Alfalfa and forage growers may want consider an insurance program that can help them cover financial risk.

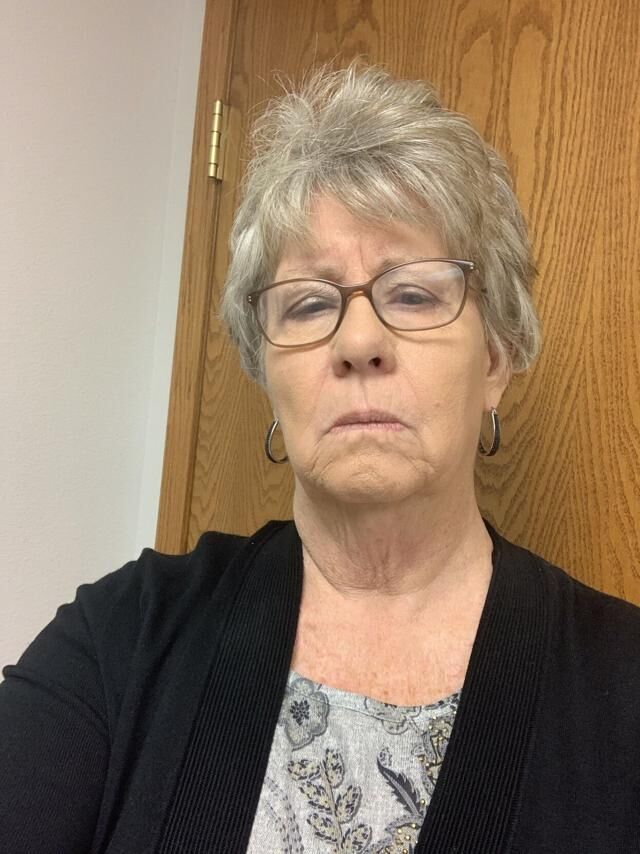

Glenda Blindert, a crop insurance agent at Blindert Insurance Agency, Salem, South Dakota, said growers need to evaluate their operation and look to see if they can cover the costs of any crop they plant.

When it comes to alfalfa and forage, there are many details to be considered.

“Forage seeding coverage is available in many states and counties,” Blindert said. “They need to check with their local agent for the coverage available in their area. This coverage covers the alfalfa from when it was planted for a full year after planting. So if the farmer ends ups with a poor stand or if it dies, he will at least be able to recoup part of the seed cost.”

For example, if someone plants 50 acres in the spring and 10 acres fail within the first year of seeding, he will be paid the payment per acre on the acres that failed or need to be reseeded, she said.

“This policy is working well and helps cover some of the initial cost of seeding,” she said.

A good insurance policy is beneficial because alfalfa is an expensive crop to plant and maintain, she said. “The farmer needs to think about crop insurance on alfalfa, just like he would with corn.”

A grower also needs to consider other risk factors when it comes to alfalfa.

“After the first year of seeding, the insurance coverage isn’t as good right now to protect the production,” Blindert said. “Crop insurance is working to improve that coverage which hopefully will happen in the next couple of years.”

Her recommendation to growers who are planting alfalfa—and if it’s an important crop on their farm—is that they should check with their local agent to see how it can be insured after that first year.

Blindert said growers also need to work with their local Farm Service Agency office to stay in compliance. Dates will vary by region, she said. Fall and spring seeded alfalfa must be reported to FSA.

She has also been evaluating forage production as enterprise units as it still has some improvements to the program that have yet to be made.

“Once we adopt the pending changes for forage production to help with the pricing of it then I think this product will be more attractive,” Blindert said.

Overall, she likes the approach being taken by Congress and the United States Department of Agriculture to help growers.

“I think that crop insurance is moving in the right direction for forage production to make this crop more attractive to plant,” she said. “Right now crop insurance coverage doesn’t offer coverage on par with the other crops, such as soybeans and corn, in our area. I think once the changes in crop insurance are made in crop year 2024 or 2025 this will make it easier to justify planting alfalfa.”

Blindert Insurance is an independent agency that provides crop insurance, plus farm, home and automobile, and business insurance. Glenda Blindert has been a presenter at High Plains Journal’s Alfalfa U events.

Dave Bergmeier can be reached at 620-227-1822 or [email protected].