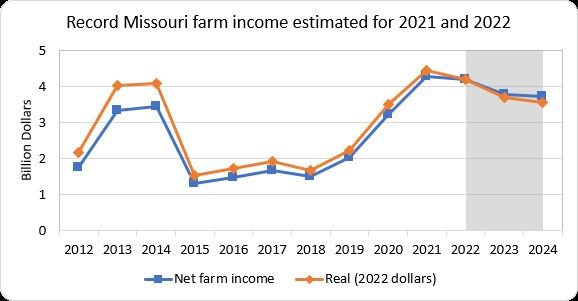

Missouri farm income appears on pace for another record year, according to John Kruse, associate research and extension professor in agricultural and applied economics at the University of Missouri.

“It’s not often when there are back-to-back record years for Missouri farm income, but the data suggests 2021 set a new record for Missouri farm income at $4.27 billion, and 2022 appears to be close behind at $4.19 billion,” Kruse said. “The last time Missouri farmers saw income levels this strong was in 2013 and ’14. Comparable real net farm income levels (2022 dollars) were $4.02 billion and $4.09 billion in 2013 and 2014, respectively.”

USDA won’t release official 2021 Missouri net farm income estimates until November.

Kruse presented his report on the 2022 Missouri farm income outlook at the recent Abner Womack Missouri Agriculture Outlook Conference, hosted by MU’s Food and Agricultural Policy Research Institute.

Commodity prices—which have gradually increased as global supplies have gotten tighter—are driving the income growth, he said. Last year’s drought in Canada reduced canola production 35%, and dry conditions continue to linger in south-central Canada. Southern Brazil and Argentina experienced a second year of La Niña-induced drought, significantly reducing their current soybean crops. Dry conditions in Europe are raising concerns for the coming growing season. In the U.S., 30% of the wheat crop is reported to be in good to excellent condition, compared with 53% this time last year. Drought conditions persist across much of the southwestern U.S., including areas supporting cattle grazing.

In addition, the Russia-Ukraine war is likely to reduce exportable crop production from Ukraine in the current marketing year 2021-22 as well as for the next marketing year 2022-23 and possibly beyond, mostly affecting wheat, corn and sunflower products, Kruse said. Sanctions on Russia are expected to affect fertilizer supplies and energy prices, and prices will likely remain high for these inputs for the next few years.

Global corn, wheat and oilseed stocks remain tight, with rice the only large food commodity with stocks above the 30-year average. Commodity prices are likely to remain volatile, reacting strongly to new developments.

Missouri farmers are also experiencing wider basis levels, which suggests prices at the Board of Trade are not necessarily reflected well in local prices, Kruse said. He advises producers to use risk management tools for pricing and production.

While higher commodity prices are expanding crop revenues, they also mean higher feed costs for livestock producers. Missouri beef cow numbers dropped 6.3% from January 2021 to January 2022. Missouri breeding hog inventories dropped 2.3% in year-over-year estimates on Dec. 1, 2021, after falling 10.2% in the previous year. Although 2021 livestock receipts are estimated to be up $1.3 billion, that increase is more than halfway offset by rising feed and feeder livestock costs. Projections in January 2022 suggested that margins could get tighter, but livestock prices in the first quarter of 2022 have been higher than were anticipated in January and will help bolster livestock receipts in 2022.

As farmers look to the 2022 growing season, there is reason for continued optimism, Kruse said.

“The strength in farm income occurs even as ad hoc government payments are significantly reduced from 2020 levels,” he said. “Stronger commodity prices may add to crop and livestock cash receipts, but there will likely be some offset from higher production expenses, especially feed, fertilizer, fuel, labor, interest, etc.”

Kruse suggests farmers pay close attention to new opportunities offered under USDA’s Climate-Smart Commodities program that could generate new revenue streams through nontraditional sources.