The U.S. Department of Agriculture released its December World Agricultural Supply and Demand Estimates report, Dec. 10, and it didn’t have much good news for farmers.

Cotton

Lower production in Texas led to a half-a-million-bale decline in production estimates, according to the report. Production was lowered to 611,000 bales, which drops ending stocks to 5.5 million. Upland cotton’s season-average farm price was unchanged from November at 61 cents per pound.

Globally, the 2019-2020 cotton forecasts saw a 700,000-bale reduction in production from India, dropping beginning world stocks by nearly about 900,000 bales. That means world cotton production is projected to hit 121.1 million bales, down 830,000 from last month, but 3 million more bales than last year.

Pakistan was down 800,000 bales, and Australia, Turkey and Chad also were down in production numbers. Brazil saw a 900,000-bale increase in its projected crop, and Uzbekistan saw gains as well.

Lower textile exports from China means China will drop its consumption by 1 million bales. That led to a 1.2 million-bale decline in projected world consumption when reduced consumption forecasts for Vietnam and Pakistan are factored

“Global 2019-20 ending stocks are nearly 500,000 bales lower this month,” the report stated. “At 80.3 million bales, total ending stocks are only projected about 600,000 bales higher than in 2018-19, but stocks outside of China are expected to rise 3.1 million bales from the year before.”

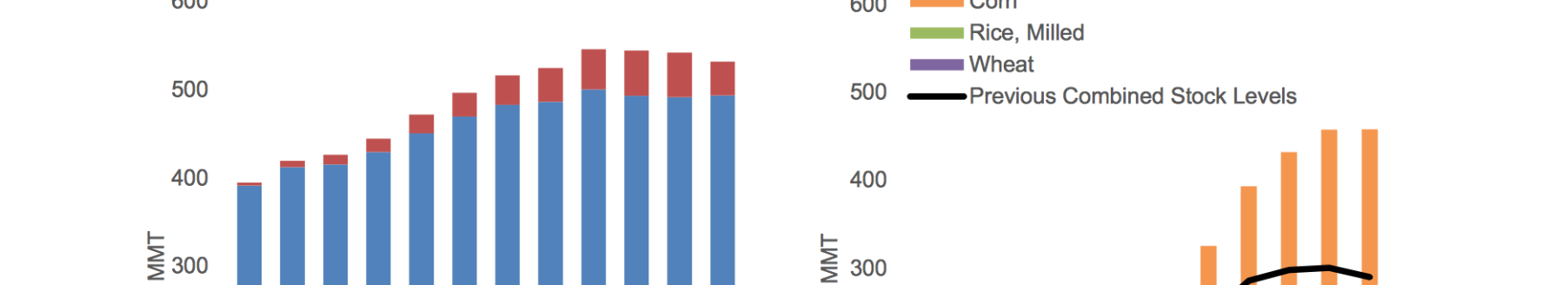

Corn

The December U.S. corn supply and use outlook was unchanged from November, with the projected season-average farm price staying at $3.85 per bushel, according to the report.

Globally, foreign corn production is expected to be higher with increases for China and Bolivia offsetting a reduction in Canada production. The latest data from the National Bureau of Statistics has China’s corn crop rising based on both area and yield. And while Canada had more harvested acres, yields weren’t what they expected.

Global corn stocks are estimated at 300.6 million tons, up 4.6 million from November.

Oilseeds

A decrease in cottonseed production dropped total U.S. oilseed production for 2019-20 to 107.6 million tons. Soybean supply and use projections remained the same as November, however the U.S. season-average soybean price was down 15 cents to a forecasted $8.85.

Globally, oilseed production was forecast at 574.6 million tons, an increase of 3.3 million tons, based on greater soybean, sunflower seed and peanut production. China had more soybean acres and a higher yield, according to the National Bureau of Statistics, and therefore its soybean production was raised a million tons to 18.1 million. Ukraine and Russia saw new record high sunflower yields, with cooler temperatures and timely mid-summer rains.

Global 2019-20 soybean exports are reduced by 0.6 million tons to 149 million based on a lower forecast out of Argentina. Vietnam is expected to import fewer soybeans, but higher amounts of soybean meal. And global soybean stocks are forecasted higher for December based on increases in China and Brazil.

Sugar

Beet sugar production this year was a challenge for many growers, and the WASDE report reflected it. Beet sugar production for 2019-20 was projected to be 4.367 million short tons, raw value (STRV), down 220,625 from last month.

“Yield and area harvested forecasts from last months NASS Crop Production report are adjusted down on processors’ updated forecasts in the latest Sweetener Market Data,” the report stated. “Beet pile shrink is forecast at a relatively low 4% due to the shortened slice campaign. Sucrose recovery is unchanged from last month.”

Wheat

The 2019-20 U.S. wheat outlook was for expected decreased supplies, higher exports and thus lower ending stocks, according to the report. Wheat imports, at 105 million bushels, would be the lowest imports in nine years. Meanwhile U.S. wheat exports are up 25 million bushels to 975 million on a strong pace to date with more competitive prices from the U.S. and reduced supplies from major world competitors.

Hard Red Winter and Durum exports were both raised by 10 million bushels, and Hard Red Spring was up 5 million. This reduction in supply and increase in use means 2019-20 ending stocks are likely to be the lowest in five years at 974 million bushels, down 40 million bushels from the last report.

“Despite the tightening stocks, the season-average farm price is lowered 5 cents per bushel to $4.55 based on NASS prices to date and expectations of cash and futures prices for the remainder of the market year,” according to the report.

Globally, the outlook for wheat in December is for slightly lower global use and trade and increasing ending stocks. Argentina and Australian wheat crops are cut 1 million tons and 1.1 million tons respectively based on continuing drought conditions. At 16.1 million tons, this would be Australia’s smallest wheat crop since 2007-08. Canada’s crop is cut 0.7 million tons to 32.4 million, based on updated data.

Meanwhile, China’s expected to see a 1.6 million ton production increase to a 133.6 million ton crop, based on updated National Bureau of Statistics data. And the EU and Russian crops are expected to be half a million tons more than expected.

“The U.S. has become more price competitive in some international markets, and increased sales are expected to continue in the second half of the market year from reduced competition,” the report stated. “With global use down 1.4 million tons, world ending stocks are raised 1.2 million tons to a record 289.5 million tons. China’s 2019-20 ending stocks are raised 1.8 million tons to 147.5 million and account for 51 percent of the global total.”

The full WASDE Report can be found online at https://www.usda.gov/oce/commodity/wasde/wasde1219.pdf.

Jennifer M. Latzke can be reached at 620-227-1807 or [email protected].