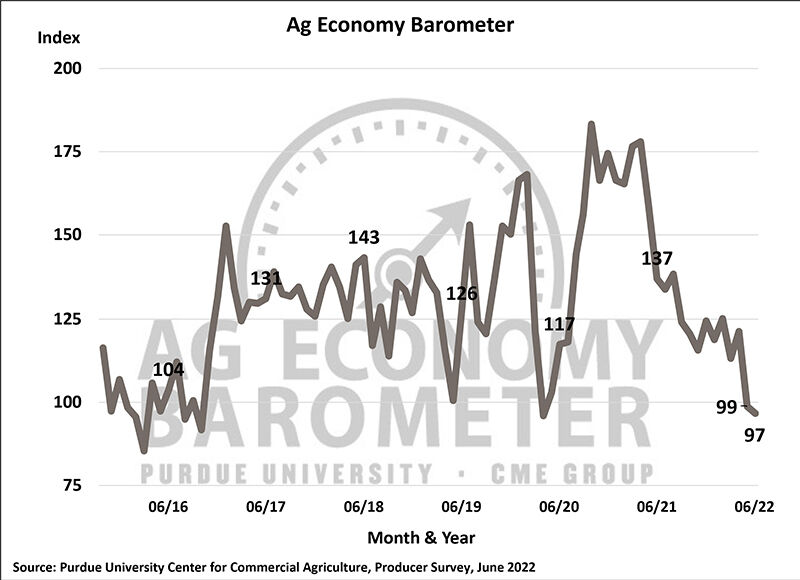

The Purdue University/CME Group Ag Economy Barometer continued to slide in June, down 2 points to a reading of 97. Producers’ expectations for the future also weakened. The Index of Future Expectations fell 5 points to a reading of 96, marking the lowest level for the index since October 2016. Meanwhile, producers were slightly more optimistic regarding current conditions; the Index of Current Conditions improved 5 points to a reading of 99. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted June 13-17.

“Rising input costs and uncertainty about the future continue to weigh on farmer sentiment,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Many producers remain concerned about the ongoing escalation in production costs as well as commodity price volatility, which could lead to a production cost/income squeeze in 2023.”

The Farm Financial Performance Index, which is primarily reflective of income expectations for the current year, improved 2 points to a reading of 83 in June, yet remains at one of the index’s lowest readings over the past two years. When asked about expectations for their farm’s financial condition in June 2023 compared to June 2022, 51% of survey respondents said they expect their farms to be worse off financially a year from now. This is the most negative response received to this question since data collection began in 2015.

For the second month in a row, the Farm Capital Investment Index held at a record low of 35, as producers continue to say now is not a good time to make large investments in their farm operation. Supply chain issues continue to frustrate farmers. In May and June, 50% of producers said that tight machinery inventories were impacting their farm machinery purchase plans.

The top concerns for producers in the upcoming year continue to be input prices (43%), followed by input availability (21%), government policies (18%), and lower output prices (17%). Looking ahead to 2023, a majority of farmers expect to see another round of large input cost increases, with 63% of producers expecting higher costs in 2023, on top of the large increases experienced in 2022. Nearly four out of 10 farmers expect input prices to rise by 10% or more next year when compared to 2022; only one out of 10 producers expect input prices in 2023 to fall below 2022’s prices. Producers also expect inflation to push up the cost of living for farm families in the year ahead. Seven out of 10 survey respondents said they expect the rate of inflation for consumer items to be 6% or higher over the next year, and 35% of respondents said they expect the inflation rate to exceed 10%.

When asked about their cropping plans for the upcoming year, one out of five (19%) of crop producers said they intend to change their crop mix in the upcoming year in response to rising input costs. Among those who plan to shift their crop mix, almost half of the respondents (46%) said the biggest change will be to devote a higher percentage of their acreage to soybeans. Twenty-six percent of those planning a crop mix change said the biggest change would be to devote more of their farm to wheat production, while 21% of respondents said they would shift to planting more corn.

Although both farmland value indices remain at strong levels, producers were noticeably less confident that farmland values will continue to rise than they were last fall. The Short-Term Farmland Value Expectations Index dropped 9 points to a reading of 136 in June, while the Long-Term Farmland Value Expectations Index dropped 8 points to a reading of 141. The short- and long-term farmland indices are down 13% and 12%, respectively, from the highs posted in fall of 2021.

This month’s survey also asked farmers who planted corn or soybeans in 2022 about their expectations for farmland cash rental rates in 2023. Over half (52%) of respondents said they expect cash rental rates to rise next year. Of those who expect rates to rise, eight out of 10 respondents said they expect rates to rise 5% or more, while four out of 10 said they expect rental rates to rise by 10% or more in 2023.