What you should know about 2019’s MFP payments

Round two of trade aid for farmers brings a few changes from last year

Saying this year’s program is “even stronger and more effective for farmers,” U.S. Secretary of Agriculture Sonny Perdue provided more details July 25 about the $16 billion trade-aid package first announced back in May.

The package marks the second year the United States Department of Agriculture is helping farmers weather the impact of retaliatory tariffs on U.S. agricultural goods and other trade disruptions involving China and other nations.

As in 2018, the package consists of the Market Facilitation Program, which alone accounts for $14.5 billion and includes direct payments to producers, plus the Food Purchase and Distribution Program and the Agricultural Trade Promotion Program.

My colleague, Matthew Farrell, K·Coe’s director of farm program services, has studied the 2019 program carefully and helped compile the following information.

1. When is the sign-up period?

Sign-ups began July 29 at local Farm Service Agency offices and will run through Dec. 6, 2019. Be aware that some offices have not been in a position to accept applications yet and have delayed producer sign-ups. Also, although USDA extended last year’s sign-up period, we encourage you not to wait until the last day to apply. There’s no guarantee USDA will extend sign-ups again this year. The money is much needed right now, but producers should work with their local offices on the best time to sign up.

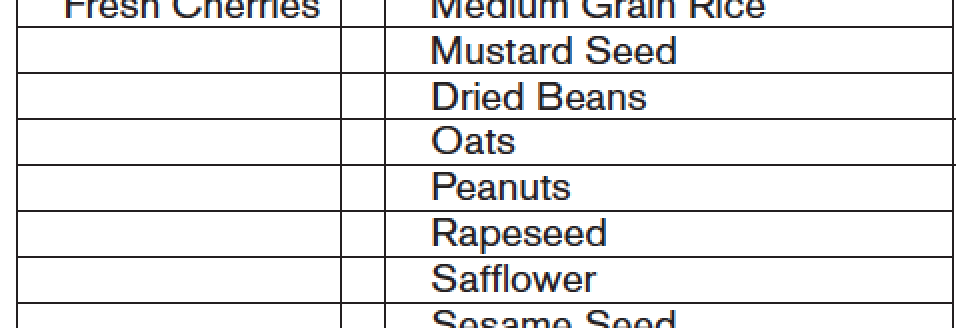

2. What are the covered commodities and their payment rates?

MFP assistance for non-specialty crops, listed in the graphic, is based on a single county payment rate multiplied by a farm’s total plantings of MFP-eligible crops in aggregate in 2019. County payment rates range from $15 to $150 per acre, depending on the trade-retaliation impact to that county.

3. What are the payment limitations?

USDA increased the payment limits from last year’s $125,000. This year, for non-specialty crops, the payment limit is a combined $250,000 per person or legal entity. For dairy and hog, the limits are $250,000. For specialty crops, the payment limit is also $250,000. These are all separate limits. No applicant can receive more than $500,000 combined among the three categories.

4. How much will the first payment be?

It will be the higher of $15 per acre or 50% of the county rate.

5. When will USDA make the payments?

USDA is saying the first payment will be made in mid to late August or after the application is complete. Second and third payments are not guaranteed but are slated for November and January, if warranted by trade conditions. Last year’s program offered only two rounds, or tranches, of payments.

6. What crop information does FSA need to know?

Producers should have timely crop certifications on file with FSA. You should also have crops planted to a farm number with FSA. If you have “prevented plant” claims, are certified with FSA and planted an FSA-certified cover crop that has the potential to be harvested or used as forage, you qualify for an MFP payment of $15 per acre. Your cover crop must have been planted by Aug. 1, 2019.

7. Where can I find the MFP application?

It can be downloaded from https://www.farmers.gov/manage/mfp.

8. What are the eligibility requirements?

Eligible producers must have an adjusted gross income of less than $900,000 or have at least 75% of your AGI from farming or ranching. For 2019 eligibility, the AGI requirement covers 2015, 2016 and 2017. You must also have an AD-1026 form on file with FSA and comply with “Highly Erodible Land and Wetland Conservation” requirements.

9. How else is the 2019 program different from last year?

The biggest differences between the two years are the extended crops that are available for payment, the increase in the payment limit from $125,000 to $250,000 and how payments are being calculated as a county rate and not a per-bushel or crop rate.

10. What if Mother Nature delayed my planting last spring?

Flooding and other natural disasters kept many producers out of their fields for extended periods earlier this year. If you filed a “prevented plant” claim and planted an FSA-certified cover crop with the potential to be harvested, you’re eligible for a $15 per-acre payment. Acres that were never planted in 2019 are ineligible for an MFP payment. Late planted crops, as long as they are certified, will be eligible for payments.

11. Are there MFP tax ramifications?

Payments are taxable in the year received, just like any other payments. Make sure you talk with your accountant to properly factor these payments into your 2019 plans.

Editor’s note: Maxson Irsik, a certified public accountant, advises owners of professionally managed agribusinesses and family-owned ranches on ways to achieve their goals. Whether an owner’s goal is to expand and grow the business, discover and leverage core competencies, or protect the current owners’ legacy through careful structuring and estate planning, Max applies his experience working on and running his own family’s farm to find innovative ways to make it a reality. Contact him at [email protected].