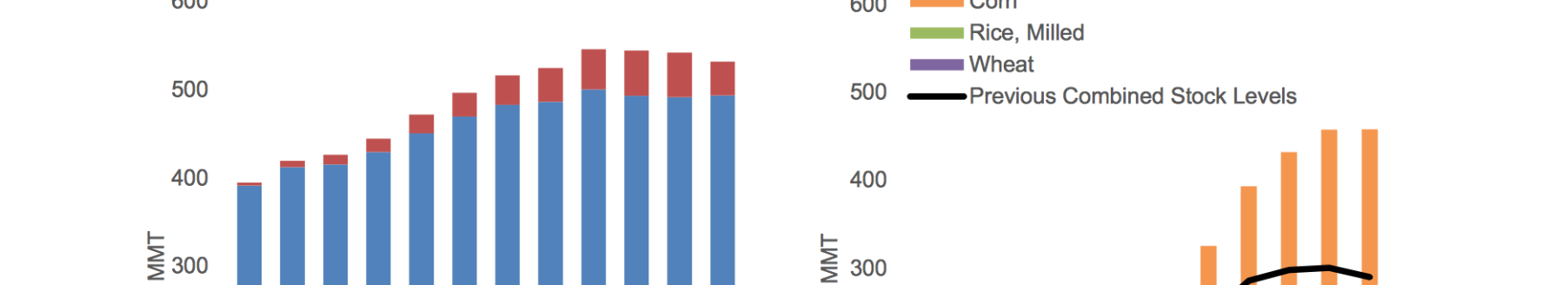

It is worth noting that DAP and potash prices have been on an upward trend over the last few years. DAP prices reached lows around $425 per ton in late 2016 and throughout 2017. Recently, prices have exceeded $500 per ton. Potash prices are currently above $350 per ton, the highest since late 2015.

A closer look at nitrogen prices

While most fertilizer prices have turned higher, anhydrous ammonia has trended lower since spring. This warrants a close look at nitrogen prices. Last fall anhydrous ammonia prices briefly fell to $400 per ton (a 20 percent drop) before returned to more than $500 per ton in early 2018.

This year, the headline story in nitrogen has been urea. After spending most of 2018 at nearly $360 per ton, urea prices recently climbed to $390 per ton. This is the highest observation in more than two years and well above the earlier lows of $300 per ton.

Recent price trends have resulted in urea being historically high priced relative to anhydrous ammonia. More specifically, the data are urea prices divided by anhydrous ammonia prices, on cost per pound of nitrogen basis.

Over the data series, the urea/anhydrous ammonia price relationship is, on average, 1.21. In other words, the price of a pound of nitrogen from urea is typically 1.21 times that of the price from anhydrous ammonia. This spring, the price relationship, at 1.24, was very close to the long-run average.

Currently, the price relation is at 1.37. This is to say current urea prices are above the average relative price (relative to anhydrous ammonia). Producers that have the option of using different sources of nitrogen might find anhydrous ammonia more attractive at current prices.

Historically, an uptick in the price relationship is typically short-lived. This is to say that it’s not clear how long urea will be relatively higher-priced. The price relationship could change with urea prices falling, or anhydrous ammonia prices increasing.

Wrapping it up

As producers beginning to think about 2019 planting decisions, fertilizer prices will soon be on everyone’s mind. Since spring 2018, fertilizer prices have mostly turned higher. Urea and DAP have increased 6 percent, while anhydrous ammonia prices have turned lower.

For nitrogen, the recent jump in urea prices has pushed the price relationship with anhydrous ammonia above the long-run average ratio. This is to say that, relative to anhydrous ammonia, urea prices are historically high.

At a higher level, fertilizer prices have recovered from earlier lows. Beyond fertilizer, even farm-level diesel prices have recovered. While lower costs of production have been a critical improvement in the farm economy since 2014, looking ahead, the expectations of reduced fertilizer prices may be behind us.

David Widmar is an agricultural economist following the key trends in U.S. agriculture. He is also a co-founder of Agricultural Economic Insight (www.AgEconomists.com) and is a researcher at Purdue University.