Four states—Mississippi, Alabama, Texas and Arkansas—produce 97% of catfish sales in the United States. U.S. catfish sales were $371 million during 2020, down 2% from $380 million the previous year.

Last year, U.S. farm-raised catfish production was 324 million pounds from 59,305 acres of water. Arkansas produced 15.7 million of those pounds from 3,900 acres, valued at $16.6 million.

Arkansas is No. 3 behind Mississippi and Alabama in foodsize inventory as of July 1, according to the National Agricultural Statistics Service, part of the U.S. Department of Agriculture. Foodsize is defined as fish that are from 0.75 to heavier than three pounds. The same report showed Arkansas had 9.5 million stocker fish, up 2% from a year ago.

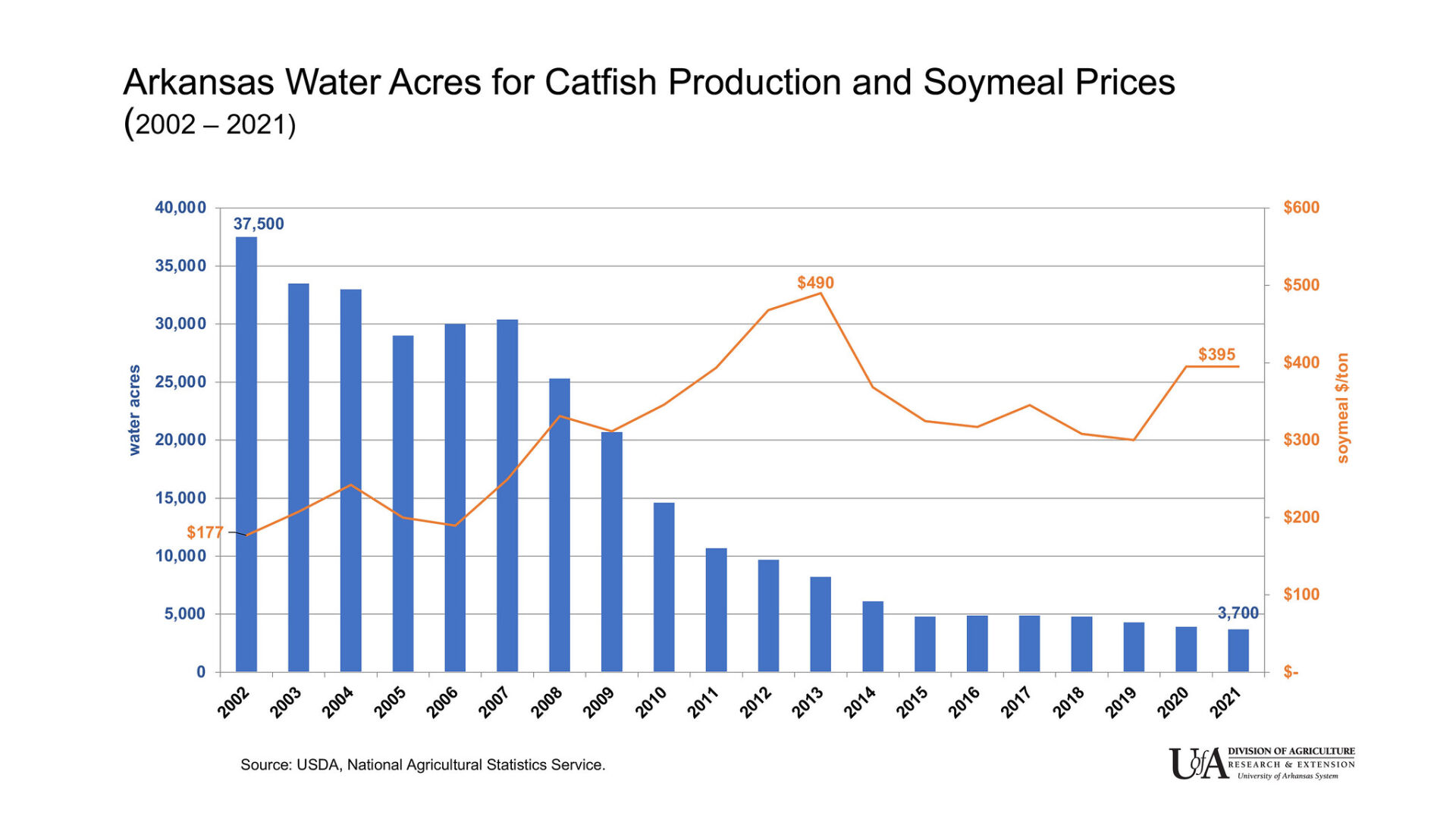

In 2002, Arkansas had 37,500 acres of ponds in catfish production.

“By 2021, the industry is one-tenth that size, at just 3,700 acres,” said Scott Stiles, extension economist for the University of Arkansas System Division of Agriculture.

“One reason for the decline can be attributed to a sharp increase in feed prices that ran from 2007 to 2013,” he said. “From 2007 to 2013 the state’s catfish industry lost 22,200 water acres: a decline of 73%.”

Stiles said that catfish feed prices are largely driven by grain prices. What the catfish industry refers to as “32% feed” typically contains 30 to 44% soybean meal and 15 to 20% corn.

“Feed costs represent approximately 50% of total operating costs for catfish farmers,” he said.

And the grain market news was only getting worse for catfish growers.

“For 2021, average soybean meal prices are projected to be the highest since 2013 at $395 per ton,” he said. “When feed costs are at high levels, growers may switch to a 28% feed to reduce costs. However, that option is still expensive as growers report paying $482 per ton in the past week for floating feed.”

If there is a bright spot for producers, it’s fish prices.

“Fortunately, catfish prices are slightly better than last year’s average of $1.06 per pound,” Stiles said. “Current farm-level prices are in the range of $1.25 to $1.30 per pound.”

With August being a key yield-determining month for U.S. soybeans, some continued price volatility can be expected.