Farmers optimistic about future even as their perception of economic conditions drops

By Jim Mintert

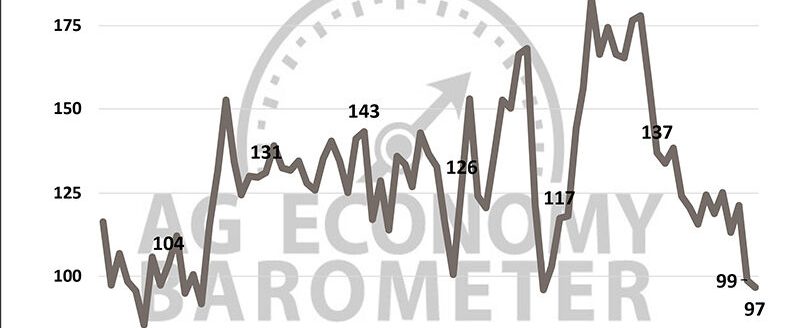

The Purdue University/CME Group Ag Economy Barometer, which is based on a mid-month survey of 400 U.S. crop and livestock producers, dropped 3 points in December to a reading of 150, down from 153 in November. The decline in the barometer occurred because producer sentiment regarding current economic conditions of the agricultural economy dropped 12 points in December, as the Index of Current Conditions registered a reading of 141, down from 153 in November. Meanwhile, the Index of Future Expectations remained strong, up 2 points in December to a reading of 155.

In the December survey, producers were asked whether their farm’s 2019 financial performance was better, as expected, or worse than their initial budget projections. Just over-half (52%), stated that their initial projections matched their farm’s financial performance; 30% stated it was worse; and 19% stated it was better than expected.

To better assess the level of financial stress among U.S. farms, producers were asked in both the November and December surveys whether they expected their farm’s 2020 operating loan to be larger, about the same, or smaller than in 2019. In a follow-up, those who expected a larger loan were asked the reason why they expected their loan to increase. Approximately, 1 out of 5 farmers on the two surveys indicated that they expect to have a larger operating loan in 2020 compared to 2019 and, of those, 3 out of 10 indicated that the reason for the larger loan is unpaid operating debt from 2019. Carrying over unpaid operating debt from year-to-year is an indicator of financial stress and these results suggest that about 6% of farms surveyed for the Ag Economy Barometer in late 2019 were experiencing financial stress.

Most producers surveyed said they expect stable farmland cash rental rates in 2020. From October through December, producers were asked whether they expect changes in rental rates in the coming year. More than three-quarters of survey respondents did not expect a change, between 8 to 9% expected a rise, and between 13 to 14% expected a decline in rental rates.

Producers remained relatively optimistic that a resolution to the ongoing trade dispute with China will take place soon and that the outcome of the dispute will benefit U.S. agriculture. In December, 54% of respondents stated they expect a resolution to the trade dispute soon which, although down from 57% in November, was still the second most positive response to this question since last March. The percentage of producers who expect the outcome will ultimately favor U.S. agriculture dropped to 72% down from 80% in November. Since this question was first posed in March 2019, approximately 73% of respondents have, on average, indicated they expect a favorable outcome to the trade dispute of U.S. agriculture.

Editor’s note: Jim Mintert is the director of commercial agriculture at Purdue University.