CoverCress Inc., is having a media moment. On April 9, it was one of 8 winners of the Pioneers award given by Bloomberg New Energy Finance.

It was a winner in the category of creating the next generation of net-zero fuels, given because of the commercial potential of the company’s novel winter oilseed crop, called CoverCress, as a feedstock for renewable fuels, along with its very low carbon score and its ecosystem benefits as a cover crop. A field of CoverCress near Havana, Illinois, is pictured above.

One week earlier, it appeared on the cover of Time magazine, recognized as one of America’s Top GreenTech Companies. In collaboration with Statista, TIME ranked CoverCress 34th overall, and 3rd among ag tech companies, out of a total of 250 companies, for its “transformative impact on sustainable development.”

Commercial rollout year

CoverCress Inc. developed CoverCress as a commercial crop by transforming field pennycress, using advanced genetic engineering combined with traditional breeding and agronomy. CoverCress Inc. CEO Mike DeCamp estimates that in the 10 years it’s been in existence, the team has dedicated about 200,000 person-hours and $20 million to developing CoverCress.

It was able to attract start-up venture capital funding initially. “We took money in small increments,” said DeCamp. “We didn’t want to have huge amounts on hand that we might have to return to investors if we were unable to meet our product development milestones.” DeCamp also chairs 39 North, an ag tech innovation district in St. Louis that has attracted a cluster of ag tech startups and companies.

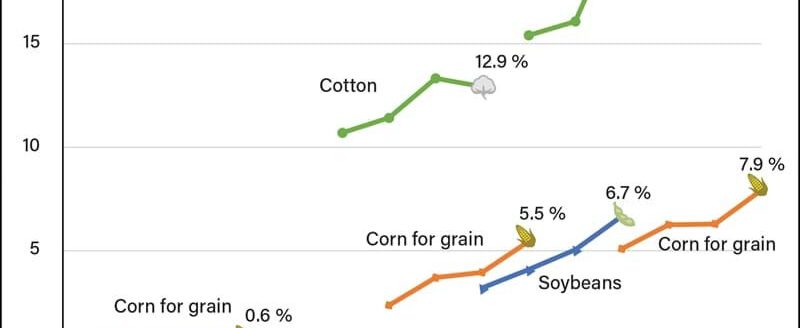

Last year was a commercial rollout year for CoverCress, with farms totaling about 3,000 acres signing commercial contracts with the company, and about 8,000 more acres in trial mode. This crop year (2024) it’s about twice that—6,000 commercial acres and 15,000 trial acres.

DeCamp admits all the media attention is nice. He said a lot of the “regulatory heavy lifting” to clear the way for wider adoption of the crop has been done. But he adds, “Attention without substance is not sustainable.” The CoverCress Inc. team is playing a long game, and that means consistently delivering results to farmers.

‘Safrinha’ crop for U.S. growers?

When the grain from the harvested crop is crushed, it produces meal that can be used for animal feed or pressed for oil to be used as a feedstock for renewable fuels.

“The fact that both these uses have markets creates the basis for us being able to contract production with growers,” DeCamp said.

While CoverCress doesn’t fix nitrogen, it improves soil health and helps lessen nitrate runoff. It benefits from less insect and weed pressure by being planted in the winter, in land that would normally be idle during that period. It’s harvested in mid to late May.

Because it fits in between scheduled plantings of corn or soybeans, DeCamp compares CoverCress to Brazil’s second or safrinha corn crop. “It’s really like a safrinha soybean crop for the U.S.,” allowing a second oilseed harvest in one growing season.

It’s important to have the right crush partners, said DeCamp. “Any crush facility that can crush canola can be easily adapted to CoverCress. However, those facilities are not present in our growing region,” said DeCamp, noting that “the soybean crush facilities that are in our growing region need to be modified.” Bunge is modifying a crush facility near Destrehan, Louisiana, to be able to handle CoverCress, winter canola and other soft seeds.

CoverCress Inc. entered into partnerships with Bunge and Chevron in early 2022 and in August of 2022 completed an exit transaction with Bayer acquiring all the equity not owned by them, Bunge or Chevron. Today, these three critically important strategic partners own the company, with Bayer as majority stakeholder. “Each of them can provide specific help and assistance with different aspects of our value chain,” said DeCamp.

“The increase in capacity to produce renewable fuels like renewable diesel and sustainable aviation fuel is generating feedstock demand that soybeans alone are not going to be able to meet,” said DeCamp. “The renewables demand could require from 20 million to 50 million more soybean acres, and that’s just not sustainable. The market needs alternative feedstock sources like CoverCress.”

David Murray can be reached at [email protected].