The Native American Agriculture Fund invests $12 million to stand up the first-ever Other Financing Institution within the Farm Credit System, expanding access to hundreds of millions in lending opportunities for Native American producers. The OFI, Native Agriculture Financial Services, will begin by participating in loans with Community Development Financial Institutions investing in agriculture and rural economic development that support Native farmers and ranchers and then expand into providing credit and financial services for Native agriculture producers and Tribal governments.

The FCS is a national cooperative lending institution network that provides access to capital and credit to support agriculture in rural communities and is the nation’s largest agriculture lender. Native American agricultural production accounts for billions annually in economic impact throughout Indian Country and rural communities, yet historical inequities and systemic barriers still limit Native farmers and ranchers from accessing capital. NAFS will serve the vital role of financing tribal agricultural production to meet the specific needs of agriculture in Indian Country in partnership with Native CDFIs and FCS institutions.

This historic investment directly addresses the original harms of the Keespeagle case and ensures that future generations of farmers and ranchers have equitable access to credit. “When I was wrongfully denied a loan by the Farm Service Agency, I went to my local Farm Credit, and without their help, my ranching operation would not have survived. I am extremely proud that the same opportunity I was given will now be available to more Native producers. By expanding lending to Native producers, NAAF, through the new NAFS lending institution, will continue to work toward eradicating the lack of access to credit for Native producers, which was at the heart of the Keepseagle case,” says Porter Holder, citizen of Choctaw Nation, lead Keepseagle plaintiff and NAAF Trustee on the creation of NAFS.

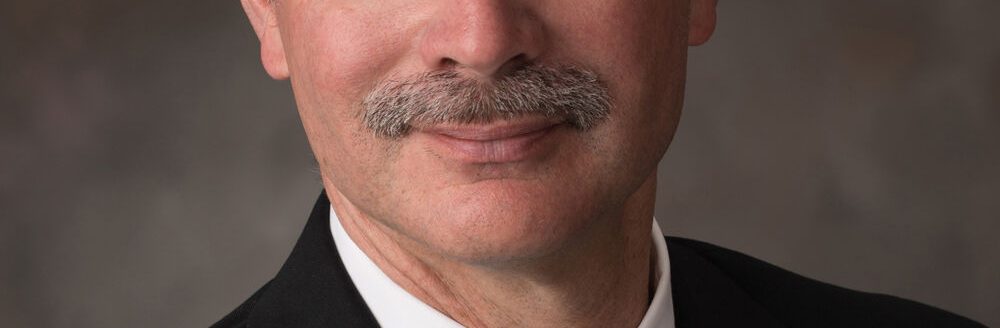

Janie Simms Hipp will serve as the President/CEO of NAFS. Throughout Hipp’s illustrious career, she has championed access to capital issues and has used her expertise to serve Native American producers and Tribal governments. She has spearheaded numerous entities dedicated to advancing agriculture throughout Indian Country, including the Indigenous Food and Agriculture Initiative, the first-ever Native agriculture law and policy research organization. Ms. Hipp has served as General Counsel for the U.S. Department of Agriculture for the past two years and has announced her departure effective July 31, 2023. She will step into the role of president and CEO of NAFS on Aug. 1, 2023.

“Ms. Hipp will continue to use her experience and voice to improve Native agriculture systems to benefit producers and their communities. Agriculture is a cornerstone of Tribal economies, and to ensure Native producers’ continued success and growth, meeting their needs to finance their operations is critical. The NAFS organization will be the conduit that supports these multiple goals, and this unique partnership with the Farm Credit System will ensure a generational difference in access to capital for Indian Country agriculture”, says Toni Stanger-McLaughlin, CEO of NAAF. “Ms. Hipp is an excellent choice for this important role and definitely has the expertise and depth of knowledge to continue meeting the needs of Native producers.”

More information will be available at NativeAgFinance.org.