2021 was a record year for United States agricultural exports. Gregg Doud, former chief agricultural negotiator in the Office of the U.S. Trade Representative, said October 2021 was historic.

“We had an all-time record high for U.S. soybean exports to China in dollar terms—and, of course, higher commodity value prices helped that out. It was an all-time record for any month in history for U.S. exports to China overall, and it was an all-time record for total U.S. agricultural exports to the world,” he said.

What will 2022 mean for agricultural trade and markets? Answering that question was the focus of a recent online forum.

The “Farm Foundation Forum: 2022 Economic Outlook for Agriculture” featured a panel moderated by Doud, vice president of situational awareness and chief economist, Aimpoint Research. Panelists discussing the 2022 outlook for ag policy, trade and markets were Amanda Countryman, associate professor of agricultural economics at Colorado State University, and Dan Basse, president, AgResource Company.

Ag trade and policy

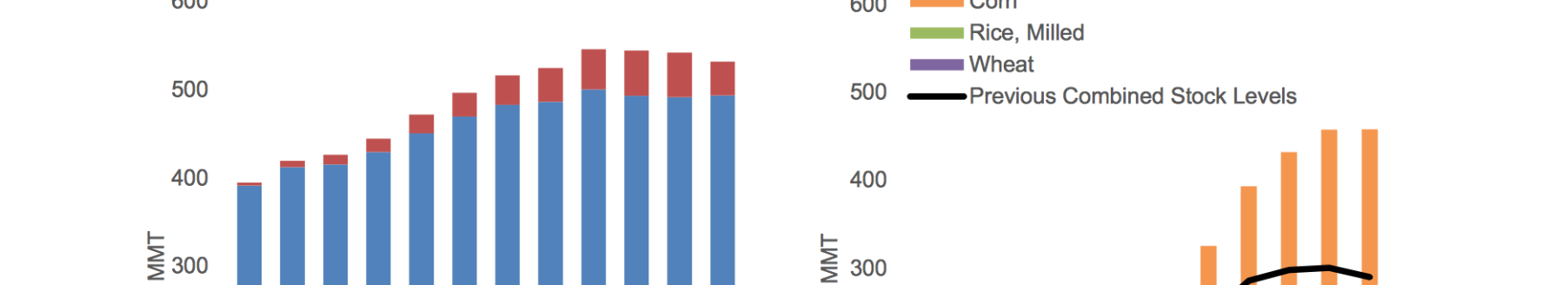

Countryman provided an agricultural trade and policy overview.

“There’s a lot of really exciting things happening when it comes to trade with China,” she said.

“There are also a lot of global challenges and uncertainty. We all know these have been unprecedented times with lots of uncertainty throughout the global economy and markets.”

She said the U.S. “had record exports at over $175 billion, when we think about the ag trade forecast for the fiscal year 2022. We also have imports at $165 billion.”

Countryman emphasized two key drivers for this increase in ag trade over the past two years—increased trade with China as a result of the Phase One trade deal and a weakened U.S. dollar during the first part of that timeframe.

“We’ve had increased exports of oilseeds and also across meat product categories,” she said.

“Between 2020 and 2021, we had a weakened U.S. dollar, and there were a lot of reasons for this when we think about the tremendous fiscal stimulus that occurred, which went hand in hand with increased public debt and the budget deficit as well as low interest rates and quantitative easing. Those were key drivers of that weakened dollar that helped to boost trade in that 2020-2021 timeframe.”

The dollar strengthened beginning last summer, Countryman noted.

“While we have this Phase One trade deal, there’s still a lot that remains to be accomplished to improve U.S.-China trade relations.”

Much of the focus of the trade deal has been on commitments by China to purchase U.S. goods and services. Countryman said the commitment “was for more than $200 billion over two years, above 2017 levels. We had purchase commitments by China to purchase U.S. agriculture, manufacturing, energy and services.”

China also agreed to reductions in food safety non-tariff measures, improved foreign investment measures, intellectual property protections and currency commitments.

China did not fulfill its Phase One import commitments by the trade deal’s Dec. 31, 2021, deadline.

Countryman provided additional context. “The Phase One trade deal really set the stage for unprecedented exports to China across agricultural commodities,” she said.

“We still have substantial, noteworthy tariffs in place on U.S. exports to China.”

She noted that agriculture fared better relative to manufacturing and energy in meeting targets for the sale of goods to China. Based on Chinese import data, Countryman said agriculture was at 76% of the target as of October 2021, manufacturing was at 61% and energy was at 48%.

She also offered agricultural highlights of the U.S.-Mexico-Canada Agreement (formerly the North American Free Trade Agreement), including modest improvements in market access for U.S. dairy and wheat into Canada. “I think there’s a lot of additional room for expansion in those spaces, but at least it’s a small start relative to where we were under the original NAFTA agreement,” she said.

Modernization is also an important part of the new agreement, including intellectual property protections important to biotechnology and agriculture.

She addressed the lost market access of U.S. agriculture into Japan with the U.S. withdrawal from the Trans Pacific Partnership. However, many of the market access gains from the TPP were regained under the mini Japan-U.S. trade agreement that replaced it, Countryman said.

The U.S. is not a member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership or the Regional Comprehensive Economic Partnership, “so the U.S. is lagging where others are moving forward.” She said there is potential for increased market access if a Transatlantic Trade and Investment Partnership deal is made between the U.S. and EU. However, EU restrictions on conventional U.S. production practices, biotechnology and pesticides are an issue.

“I do want to highlight among some very challenging prospects in the coming year, agriculture is faring well relative to others. The past two years have been tremendous for U.S. agriculture when we think about exports and global markets,” Countryman concluded. “I think there are tremendous opportunities for innovation, as there is a continued focus on sustainability and regenerative agriculture. Agriculture is innovative, and I think there’s a lot of opportunity there.”

Ag market themes for 2022

Basse provided an overview of agricultural market themes for 2022. First, he sees a new commodity super cycle lasting for two or three years.

“Energy will be the upside leader. This transformation from fossil fuels to green fuels to, ultimately, electrical power or nuclear power is a bumpy road,” Basse said, so the price of crude oil, ethanol and biodiesel will keep underpinning agricultural markets.

Basse, a commodity analyst, said President Joe Biden sees himself as a champion for biofuel, which is a stepping-stone toward meeting his goal of 20% vehicle electrification by 2030. “This push for biofuels is endemic. It’s going to continue,” he said.

The U.S. Department of Agriculture sees farmers as part of the carbon answer, and efforts to develop a system for paying them to sequester carbon will continue.

Two new U.S. ag demand drivers—Chinese corn imports, mainly from the U.S. and Ukraine, and U.S. renewable diesel—will raise farm profits and pull an additional 15 million to 20 million crop acres into production by 2025.

“As we look at agriculture over the last 80 years, these demand drivers are so important to the profitability of our farmers. We think back to the reconstruction effort after World War II or the Russians coming with their gold bars in the 1970s to buy U.S. grain. These were demand drivers that really lifted the fortunes and profitability of U.S. farmers,” he said.

“These are things that will dramatically alter the U.S. landscape going forward.”

Basse said U.S. beef and dairy herd liquidation sets up a bullish outlook for beef and dairy in 2022. He also expects beef and dairy prices to rise to record levels by 2023. Drought and decreased hay acreage in the U.S. will increase forage prices.

U.S. farmland and farm incomes continue to increase and are expected to rise into 2023 or 2024, when the next farm bill will be passed. Basse said he sees “a dynamic and volatile market ahead for many agricultural sectors, with weather only amplifying the need for demand rationing. For now it’s a shining of the raw material markets.”

Basse said inflation has soared to its highest rate in 40 years, which also affects commodities.

He also discussed concerns about reaching peak U.S. farmland. Basse said that in recent years “we have been stealing land from hay and CRP (Conservation Reserve Program) to get more principal crop acres.” Secretary of Agriculture Tom Vilsack and the Biden administration want to increase CRP acreage by 3 million to 5 million acres, Basse said. Hay acres are now at their lowest levels since 1909. Reaching peak farmland would have a tremendous effect on U.S. agriculture.

Policy priorities

Countryman said continuing to focus on China should be a priority in 2022. “There are still a lot of really important policy aspects that were not addressed in Phase One that need to be continually discussed. I think they’re incredibly challenging. Again, these are domestic policy issues and challenges related to the Chinese economy and the way it functions that are going to be very difficult to tackle.” With the expiration of the Phase One deal, she said several matters are still left undone that will affect our ability to move forward with China.

“The most important, No. 1 priority in the coming year from a trade policy perspective should be China,” Countryman said.

She also said the U.S. should not minimize the influence the EU has globally with regard to the constraints they put on products available for trade and that they impose on countries they have trade deals with.

Doud was one of the primary architects of the Phase One China Trade Deal.

Considering that China fell short of meeting its commitments by $16 billion, did the Phase One trade deal matter? Doud’s answer is yes. The Trade One deal addressed 57 structural components in our trading relationship between the U.S. and China in agriculture, and most of those have been fixed entirely, Doud said. He noted the deal also resulted in an increase in the number of facilities and products in the U.S. that are eligible to export to China.

“We’ve taken 1,500 facilities to well over 4,000 facilities in the U.S. that are eligible to export agricultural products to China, and that has made a huge impact in our access into the Chinese market. That’s something I’m very proud of,” Doud said.

As discussions continue for further agreements, he said bilateral trade negotiation requires Trade Promotion Authority, which expired last July and was last reauthorized in 2015.

“The first step is to get Congress to re-approve that. That’s something I think everybody in agriculture ought to be emphasizing because without it, you’re dead in the water.”

View the complete forum at https://youtu.be/N2hqQDKopMM.

Shauna Rumbaugh can be reached at 620-227-1805 or [email protected].