Recent Cattle on Feed provides no unexpected turns

A recent Cattle on Feed report did not provide any surprises to livestock analysts.

The U.S. Department of Agriculture indicated the Cattle on Feed was up 2%.

“The report was about as close to pre-report analyst expectations as they can get. Ahead of the report, smaller December placements were expected to be the driving force in drawing that year-over-year increase from the Dec. 1 on-feed inventory tighter, and that followed as expected,” said Lance Zimmerman, a senior beef analyst at RaboResearch.

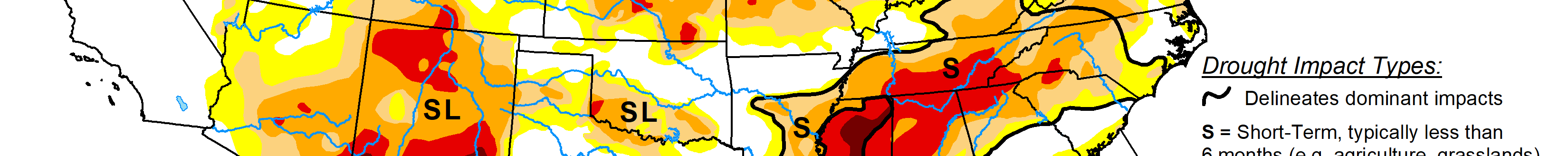

As drought affects become less of a factor in cattle movement through the winter, the tighter feeder cattle and calf supply had a factor in cattle movement, he said. December marketings were also 1% below year-ago levels, which was consistent with what the monthly steer and heifer slaughter suggested.

“There was one less slaughter day in December 2023 compared to last year though due to how the calendar year fell. So, on a days-adjusted basis, packers received more fed cattle than the year prior, he said.

For cattle and calves on feed for the slaughter market in the U.S. for feedlots with capacity of 1,000 or more head totaled 11.9 million head on Jan. 1, 2024. The inventory was 2% above Jan. 1, 2023. The inventory included 7.2 million steers and steer calves, up 2% from the previous year. This group accounted for 60% of the total inventory. Heifers and heifer calves accounted for 4.74 million head, also up 2% from 2023.

“There continues to be no indication in national aggregate at least) that initiated herd expansion by holding back heifers,” said Glynn Tonsor, professor in the department of agricultural economics at Kansas State University. “This not surprising and signals summer of 2024 is the earliest we may start to see that occur with the summer of 2025 being more likely to have an impactful number of heifers retained.”

Zimmerman said Oct. 1, 2023, the heifer inventory in feedyards was up 1.3%, also a telling sign. It was going to take a relatively significant shift in placements to move the year-over-year trend in the opposite direction. That didn’t happen. The year-over-year increase widened to 1.8%. The surge in late summer and fall placements—despite much tighter USDA-reported feeder cattle and calf supplies in the Jan. 1 and July 1 cattle inventory reports—suggested the increase was likely due to ample heifers entering feedyards.

“One data point I track is the percentage of heifers in U.S. feeder cattle and calf sales, and the data suggested this was likely, he said.

During fourth quarter 2023, the percentage of heifers in feeder cattle and calf sales was 41.4%. This compares to 40.7% last year at that time and 40.4% over the previous five years. Expect the number of heifer replacements available in 2024 to remain historically small. That means fall 2024 is the next best opportunity for U.S. producers to secure future herd replacements.

Placements in feedlots during December totaled 1.7 million head, 4% below 2022.

“No surprise as the 4% decline in placements also aligns with pre-report expectations,” Tonsor said.

At some point, the decline in feeder cattle and calves outside of feedyards from USDA’s semi-annual Cattle Inventory reports will be reflected in the agency’s monthly Cattle on Feed reported placement numbers, Zimmerman said. 2023 placements will be down 305,000 head for the year, while the Jan. 1 available supply of feeder cattle and calves was down 724,000 head.

“Drought can create a lag between the two datasets,” he said. “There is also risk of sample error in any survey. Perhaps the decline in available supplies was overstated by the Cattle Inventory report, or the placement numbers were overstated by the Cattle on Feed report at times. It is hard to tell with certainty, but eventually the slaughter numbers will tell the truth. And the USDA generally publishes revisions as more data is available.”

The 2022 Census of Agriculture data could also help everyone better understand breeding stock and other cattle inventories and movements better, he said, and that data will be released later this year. It is always important to remember these reports are fallible. The data is only as good as the instrument used to capture it. That is why producer participation is so valuable.

“I always tell cattle producers ‘You can only complain about USDA report accuracy if you support the process. If you are ignoring USDA phone calls or throwing surveys in the trash, then you forfeit the right to complain about the results.’”

Net placements were 1.64 million head, the report noted. During December, placements of cattle and calves weighing less than 600 pounds were 440,000 head, 600 to 699 pounds were 410,000 head, 700 to 799 pounds were 388,000 head, 800 to 899 pounds were 279,000 head, 900 to 999 pounds were 110,000 head, and 1,000 pounds and greater were 85,000 head.

Going forward Zimmerman expects less feedyard placements. “It is more challenging navigating when the biggest declines are coming and how large those declines will be over a sustained period of time. Weather will continue to influence cattle movement.”

Sign up for HPJ Insights

Our weekly newsletter delivers the latest news straight to your inbox including breaking news, our exclusive columns and much more.

He thought during January it was hard to move a lot of cattle. That could mean more cattle being pushed into feedyards in February at a higher level than normal.

Marketings of fed cattle during December totaled 1.73 million head, which was 1% below 2022.

The Cattle on Feed report is based on a survey of feedlots with at least 1,000 head capacity.

The report can be found at https://downloads.usda.library.cornell.edu/usda-esmis/files/m326m174z/hx1202579/fn108j71h/cofd0124.pdf

Dave Bergmeier can be reached at 620-227-1822 or [email protected].