More help is here: CFAP relief program for agricultural producers

Did you see price declines or supply-chain chain disruptions due to COVID 19? You could be eligible for payments

I’ve received many calls from farmers and other agricultural producers in the last month, asking about the U.S. Department of Agriculture’s Coronavirus Food Assistance Program.

This relief program could be for you if you saw 5% or greater price declines due to coronavirus impacts. You may also be entitled to payments if COVID-19 disrupted your market supply chain or added significant marketing costs.

Here’s what you should know:

• USDA is accepting applications through Aug. 28, 2020. Apply through your local Farm Service Agency.

• CFAP is separate from other USDA program payments. That means payment limitations are separate too.

• USDA will issue only 80% of eligible payments when it approves a CFAP application. It will pay the remaining 20% if funding remains. Payments begin within a week of application.

• USDA is using two funds for the program: the CARES Act and the CCC Charter Act.

• To be eligible for payments, a producer must have had a share in an eligible commodity between Jan. 15 and April 15, or April 16 through May 14.

• Persons or legal entities also qualify for payment if: a) they had an average adjusted gross income of less than $900,000 for tax years 2016, 2017, and 2018,or b) they derive at least 75% of their adjusted gross income from farming, ranching or forestry.

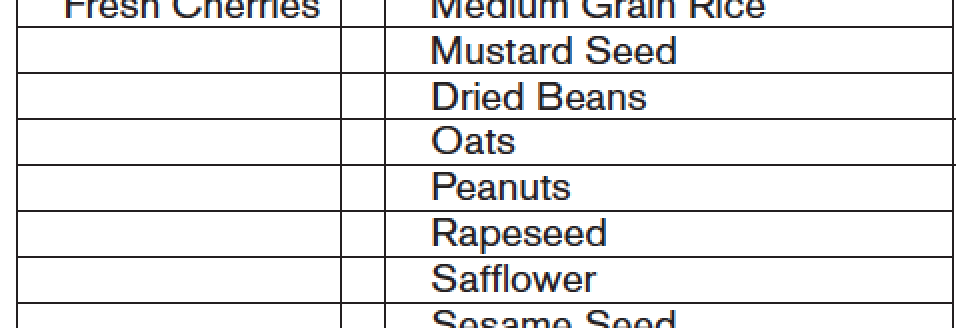

• USDA offers program payments under these five commodities:Non-specialty crops; specialty crops, livestock, wool and dairy.

• CFAP payments are limited to $250,000 per person or entity for all commodities combined. Corporations, limited liability companies or limited partnerships may qualify for up to three payment limits if at least three members of the entity each provide at least 400 hours of active personal labor or active personal management for the farming operation.

• CFAP considers contract growers who don’t own the livestock as producers who are eligible for payment if their contract allows them to have a risk in the livestock.

• If you commercially marketed milk during January, February, and March of 2020 , you’re eligible for payment under CFAP. In addition, milk that was dumped during this timeframe will be considered marketed and therefore eligible for payment.

• Persons and legal entities must comply with the provisions of the “Highly Erodible Land and Wetland Conservation” regulations. These are also called the conservation compliance provisions.

• CFAP payments don’t need to be repaid. There is no cost to apply to FSA.

For more details, visit USDA’s CFAP page at https://www.farmers.gov/cfap. The site offers a “CFAP Payment Calculator” that allows you to input information specific to your operation to determine estimated payments and fill out the application form.

If your operation made changes between 2019 and 2020, you may encounter complexities that could affect eligibility. K·Coe is helping farmers and ranchers with CFAP questions, FSA sign-ups and application help.]

Editor’s note: Maxson Irsik, a certified public accountant, advises owners of professionally managed agribusinesses and family-owned ranches on ways to achieve their goals. Whether an owner’s goal is to expand and grow the business, discover and leverage core competencies, or protect the current owners’ legacy through careful structuring and estate planning, Max applies his experience working on and running his own family’s farm to find innovative ways to make it a reality. Contact him at [email protected].