September WASDE offers limited good news for growers

The Sept. 12 World Agricultural Supply and Demand Estimates report from the United States Department of Agriculture brought some good news to soybean growers and dairymen, while corn growers saw a dimmer light at the end of the tunnel.

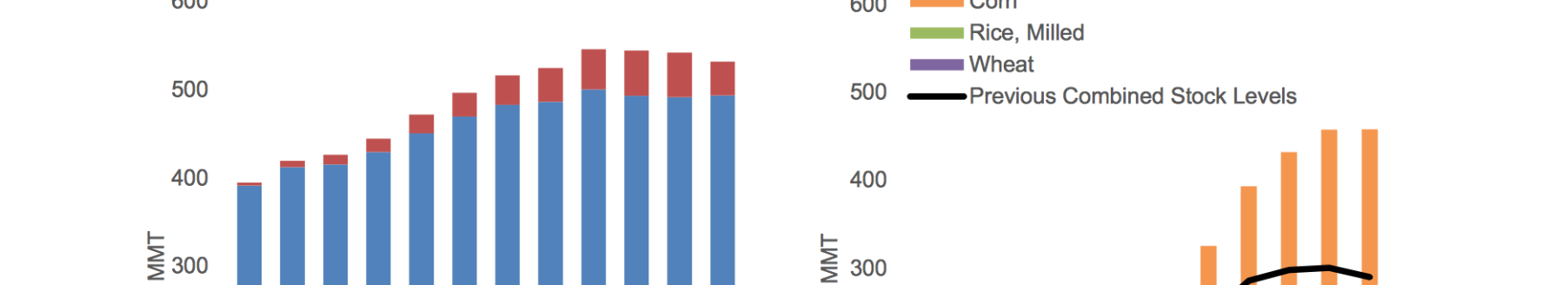

Corn

The report trimmed down U.S. corn production estimates based on a lower yield forecast.

“This month’s 2019-20 U.S. corn outlook is for reduced production, lower corn used for ethanol, and slightly higher ending stocks,” the report stated. The report dropped corn production by 102 million bushels, to 13.799 billion bushels, from the August estimates based on a lower yield forecast for this fall’s harvest.

Corn supplies are down from August, and it appears corn users are moving through the corn that’s left from lower exports and ethanol use, the report stated. Corn used for ethanol for 2019-20 was lowered by 25 million bushels. Still, the use can’t outpace the supply, according to the report, and ending stocks were up 9 million bushels from August, with the season-average corn price unchanged at $3.60 per bushel.

Oilseeds

The report also dropped projected U.S. oilseed production by 1.3 million tons from August, based on lower soybean and cottonseed production, offset a little by a higher peanut forecast.

“Soybean production is projected at 3.6 billion bushels, down 47 million on a lower yield forecast of 47.9 bushels per acre,” the report stated. “Soybean supplies are reduced 2% on lower production and beginning stocks.” Soybean crush and exports were unchanged, and so ending stocks were projected at 640 million bushels, down 115 million from August.

That brings a little good news to soybean growers with a forecasted U.S. season-average soybean price at $8.50 per bushel, up 10 cents.

“The soybean meal price is projected at $305 per short ton, up $5,” the report stated. “The soybean oil price forecast is unchanged at 29.5 cents per pound.”

The report forecasted higher U.S. soybean exports to the tune of an increased 45 million bushels based on the official trade data through July and indications from record high August export inspections. The crush was raised 20 million bushels, and so the report estimated that ending stocks will be 1 billion bushels, down 65 million bushels.

Wheat

Most classes of U.S. wheat saw falling prices in August, mostly due to harvest and the weakness in corn prices. Hard Red Winter “plummeted” $16/ton to $196, according to the report. Thankfully Soft White Winter still garners a premium, though it dropped $9 per ton, due to demand rom Asian buyers and a tight supply from Australia. The projected U.S. season-average farm price was lowered 20 cents to $4.80 per bushel.

Livestock, poultry and dairy

The WASDE report lowered 2019 total red meat and poultry production, based on reduced beef, pork and turkey production.

Beef production is reduced from August based on slower than expected pace of fed cattle slaughter and lighter carcass weights in the fourth quarter, the report stated.

Looking toward 2020, though, the report forecasted a higher than expected beef and broiler production, with more cattle headed to processing plants in the first half of the year.

“First-half carcass weights are also expected to support increased beef production,” the report stated. The cattle price forecast, though, was lowered, based on expectations of continued price weakness now and into 2020.

On the pork front, 2019 and 2020 export forecasts were raised from August based on recent trade data and the anticipation of strong global demand for U.S. pork. Still, hog price forecasts were reduced a bit for 2019 and the first half of 2020.

Dairymen saw a glimmer of hope in the report, with the 2019 all milk price forecasted to raise to $18.35 per hundredweight, and the trend continuing into 2020 with a forecasted price going to $18.85 per cwt.

That’s based on a stronger growth in milk per cow in 2019, despite reduced cow numbers. Herds are expected to increase their per-cow production into 2020, which slightly offsets the slower expected growth in dairy cow numbers.

Weaker expected global demand for U.S. butterfat products is expected to drop export forecasts fro both 2019 and 2020.

Cotton

The report reduced beginning cotton stocks by 400,000 bales in September, based on the 2018-19 reported ending stocks from the Farm Service Agency and National Agricultural Statistics Service.

Production is expected to decline by 654,000 bales, dropping U.S. production to 21.9 million bales, mostly due to a decline in production in the Southwest, the report stated. Meanwhile, consumption was dropped by 100,000 bales, based on recent activity.

Reduced U.S. production, and a lower projected U.S. share of world trade, resulted in 700,000 fewer bales exported in the projections. According to the WASDE report, the U.S. share of China’s cotton imports fell to 18% in 2018-19, down quite a bit from the 45% share the U.S. had just the year before, and almost half of the 30% 5-year share.

“This was also the lowest market share since China reformed its cotton sector in 1999,” the report stated. “U.S. cotton faced two challenges in China in 2018-19; first, the additional tariffs being placed on certain imports of U.S. cotton; and second, the arrival on the world market of two consecutive record Brazilian crops.”

Brazil has benefited most from the U.S.-China trade war, as well as India’s continual increase in its domestic Minimum Support Price that limited its competitiveness in the Chinese market. Brazil’s record 2018 crop and the prospects of an even larger 2019 crop induced exporters to ship cotton rather than carry it over, the report stated.

And, more importantly, China’s State Reserve purchases were almost exclusively Brazilian cotton in 2018, not the traditional U.S. cotton from years past. With Brazil’s record crop this year, it’s not likely U.S. market share will recover in 2019-20, the report added.

That dropped the 2019-20 season-average price for upland cotton to 58 cents per pound, down 2 cents from August.

For the full report, visit www.usda.gov/oce/commodity/wasde/

Jennifer M. Latzke can be reached at 620-227-1807 or [email protected].