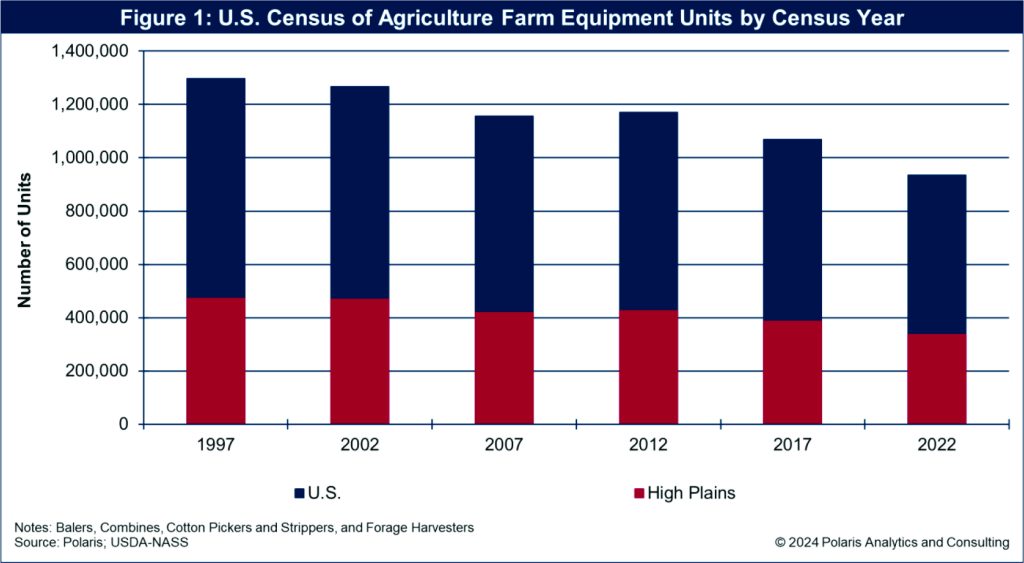

Across the United States and the High Plains, the amount of farm equipment (balers, combines, cotton pickers and strippers and forage harvesters) on farms is shrinking.

Since the 1997 Census of Agriculture, the year the National Agricultural Statistics Service of the U.S. Department of Agriculture took over the Census, the units of equipment on U.S. farms dropped by 362,133, or 28%, to 934,898 in 2022.

Across the High Plains, the drop in equipment was at a similar rate to the national level. The equipment on farms in the High Plains since 1997 was down by 136,416, or 29%, to 336,334 pieces of equipment in 2022.

The total number of farm equipment units reported by farm operations by Census of Agriculture year is shown in Figure 1.

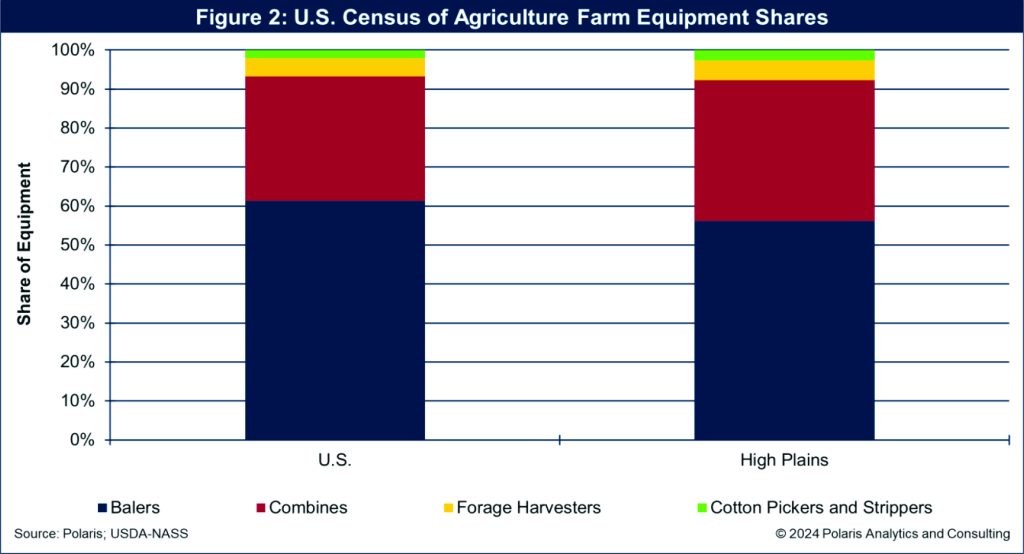

From the Census there are four key farm equipment types: balers, combines, cotton pickers and strippers and forage harvesters. The share of total U.S. equipment reported by farm operations in the High Plains averaged about 37% from one Census to the next.

Since 1997, the High Plains had 33% of the balers in the U.S., 39% of the forage harvesters, 41% of the combines and 50% of the cotton pickers and strippers, due to the region’s unique crop mix.

The share of equipment types on farms in the U.S. and across the High Plains is shown in Figure 2.

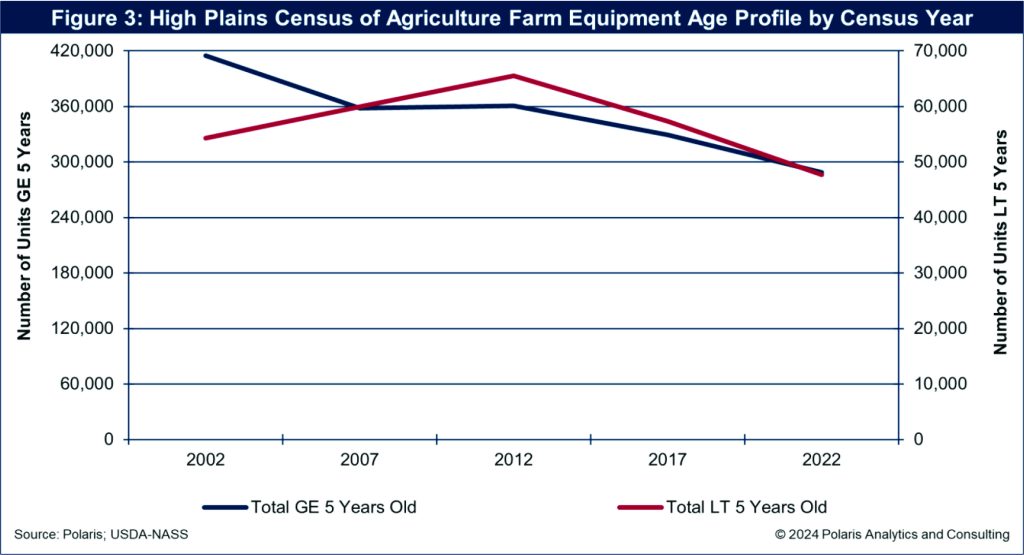

Farmers keep equipment around, replacing steadily

Farmers are consistent when it comes to keeping equipment on the farm. Based on Census of Agriculture data, from one Census to another, about 86% of the equipment reported by farmers in the High Plains is greater than or equal to five years old. The remaining 14% is less than five years old. Farmers are not replacing equipment at a rapid pace.

Given that the number of units reported by farmers has been declining, such news is not welcomed by equipment manufacturers. While there was a bump in relatively new equipment (those less than five years old) on farms in 2007 that totaled 59,950 units (compared to 54,324 in 2002), and in 2012 there were 65,531 reported, a reversal in newer equipment emerged in 2017 when farmers reported 57,322 units. In the most recent Census for 2022, the equipment on farms and less than five years old dropped to a historical low totaling 47,701 units.

The farm equipment age profile for farms in the High Plains is shown in Figure 3.

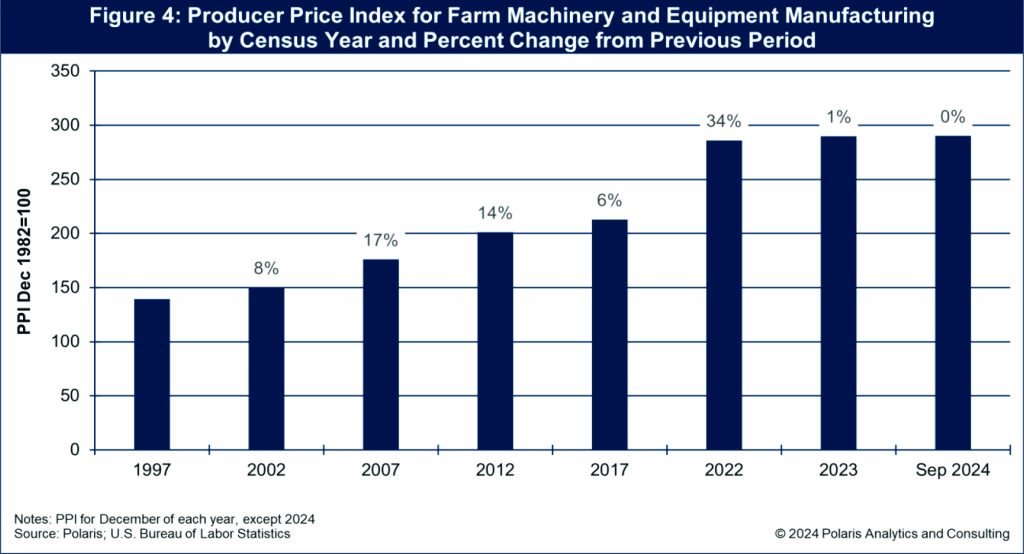

High prices are solving farmer decisions

As much as high prices cure high prices, will high equipment costs cure high equipment costs? By looking at the Producer Price Index for farm machinery and equipment manufacturing for the same Census years, there is a discernable pattern. Prices only increase.

Since the 1997 Census, the PPI for farm machinery and equipment has steadily increased. For each December of the Census years, the PPI was 139.5 in 1997, increasing 8% in 2002 to an index of 150.1, another 17% in 2007 to 176, up 14% in 2012 to 201.1 and rising 6% in 2017 to 212.9. Those price increases seemed tolerable until 2022. In December 2022, the PPI leapt 34% from December 2017 to an index of 286.1.

The rising PPIs reflect higher manufacturing costs associated with labor, materials (e.g., steel), parts and other factors. In 2022, the price also reflected the great supply chain disruption from COVID that included massive government spending to boost economies around the world through consumer spending, infrastructure investment and corporate capital spending, which exacerbated pricing on steel and other costs of goods. Tariffs on imported steel also increased production costs for manufacturers.

While the PPI for farm machinery and equipment manufacturing has leveled off, increasing 1% through December 2023 to an index of 289.9 and fractionally higher through September 2024 to an index of 290.2, the PPI remains high and unlikely to pull back in any meaningful manner. Since the inception of this PPI in 1926, a period of 1,185 months, there were 105 times the PPI was lower than the previous month but 631 times it was higher than the previous month.

The PPI for farm machinery and equipment manufacturing by Census year is shown in Figure 4.

Farmers vote with their wallet, and banker input

As price takers, farmers are sensitive to rising costs, especially equipment. Given the surge in machinery and equipment costs, farmers are staying out of the market by refraining from buying new equipment. The cost of farm machinery and equipment remains elevated and shows no sign of retreating.

With crop prices historically low and interest rates that are elevated, farmers are further strained (and told by bankers and financial advisers to closely evaluate their situation if they want to buy new or near new equipment) in context to their entire operation.

Ken Eriksen can be reached at [email protected].