Two railroads jointly announced on March 21 their plans for what would, if approved, be the largest rail merger ever in unadjusted dollar amounts.

Under the proposed agreement, Canadian Pacific would acquire Kansas City Southern in a stock and cash transaction worth $29 billion, including the assumption of $3.7 billion worth of debt by Canadian Pacific. The proposal heads to the U.S. Surface Transportation Board, the regulatory agency created by Congress to review proposed railroad mergers and resolve railroad rate and service disputes. The STB, which is affiliated with the U.S. Department of Transportation, is expected to render its decision by mid-2022, according to CP.

The boards of both companies have unanimously approved the merger, so they obviously believe it is in best interests of shareholders of both companies. But what about customers—including agricultural shippers? Will they benefit?

Mike Steenhoek, executive director of the Soy Transportation Coalition, has gone on record with thoughts on both the possible challenges and opportunities of such a merger. “Whenever a merger or acquisition among large providers of a particular service occurs—including within the railroad industry—it is healthy to have some degree of concern given how mergers and acquisitions in the past have indeed resulted in a reduction of rail service access or increased rates among agricultural shippers,” he said in an email.

One concern voiced by Steenhoek is whether this merger will be the start of a merger wave. “I do not know of many agricultural shippers who would welcome such a prospect. It obviously remains to be seen whether this will occur.” The STB issued what amounted to a freeze on large-scale rail mergers in 2000 due to regulatory and anti-trust concerns.

No service overlap

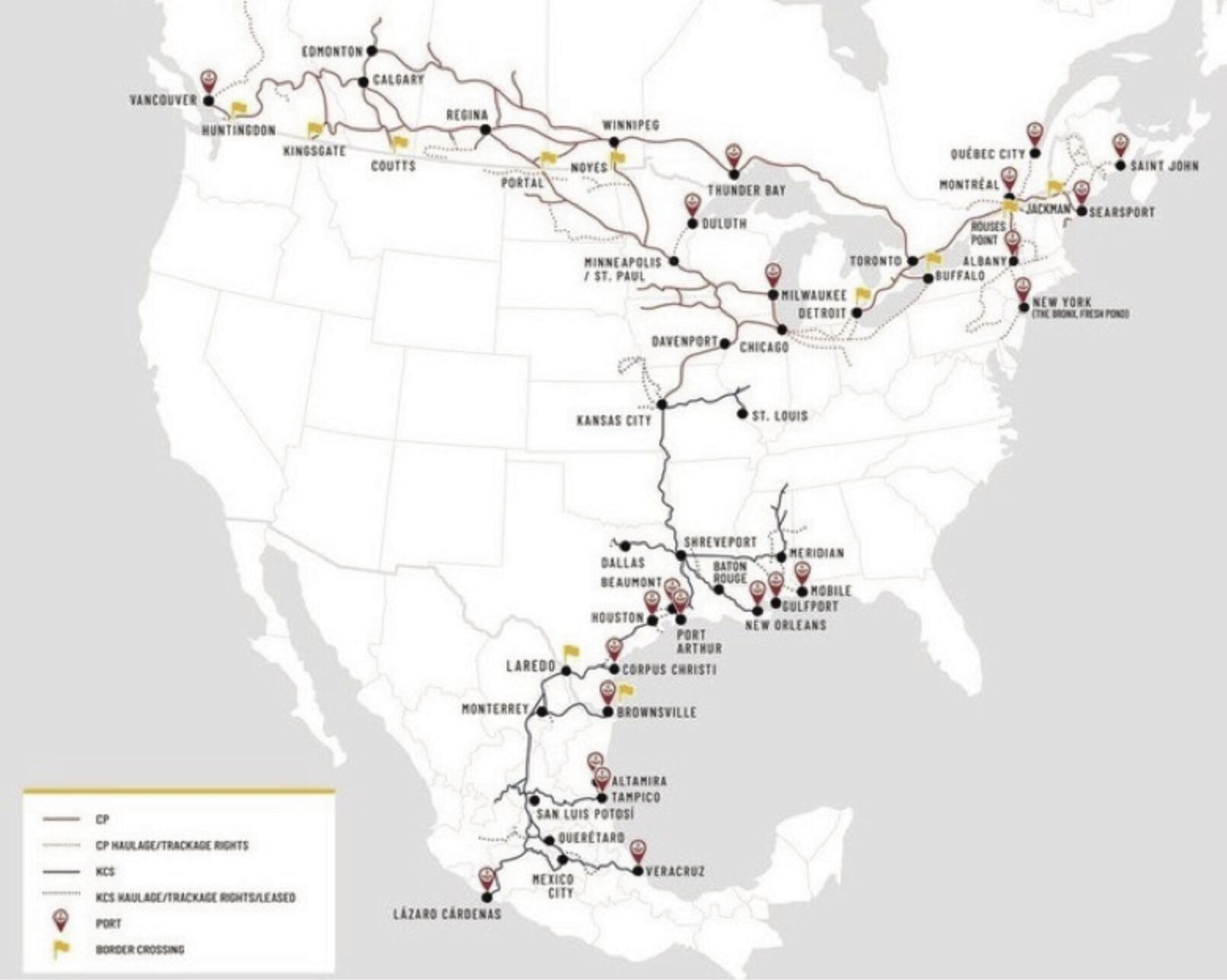

Some rail analysts have said STB approval is more likely because in this case, there is no overlap in the route networks that would be merged. “Whenever a merger or acquisition is proposed, red flags are particularly raised among customers when the two companies have a similar geographical footprint. This does not guarantee that significant portions of service will be disbanded or eliminated, but it often portends that,” said Steenhoek.

However, he added, “As one can see from reviewing the current Canadian Pacific and Kansas City Southern network maps, the two railroads currently have very little service overlap. This provides some degree of encouragement among customers–including agricultural shippers—that this particular proposed merger may result in increased service options.”

Two existing rail networks serving Canada and Mexico would link up in in Kansas City, creating the first North American rail network including all three countries. The commodity research firm Higby Barrett commented on LinkedIn, “At first glance, the merger does not seem to be a game changer for grain and oilseed movements. A CN KCS merger would open up the Upper Plain states. Not as exciting as it first appeared.”

Opportunities

But those cautions aside, what about the opportunities? “Among current Canadian Pacific customers, the proposed merger could very well result in greater access to new markets in the southern U.S. and Mexico. Many of these current Canadian Pacific customers currently only have access to export terminals in the Pacific Northwest. Similarly, current Kansas City Southern customers may enjoy new access to markets served by the Canadian Pacific network. Canadian National Railway’s current network provides seamless access from New Orleans to Chicago, which then splits in a Y-shape–ultimately provided service to both the east and west coasts of Canada. The proposed Canadian Pacific-Kansas City Southern merger will provide access to a similar geographical reach with the additional access into Mexico,” said Steenhoek.

Even after the current merger, assuming it is approved, the new entity would still be the smallest of what would then be the Big Six Class 1 railroads, defined as railroads with annual operating revenues greater than $504 million a year.

“At this moment, it is too early to make a definitive conclusion on whether the merger, if approved, will primarily benefit shareholders, customers, or both,” Steenhoek said.

Could the merger avoid potential container imbalance issues in the future, like the one affecting some exporters of containerized ag products today? It’s hard to say, since approval may not be granted for a year and much can happen in that time. But rail congestion around the Chicago area has been cited as a contributing factor to the container imbalance.

A piece on the rail merger in Forbes noted, “The [rail] congestion around Chicago today is so bad that shippers at times rely on trucks to move freight on the Dallas-to-Chicago corridor. Right now, neither Canadian Pacific nor Kansas City Southern can do much to help, as neither service has track spanning the entire route. With this merger deal, that would change, creating a new single-line route from Texas to Chicago without forcing shippers to deal with two rail companies and possible delays at a switching yard.”

David Murray can be reached at [email protected].