The potential for an explosive upside move for United States wheat prices is high due to record low hard red winter wheat acres combined with U.S. Great Plains drought and late hard red spring wheat planting. Compounding the price risk are the dry conditions in Canada and questions around Argentine wheat production post the 2018 drought.

Since last fall, the major U.S. HRW growing areas have suffered under a drought. Spotty rainfall in Kansas, wildfires in Oklahoma and the severe drought in the Panhandle of Texas add to the deteriorating yield prospects. 2018 crop condition ratings can provide direction to potential yield. As of May 20, the crop condition index (scale: 0 to 500) was 293 compared to the five-year average of 318.

Based on history, an extrapolated HRW yield would be in the mid-30 bushels per acre. The recent Kansas wheat tour reported delayed development, thin stands and a yield estimate of 37 bushels per acre, versus 48 bushels per acre in 2017. If realized, it will be the lowest Kansas wheat production since 1989.

At trend yield, wheat stocks are forecast to decline over 70 million bushels to 487 million bushels. The expected average 2018-19 farm received price for HRW increases to $4.62 per bushel from a 2017-18 price range of $4.10 to $4.25.

However, lower acreage provides little cushion for production problems. Assuming a drought-reduced yield of 37 bushels per acre and average ratio of harvested versus planted acres, ending stocks fall to 419 million bushels and the average farm price increases to $5.56 per bushel, nearly a $1 increase above the trend yield scenario and a $1.50 per bushel increase YOY.

As the stocks-to-use ratio approaches 35 to 40 percent, price bidding heats up. An additional likely supply risk comes from potentially lower harvested acres due to abandonment. As a result, production and stocks would decline even more and prices are supported further.

There are additional production risks that support HRW prices. When HRW supplies are low, or protein content is insufficient, demand for the smaller HRS wheat crop increases. It has been a late spring in the major U.S. growing areas of North Dakota and Montana.

Thus, North Dakota could plant less HRS. Montana has fewer alternative crops, however, a late-planted crop will potentially yield less. Therefore, the much needed increase in 2018 HRS production may not materialize, tightening up the balance sheet and supporting higher U.S. prices.

Canada may become an even more important supplier of HRS to the U.S. Stats Canada is projecting an increase in Canadian spring wheat plantings, up 15.4 percent over 2017 to 18.2 million acres. However, the major wheat growing areas of the prairies provinces have received between 15 to 35 percent less rainfall in the past six months than normal, raising concerns over yields.

Projected 2018 Argentine winter wheat plantings are between 5.4 to 5.9 million hectares, versus 5.7 million hectares last year. While soil moisture has recovered in 70 percent of the growing region, there are still moisture deficits in southeastern Buenos Aires and in La Pampa provinces. In 2018-19, there is less room for Argentine yield problems than normal.

Of the major western hemisphere wheat exporters (Argentina, Canada, and U.S.)—that account for 90 percent of the hemisphere’s wheat production—only Canada looks poised to increase 2018 production due to more area. Using projected planted area for these three countries, production expectation is down over 3 million metric tons, or 3.2 percent, in an average yield scenario.

Under both trend- and low-yield scenarios, HRW prices increase due to lower stocks resulting from record low planted acres. U.S. wheat flour buyers need to factor in at least two years of higher wheat prices in their cost of goods budget. While current futures may not be attractive to buyers, basis values are not yet reflecting production issues.

Futures have given buyers opportunities to buy at lower values and those opportunities should be taken advantage of. Likewise, producers should take advantage of market rallies and forward selling opportunities if it meets their profit objectives.

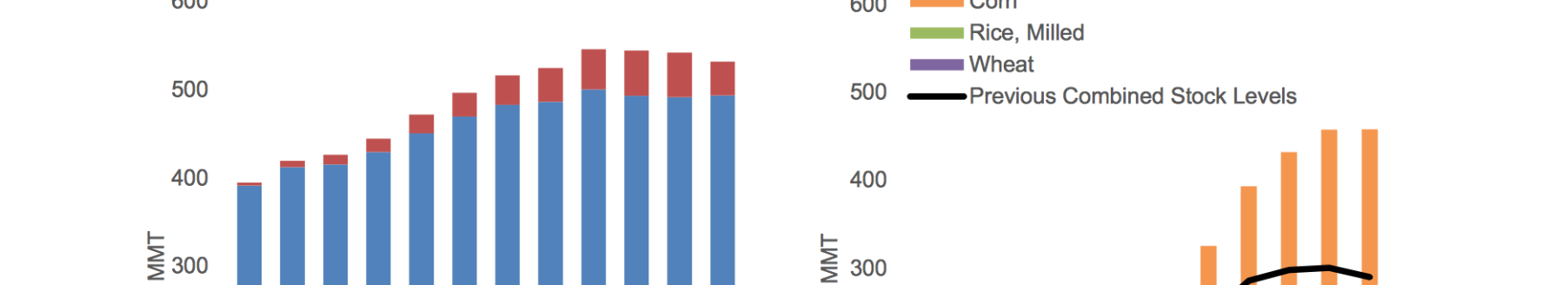

However, the global wheat price outlook is not considered to be bullish from current levels, with the second-highest global stocks on record and the highest stocks-to-use ratio since 2000-01. The higher U.S. prices will diminish U.S. exports outside the Western Hemisphere and open up further opportunities for Europe and Black Sea exporters.