This past year has been full of rough waters for most industries, and for agriculture it has been 365 days of just trying to hang on as markets rose and fell at the mercy of a devastating pandemic. At the 2021 Virtual Commodity Classic, Jason Henderson, senior associate dean in the college of agriculture and director of Extension at Purdue University, shared the economic environment that farmers and agricultural businesses will be facing in the next couple years.

“Farmers cannot control the macro environment and if they ignore the economic environment, they will get rolled by economic waves,” Henderson said. “Last year the economic wave was COVID-19, and the depth of the economic recession hit in the summer of 2020, but fortunately since then the economic recovery has been stronger than expected.”

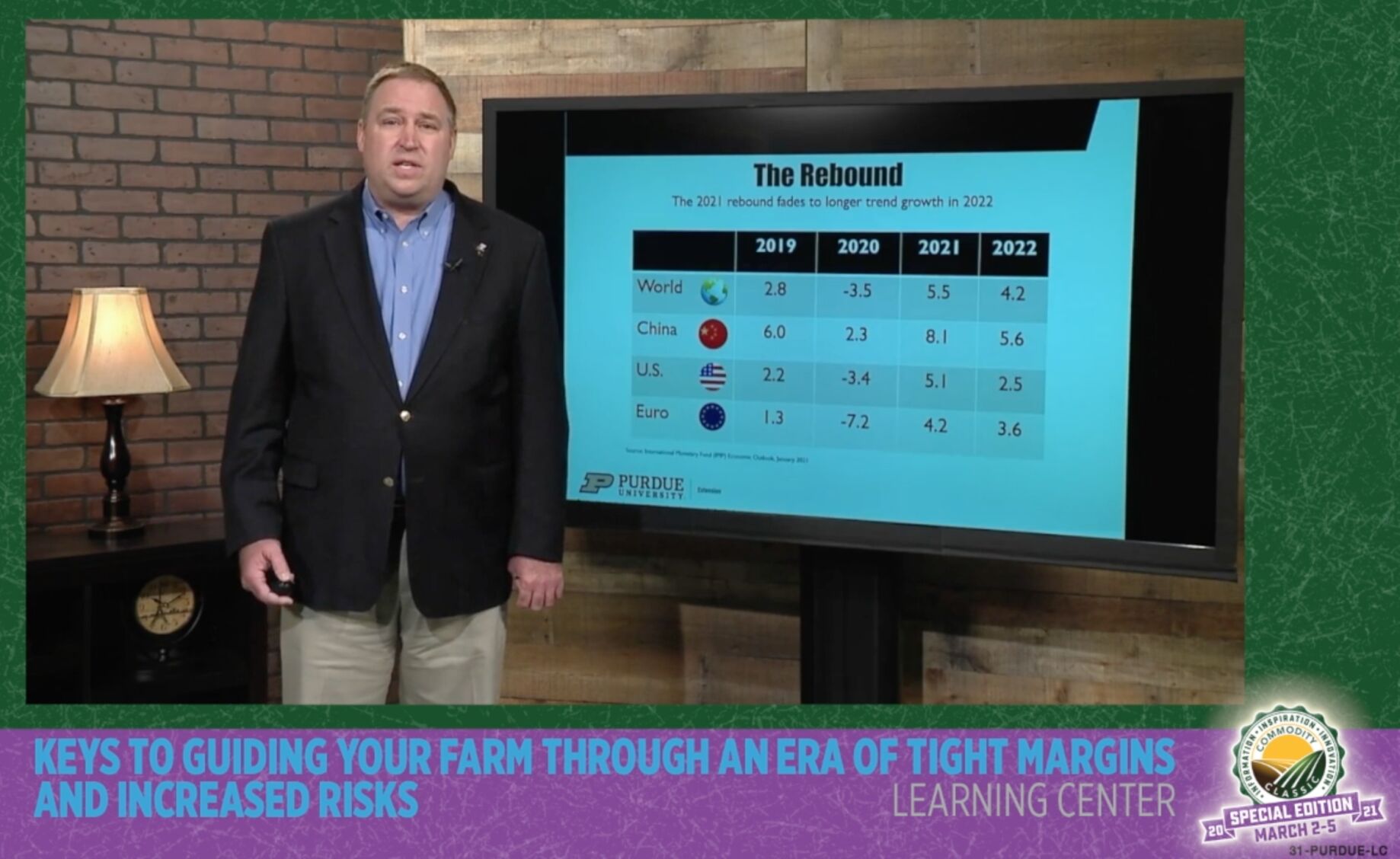

For example, Henderson said last year the world gross domestic product fell 3.5%, which was much less than the forecast. For the Chinese and United States economies, both nations had stronger than expected growth at the end of last year.

“The rebound is expected to continue this year and slowly ease back to trend growth in 2022,” he added.

Henderson said world growth is expected to rise 5.5% this year and ease down 4.2% next year. Similar patterns of growth are expected in China and the U.S.

“So what does this mean for agriculture,” Henderson asked. “Over the next couple of years, I expect there to be solid economic gains, but these gains will not be strong enough to spur inflation.”

As a result, interest rates will remain low and, in fact, the Federal Reserve has already made statements of low interest rate expectations though 2023.

“Solid growth and low interest rates tend to be good, but not great for agriculture,” Henderson explained. “Farmers are asset rich and cash poor. Low interest rates underpin high land values and make debt cheap.”

He said the side effects are for farmers to use collateral and debt to finance agricultural investments, which he expects to rise this year. As a result, the primary risk for agriculture could be debt accumulation and a similar risk exists for the economy and the government. Additionally, Henderson did not expect actual GDP to reach its potential until 2024.

“This is another piece of evidence that agriculture could face an economy that is growing over the next couple years, but below its potential,” he added. “Agriculture could face a low inflationary environment with low interest rates—a recipe for good, but not great economic opportunities.”

Lacey Newlin can be reached at 620-227-1871 or [email protected].