Texas drought, shifting markets shape 2026 crop outlook

Texas row crop producers are heading into planting season amid early weather uncertainty, shifting price relationships in major commodities, and ongoing economic pressure from high input costs, according to Texas A&M AgriLife Extension Service economists.

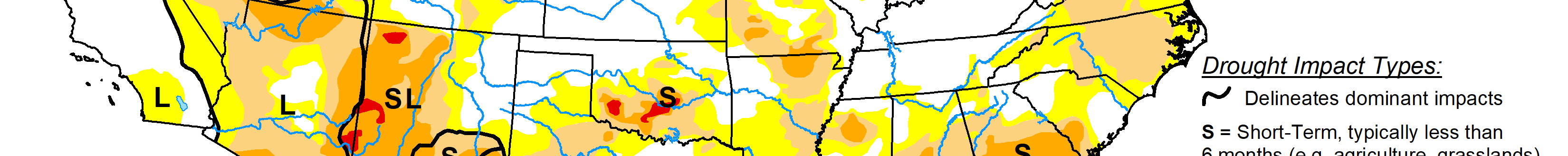

While timely rains supported strong cotton yields in 2025, the upcoming season is beginning under La Niña conditions that have kept much of Texas warm and dry since the fall. The pattern is expected to fade by March, but dryness could persist into key planting periods across the state’s staggered cotton calendar, said John Robinson, Ph.D., AgriLife Extension cotton economist in the Texas A&M Department of Agricultural Economics.

Robinson said that contrasts sharply with last year’s wetter-than-normal conditions and raises the likelihood of lower production and more volatile pricing through the spring and early summer.

La Niña shifts cotton outlook with early drought risk

Even if weather-driven rallies appear, Robinson said they rarely hold through harvest, leaving growers exposed to timing risk in a market that exports 85%-90% of U.S. cotton and responds quickly to global demand signals.

The state’s cotton sector also continues to feel a cost squeeze, with input costs outpacing gains in market prices and tightening margins across Texas row-crop operations.

Corn–soy acreage balance and global wheat pressures ahead

Beyond cotton, 2026 pricing dynamics in corn, soybeans and wheat will influence planting decisions and market behavior, especially in the Corn Belt and export-driven oilseed markets, said Mark Welch, Ph.D., AgriLife Extension grain economist in the Department of Agricultural Economics.

Corn remains a primary price driver for grain commodities and continues to shape acreage decisions in the Midwest. U.S. corn plantings reached roughly 98.8 million acres in 2025, rising by more than 8 million acres over 2024, and Welch said the market will watch whether those acres hold or begin shifting toward soybeans as relative prices adjust.

Futures currently reflect soybeans near $10.86 per bushel and corn near $4.50 per bushel, Welch said.

Soybean prices may strengthen further in 2026 due to competitive returns and trade positioning.

Global supply remains heavily influenced by South American production, led by Brazil, now the world’s largest soybean exporter and a major factor when it comes to pricing U.S. soybeans, Welch said.

Geopolitical outcomes could impact crop prices

Even though the U.S. only accounts for just over 6% of the world’s wheat production, it accounts for about 11% of global wheat exports. A smaller U.S. winter wheat crop could lend upward price support, Welch said.

However, geopolitical outcomes could sharply alter that landscape. For instance, an end to the war in Ukraine could drive wheat prices lower, Welch said.

Taken together, Robinson and Welch expect continued weather uncertainty in the Lone Star State, competitive acreage decisions in the Midwest, and international influences in soybeans and wheat markets to define early 2026 as growers weigh planting choices.

PHOTO: Cotton picker on Tuesday, Sep 17, 2024, in El Campo, Texas. (Michael Miller/Texas A&M AgriLife)