The image of American Gothic’s farm couple is what many people think of when they hear “farmer.” Times change, but farming is still overwhelmingly a family business in America in 2020.

In 2019, the average value of production on the 2 million farms was roughly $168,218, according to the U.S. Department of Agriculture-Economic Research Service. And yet, almost half of American farms had production valued at $6,000 or less, and more than 60% of all production came from farms with at least $1 million in agricultural receipts.

The USDA’s 2020 report “America’s Diverse Family Farms,” released Dec. 11, provides insights into the make up of farms—their annual revenues, the main occupation of the farm’s principal producer and the family or non-family ownership to name a few.

Defining the farm

To better understand the conditions of America’s farms, the ERS has created a farm typology, which sorts farms by principal operator, amount of production sold and more. To start, a “farm” is an operation that sells at least $1,000 of farm products in a given year. According to Christine Whitte, agricultural economist in the Farm Economy Branch in the Resource and Rural Economics Division, the U.S. farm sector is broken into four main categories:

• Small Family Farms with less than $350,000 revenue;

• Midsized Family Farms with revenue $350,000 to $999,999;

• Large-Scale Family Farms with revenue of $1 million or more; and

• Nonfamily Farms, where the principal operator doesn’t own a majority of the business.

Of those four main categories, the small family farms are further broken into: retirement farms, with principal operators who are retired from full-time farming (10.7% of U.S. farms in 2019); off-farm occupation farms, with principal operators who report a primary occupation other than farming (41.4% of U.S. farms); farming-occupation farms, with principal operators that list farming as their occupation (37.5% of U.S. farms).

Whitte said according to the report, family farms make up 98% of all American farms, and account for 85% of U.S. farm production.

Farmland and commodities

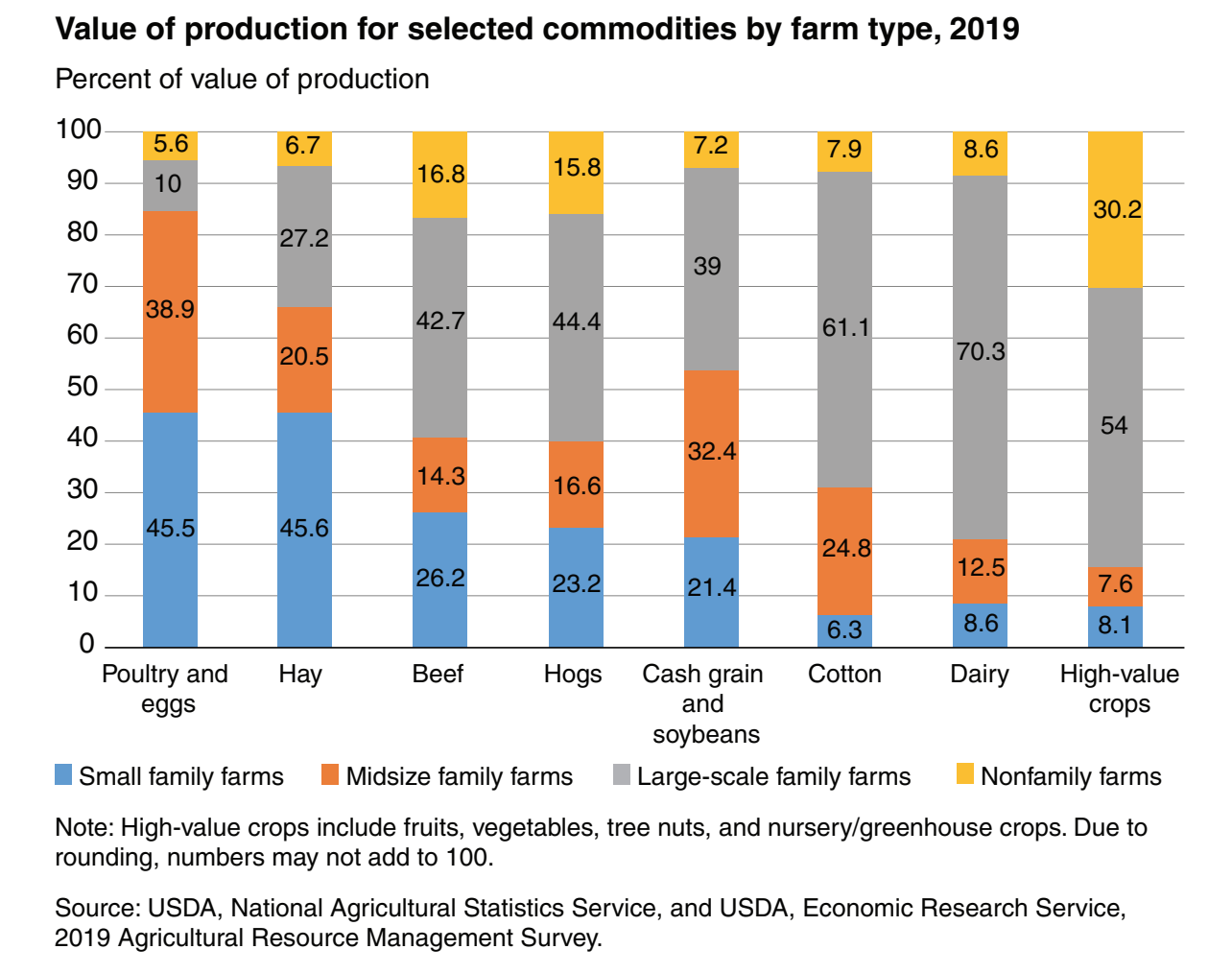

The report found that small farms operate almost half of U.S. farmland and yet account for only 22% of U.S. production. That’s because many of the small farms produce commodities like poultry, eggs or hay, which on the whole don’t account for a large portion of American ag production. Small family farms, for example raise 45% of the poultry and eggs in this country and 46% of the hay.

Both small and large-scale family farms account for 69% of beef production, but smaller farms generally tend toward the cow-calf production end, while large scale farms are typically tied to operating feedlots.

Midsize family farms and large family farms account for the majority of cotton (86%) and cash grain and oilseed production (71%), and hogs (61%), Whitte added.

“Large-scale family farms account for over two-thirds of dairy production, while large-scale family farms produce just over 50% of high-value crops such as fruits and vegetables,” the report stated. “Nonfamily farms produce more than 30% of high-value crops, nearly double that of any other major commodity grouping.”

Farm incomes

The report showed that farm households today often use off-farm income to cover farm expenses. Primary sources of that off-farm income are self-employment and wage or salary jobs. However, public and private pensions, interest and dividend payments, asset sales, Social Security payments and others provide a significant source, particularly for retirement farms.

Between 62 and 81% of small family farms had operating profit margins in the high-risk red zone, which indicates a higher risk of financial problems. However, as Whitte explained, many of these small farms also have operators who have off-farm income substantial enough to make up the gap.

According to the report 9 to 23% of small farms operate in the low-risk green zone, while 28 to 39% of midsize, large, and very large farms operate in that same low-risk green zone.

In general, farm households aren’t low income or low wealth, when compared with all U.S. households, the report stated.

“In 2019, 57% of farm households received an income at or above $68,703, the median for all U.S. households,” the report stated. Median household income in 5 of the 7 farm types exceeded both the median U.S. household income and the median income for self-employed households.

“Overall, only 3% of farm households had lower wealth than the median U.S. household,” the report stated. This is because farming is capital intensive and generally farms have large acreages of land that contributes to their wealth.

Women in agriculture and the next generation

Women are quickly rising as operators and principal operators of American farms. According to the report, women are operators in 51% of all farming operations, and are principal operators on 14% of operations.

“Operations with principal female operators contributed just over 4% of the total value of production in 2019,” according to the report. Many of these female farmers (61%) are found in farms that specialize in poultry and other livestock like horses, bees, sheep and goats and more.

Another trend that the report documented is the need for succession planning among U.S. farms of all sizes. According to its findings, 17% of principal operators plan to retire in the next five years, but more than half of those have not developed a succession plan.

Who will inherit from those soon-to-be-retirees? Thirty-three percent plan to pass it along to a family member, with half of those being family members who don’t currently work on the farm. That has vast implications for farmland control in the next decade.

“Principal operators planning to retire in the next five years operate 15% of total farmland,” the report stated. Of that 15% of U.S. farmland that’s going to change hands in the next five years:

• 48% is on operations with identified successors;

• 23% is covered by a succession plan without an identified successor; and

• 29% has no succession plan.

Whitte said USDA estimates that 8% or less of U.S. farmland is likely to become available for purchase from retiring principal farm operators in the next 5 years.

Jennifer M. Latzke can be reached at 620-227-1807 or [email protected].