Keeping crop supplies in perspective with crop storage

The new crop year is underway after months of planting, treating, waiting and praying that the seed planted in the spring will be a bountiful harvest this fall.

A crop year in the United States starts the month harvest begins for a crop, for example, June 1 for barley, oats and wheat and Sept. 1 for corn, sorghum and soybeans. With Sept. 1 now in the rearview mirror, harvest is upon us.

Record fall crop harvest on the horizon

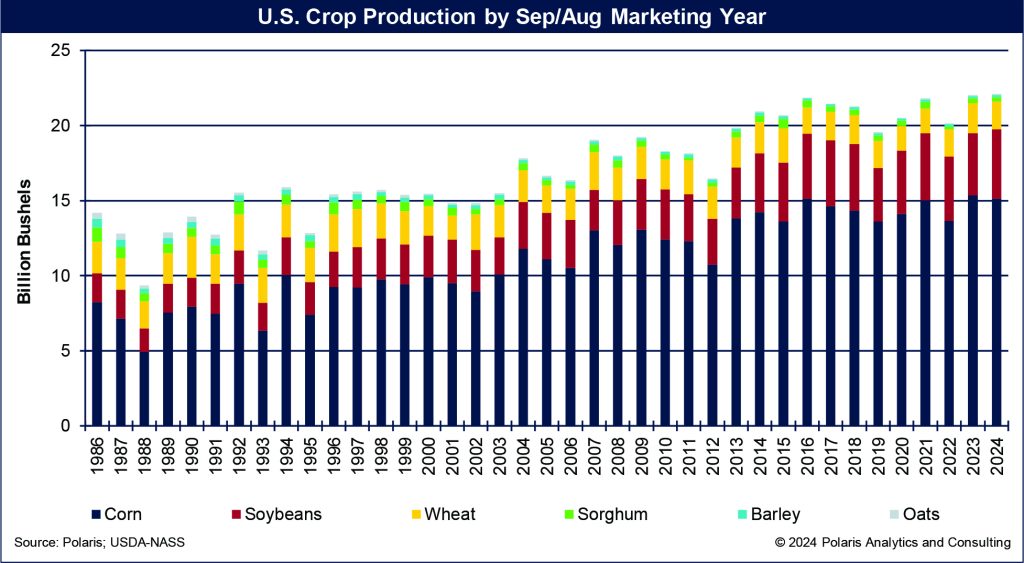

According to the crop statisticians at the U.S. Department of Agriculture, this year’s harvest is expected to be bountiful with 15.2 billion bushels of corn, which would be the second largest corn harvest in history, 302 million bushels of sorghum and a record 4.6 billion bushels of soybeans.

Together these crops will total 20.07 billion bushels and be 1.3% or 249 million bushels bigger than last year’s harvest. If realized, it will be the first time the harvest of these crops exceeds 20 billion bushels.

The National Agricultural Statistics Service at USDA released its crop forecasts for the 2024-25 marketing year on Sept. 12. Crop production for all crops is shown in the U.S. crop production by September/August marketing year chart.

Abounding crop supplies to bolster storage capacity utilization

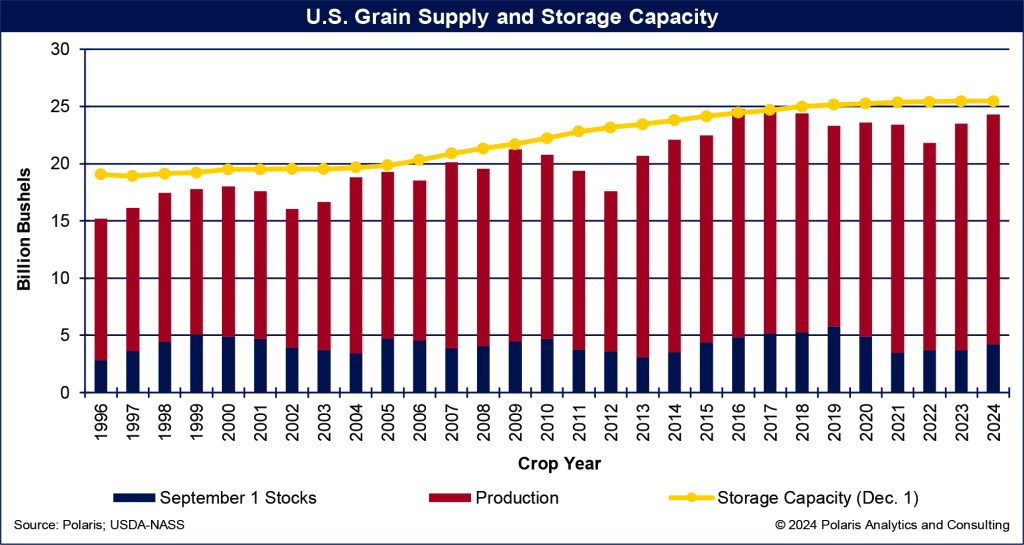

Sept. 1 grain and soybean stocks are forecast to total 4.21 billion bushels, which would be an increase of 523 million bushels or 14.2% from stocks one year ago based on data compiled from the World Agricultural Outlook Board at USDA.

NASS will release its “Grain Stocks” report on Sept. 30 that will include Sept. 1 grain stocks by state and position, along with the “Small Grains Summary” report.

Adding together Sept. 1 grain stocks and fall production of corn, sorghum and soybeans, grain supplies during the first quarter of the new crop year are forecast to total 24.285 billion bushels, 3.3% or 773 million bushels more than last year. If realized, grain supplies during the September to November crop quarter will be the fourth largest volume in U.S. history.

Comparing grain supplies to storage is an important measurement to understand how utilized grain storage capacity is. A higher utilization level suggests there is not as much capacity to store crops while a lower utilization level means there is adequate space available.

As of Dec. 1, 2023, grain storage capacity across the United States totaled a record 25.468 billion bushels. Grain storage capacity has increased an average of 0.4% in the past five years, much slower than the 0.8% of the past decade. USDA-NASS reports grain storage capacity in the January “Grain Stocks” report.

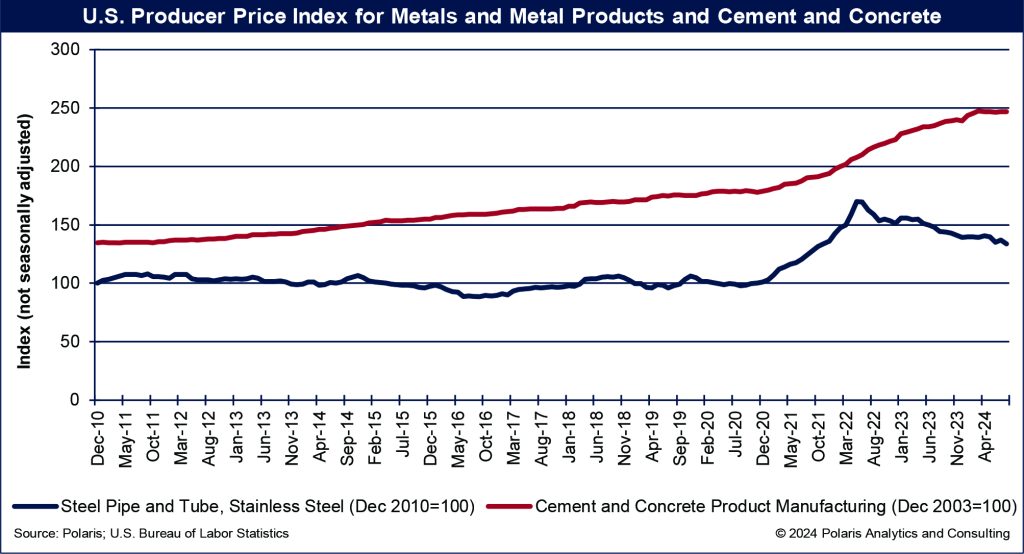

Expansion in storage capacity for 2024 is expected to be lower still or mostly unchanged. The slower expansion is due to higher installation costs related to steel prices and labor issues and high interest rates. The purchasing price for steel and cement, for example, remain elevated.

Steel prices peaked at an index of 170 in May 2022 and have steadily declined since then to an index of 134 for August 2024, a drop of 21.2% over that time. Cement prices, on the other hand, continue to run higher. From May 2022, cement prices are up 18.8% to an index of 247 for August 2024.

Most importantly, farmers and commercial operators are restraining to make capital investments during a period of low grain prices.

The steel and cement price indices are shown on the U.S. producer price index metals and cement figure.

Speaking with farmers and storage bin manufacturers at the Farm Progress Show in Boone, Iowa, in August, farmers said they are not making investments in storage this year. Bin sales people confirmed that sales have been slow and will be down compared to last year.

Presuming storage capacity will essentially be unchanged, and given the anticipated supply of this year’s crops, storage utilization will tighten to 95.4%, up from 92.3% one year ago and 91.3% of the past five years. By experience, storage capacity expansion increases at a faster pace when utilization levels exceed 95% and are expected to increase. Utilization levels tighten when crop supplies grow faster than capacity expansion.

Grain supplies and storage capacity are shown are shown on the U.S. grain supply and storage capacity chart.

Managing harvest flows

In addition to getting their equipment ready and plans prepared to rev up to harvest their corn, sorghum and soybeans, farmers have options where to take that harvest.

With relatively weakened grain prices, farmers’ marketing efforts and market signals do not point toward rapidly sending supplies to a market consumption position such as feeding, a crush or grind facility or barge or rail loader for the export market.

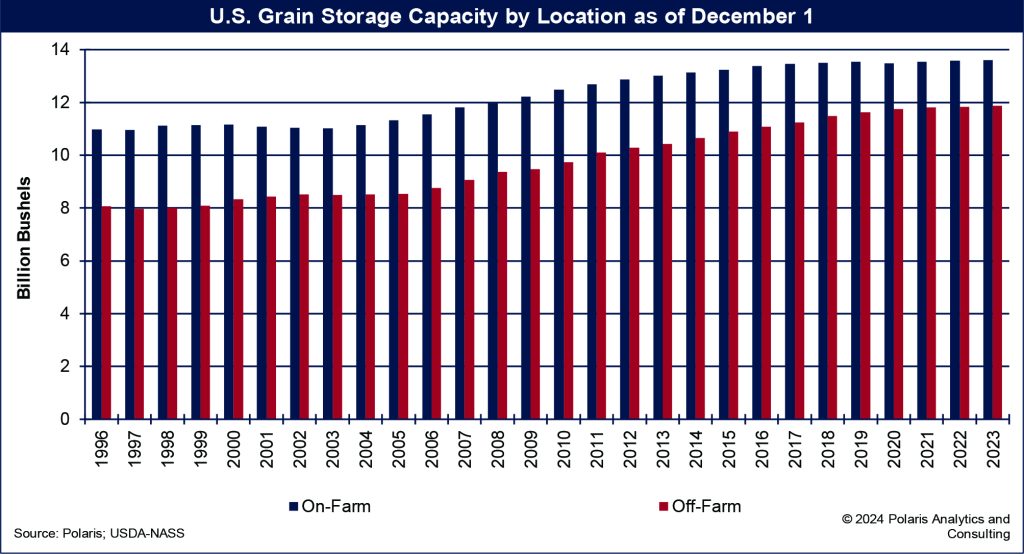

Farmers have the benefit of on-farm storage to aid harvest logistics. Over the past five years, they added nearly 100 million bushels of on-farm capacity to deliver their harvest from the field. However, commercial operators added 258 million bushels to their off-farm storage units. As of Dec. 1, 2023, on-farm grain storage across the U.S. totaled 13.592 billion bushels, while off-farm storage totaled 11.876 billion bushels.

Farmers have had the highest share of grain storage but have been losing ground to commercial interests. Over the past decade, the farmer share of U.S. grain storage has declined from 55.2% in 2014 to 53.4% in 2023. With this fall’s harvest exceeding 20 billion bushels, farmers will have to move a sizeable portion of the volume off farm to commercial storge or to a consumption position.

Grain storage capacity is shown in the U.S. grain storage capacity by locations as of Dec. 1 chart.

This year’s supply chain logistics for moving the crop harvest may see more storage needs than positioning for market consumption. Soybeans will clog up the export supply chain through October going into November. Then corn starts flowing into the export channels.

Other global influences will be hampering grain logistics this fall, including low-water conditions on the Mississippi River for the third consecutive year, border issues sending grain in to Mexico, a likely strike by the International Longshore Association on the East and Gulf Coasts (though grain elevators use non-union labor), rail contract issues in Canada that impact U.S. logistics as well and on-going terrorist attacks on vessels plying through the Red Sea and around the Arabian Peninsula, to name a few.

Farmers’ harvest plans are tough enough without global pressures and chokepoints disrupting those plans.

Ken Eriksen can be reached at [email protected].