At first glance, the USDA April 10 World Agricultural Supply and Demand Estimates held very few surprises for wheat. Most reviewers would consider this a bearish report with another increase in predicted U.S. and global wheat ending stocks. However, a somewhat unnoticed factor was increased global wheat feed use, now forecast at 146 million metric tons, 7 percent above the 5-year average. This was due largely to shrinking supplies of traditional feed grains. With an average 19 percent of global wheat production being used as feed each year, the current feed grain supply and demand situation has implications for wheat.

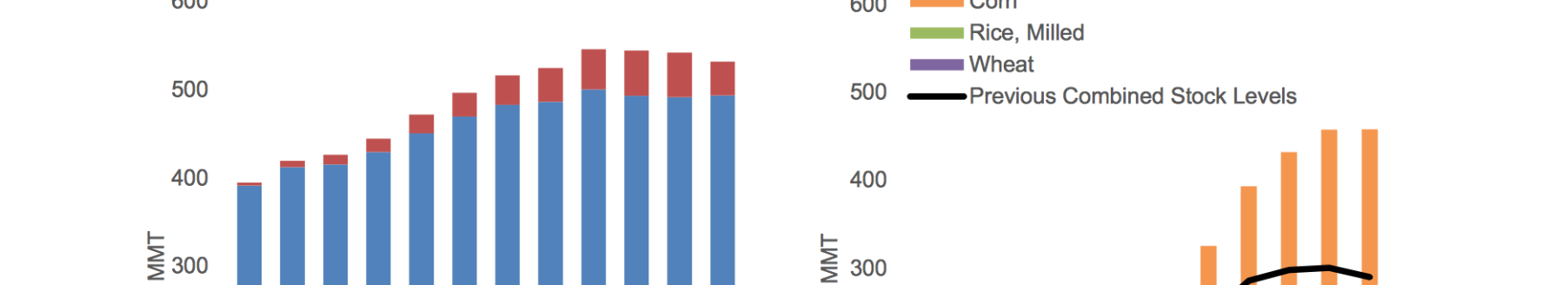

A deeper look at the feed grain situation shows the most striking decrease was in global corn production, which fell 4 percent year over year to 1.04 billion metric tons due to sharply lower production in drought-stricken Argentina and lower second-crop corn production in Brazil. At the same time, 2017-18 corn feed demand grew 18.0 MMT. These facts set up a total stocks-to-use ratio of 19 percent. However, it is important to note that China holds 40 percent of the world’s corn stocks, which will not leave the country. Removing China from the equation brings the stocks-to-use ratio down to 14 percent.

The constrained corn supply caused USDA to reduce global corn feed demand by 4 MMT from the prior month’s estimate of 654 MMT. In addition to reduced corn feed use in Argentina, USDA noted decreased corn feed demand in the European Union with a corresponding increase in wheat feed demand. EU 2017-18 wheat feed use is expected to reach 58.5 MMT, 9 percent above the 5-year average, if realized.

While corn had the most precipitous drop in supply and increase in demand, global production of barley, millet, oats and sorghum also fell in 2017-18, while rye remained stable year over year. Including corn, global feed grain production fell 4 percent or 49.9 MMT year over year in 2017-18, while global feed grain consumption increased 15.1 MMT. The increased consumption and decreased supply of traditional feed grains will cut 2017-18 ending stocks for those grains by 38.8 MMT.

With the global feed grain supply tightening, prices for those commodities continue to rise. Since the beginning of 2018, world feed barley prices increased an average $19 per metric ton, global sorghum prices averaged a $15 per MT increase, and the average world corn price increased $26 per MT, according to International Grain Council data. Supported by increased feed wheat demand, global wheat prices also increased an average $9 per MT.

With feed grain prices increasing, farmers around the world have taken notice and are expected to plant more corn, barley and sorghum in 2018-19—at the expense of wheat.

IGC expects 2018-19 global wheat harvested area to fall to a six-year low of 538 million acres (218 million hectares), down 1 percent from 2017-18 levels. The analyst group expects generally favorable Northern Hemisphere weather to increase global yields and partially offset the reduced planted area. Still, IGC currently forecasts 2018-19 global wheat production to fall 17 MMT year over year to 741 MMT.

Weather news is dominating the futures markets right now, but customers should be mindful of the feed grain situation, which is slowly siphoning some of the world’s excess wheat stocks in 2017-18 and switching wheat planted area to feed grains.