Farmers can expect a challenging marketing environment for agricultural crops grown in 2023 as the global economy faces recessionary challenges, according to a Texas A&M AgriLife Extension Service grains marketing economist.

“The economic challenges around the world are severe,” said Mark Welch, Ph.D., AgriLife Extension grain marketing economist, told attendees at the Texas Plant Protection Association conference.

Farmers looking to market their crops will have do so carefully amidst several challenging economic factors.

“Interest rates, inflation are all important factors,” he said. “The Federal Reserve has gotten aggressive (with interest rate hikes). Moving from near zero at the beginning of the year to 4%, increases in the federal funds rate may have dampened overall inflation. The Consumer Price Index that was 9% in June is now down just below 7%. But core inflation, less food and energy, is still stubbornly high, around 5%.”

Federal Reserve

Welch said the Federal Reserve isn’t done raising rates to try to curb inflation. He expects a quarter of a percent to a half of a percent hike in the future.

He noted there are ample number of jobs keeping the economy from revisiting the recession of the 1970s when mortgage rates were 15% to 18%. Welch said if the inflation rate can be lowered back to 2%, it’s still going to be a challenge.

“We’ve got a long, long way to go,” he said. “If we are headed to a recession in 2023, we know recessions are not good for agriculture.”

Projections of net farm income for 2023 is a $12 billion decline compared to 2022, according to the Food & Agricultural Policy Research Institute at the University of Missouri.

“Input costs are likely to go down, but not as fast as the prices you are likely to be selling at,” Welch said.

Meanwhile, farmers making marketing decisions should do so thoughtfully, but not completely hold back waiting for another economic challenge to affect prices. Welch said it’s good to understand the fundamentals such as supply and demand, market prices and other factors.

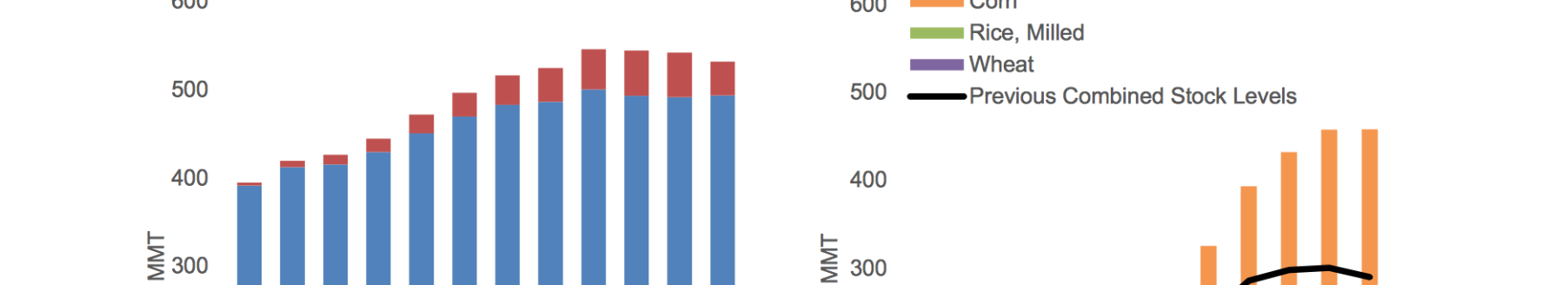

Regarding corn, on the supply side, world corn production was projected at 46 billion bushels in 2022 with the U.S. accounting for about 14 billion bushels. Texas accounts for about 2% of the U.S. total. World corn production was a record high in 2021 at 48 billion bushels.

The world harvested 543 million acres of wheat last year, which was an increase of 11 million acres over the last three years. In its long-term projections, U.S. Department of Agriculture pegs U.S. corn plantings in 2023 at 92 million acres, up from 88.6 million acres in 2022, Welch said.

“The 2023 U.S. corn yield in that projection from USDA is 181.5 bushels per acre compared to 171.9 bushels in the season just ended,” he said. “Days-on-hand supplies are currently at about 30 days.”

Welch said when days of supply are below 40 days, it results in higher prices. When there is above 40 days supply, prices are typically lower.

Meanwhile, the wheat market is tight, feeling the effects of dry weather as well as economic challenges impacting market prices.

“If we can get out of this La Niña weather pattern, that will help the wheat situation,” Welch said. “But right now, it’s very tight.”

Overall, Welch projects commodity markets to remain high, but farmers will continue to be faced with high crop expenses due to the economic environment.

“High prices, high input costs with tighter margins,” Welch said. “(As the) U.S. starts to increase corn and wheat production, prices will be moderately lower and the global recession impacts and weather will be important factors on production and prices.”