The United States is a resource-rich country feeding and fueling its people and others around the globe. Farmers across the vast production areas of the U.S. grow an abundance of crops that are used as feed, food and fuel across the U.S. As a surplus producer, the United States also sends grains and soybeans to the export market.

For U.S. farmers, these exports are not just transactions but lifelines that sustain their livelihoods. The revenue generated from international markets is vital, providing farmers with the financial stability needed to plan for future seasons. Moreover, the export market helps to balance domestic supply with global demand, which can stabilize prices and ensure that farmers are not left with unsold surpluses that could lead to financial decline.

However, despite its historical presence, the U.S. is not the dominant supplier it once was.

U.S. crop exports finding opportunities

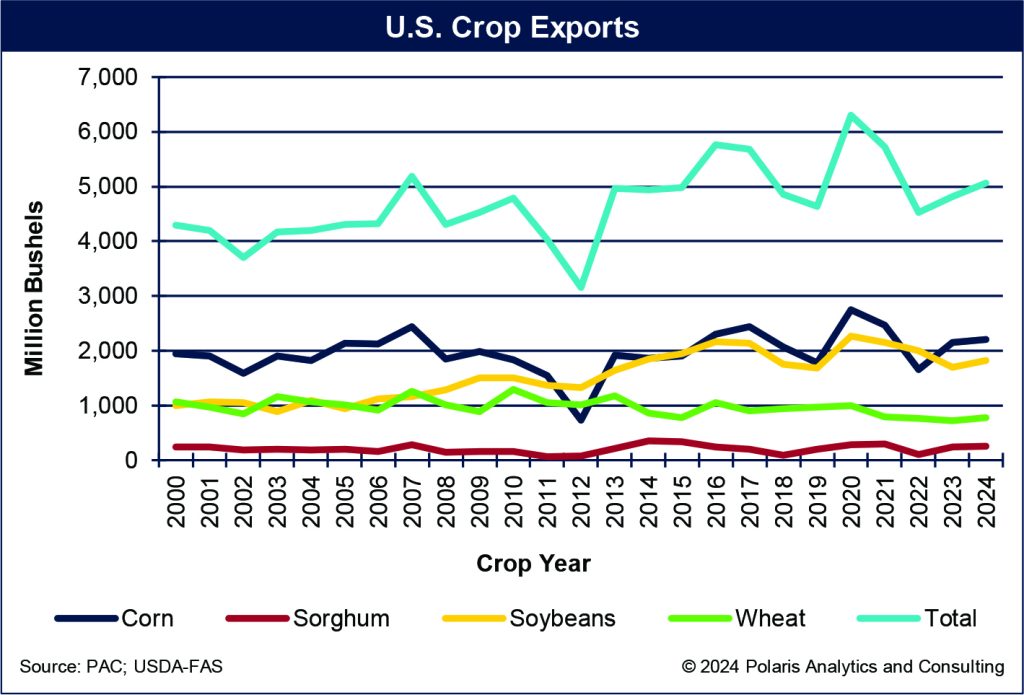

U.S. crop exports of barley, corn, oats, sorghum, soybeans and wheat during the 2024-25 crop marketing year are looking up, forecast to exceed 5 billion bushels (or 133.3 million metric tons) for the first time since 2021-22. If realized, it will be the sixth time in U.S. history that exports will surpass the 5-billion-bushel mark. The record was in 2020-21, when exports exceeded 6,302 million bushels. The 5,065 million bushels forecast for 2024-25 is 244 million bushels or 5% more than 2023/24.

The World Agricultural Outlook Board at the U.S. Department of Agriculture released its initial crop supply and demand balance tables of the major crops for the 2024-25 crop marketing year, including its first look for exports on May 10. The old crop (2023-24) balance tables were also updated at that time.

Leading the way higher is soybean exports that are forecast to be 7.4% higher to 1,825 million bushels. Corn exports are forecast to total 2,200 million bushels, up 50 million bushels or 2.3% from 2023-24, while wheat exports look to improve 7.6% to 775 million bushels during 2024-25, up from the historic low of 720 million bushels in 2023-24.

U.S. crop exports are shown in the following chart.

The world hungers for grains and soybeans

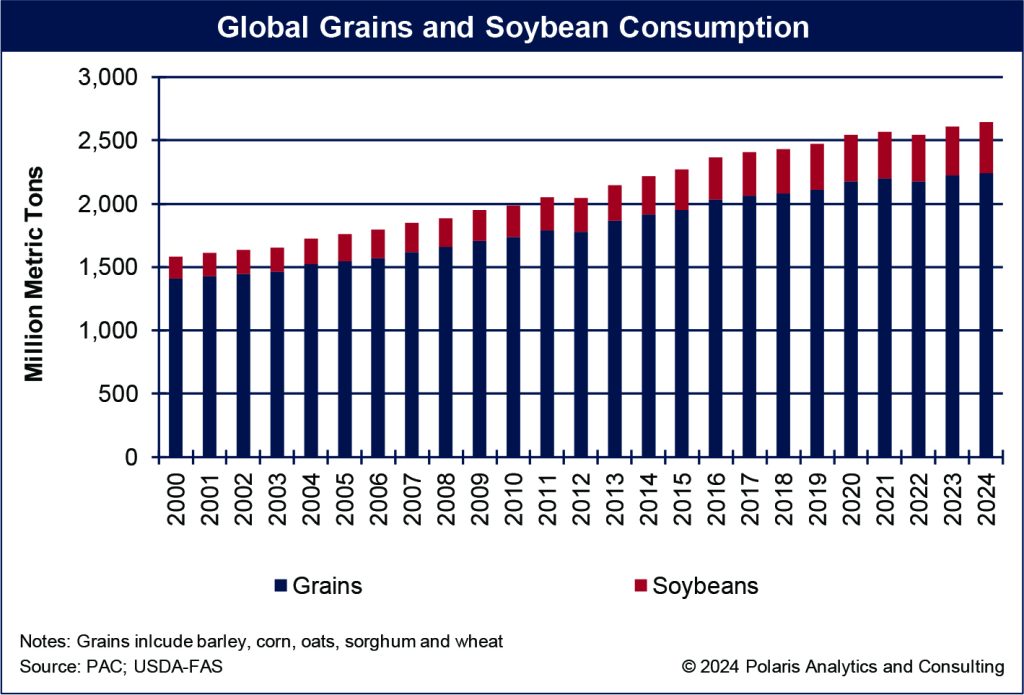

Globally, grain and soybean consumption patterns generally rise each year, doing so 54 times over the past six decades. The last time annual consumption weakened was in 2021, when it dipped 0.8%.

Over the past decade, since 2013, annual consumption growth has averaged 2% per year, totaling 2,608 million metric tons during the 2023-24 marketing year. For 2024-25, USDA is forecasting a 1.4% increase or an additional 37.6 million metric tons to be consumed, totaling 2,646 million as shown in the chart below. With a still positive global population growth rate, higher per capita income levels and a penchant for biofuels to be produced using grains or soybeans, global consumption is not expected to slow down anytime soon.

Despite positive overture, U.S. crop exports losing ground

While the USDA has a positive overture for U.S. crop exports, the reality is the United States has lost its dominance as the majority supplier of grains and soybeans to the global export market. As recently as 2000-01, the U.S. dominated the export trade scene with two-fifths of global grains and soybean market share.

But in 2007-08, the same year the U.S. devoted itself to blending corn-based ethanol in gasoline, its global market share in the grain and soybean trade plummeted, to 25% in 2012-13, the drought year, and falling further to nearly 10% in 2022-23. For 2024-25, the U.S. is expected to have a 14% market share in global grain and soybean trade as shown the included chart.

Three countries displaced the market share of the United States: Argentina, Brazil and Russia. By and large, Brazil led the way, taking advantage of its land expansion across its central High Plains or Cerredo. Every hectare of expansion planted to soybeans means, following soybean harvest, there is a hectare of corn planted on that same ground that allows for double cropping in one growing season.

With relatively low domestic use and large crop production, Brazil’s exports surpassed the U.S. in 2020-21 and have not looked back, with nearly 160 million metric tons per year since 2022-23. That volume is about 20 million metric tons more than what the U.S. sends to the global market. While the U.S. has lost market share, its level of exports hovers between 120 million metric tons and 140 million per year.

On May 21, the USDA announced funding from the Regional Agriculture Promotion Program. The funding totals $300 million and is being distributed to 66 organizations. The program seeks to help groups promote U.S. agricultural exports to areas in South and Southeast Asia, Latin America, the Middle East and Africa.

This $300 million is the first installment of five under the program. Organizations such as the U.S. Grains Council, U.S. Soybean Export Council and U.S. Wheat Associates, among others, will use the resources to secure market opportunities and bolster exports.

U.S. has resilient and reliable supply chain to serve the global markets

The U.S. grain and soybean supply chain for exports is a marvel of logistics, encompassing everything from the initial planting to the final shipment reaching foreign ports. This chain is crucial for maintaining the flow of goods and ensuring that U.S. products remain competitive on the world stage.

Efficient supply chain management minimizes losses and maximizes profits, essential for the economic well-being of U.S. farmers and the agricultural sector.

Even when there are disruptions in the supply chain, the U.S. system is resilient and reliable. Farmers across the High Plains of the United States have many options for their grain and soybeans to be shipped to export position, by rail to the Pacific Northwest, by barge down the Mississippi River to the Center Gulf or into a container.

Those movements are made possible through an intricate transportation network of barge and rail. More than one-half of all U.S. grain and soybean exports are shipped through elevators on the Lower Mississippi River, while another one-fourth to one-third move through the PNW export elevator network. The inland logistics of barge and rail handle high volumes with incredible efficiency. The loading of containers with grains and soybeans represents about 3% of export inspections. The U.S. has multiple outlets and a resilient and reliable system to be a continued supplier to the global grain and soybean trade market.

The U.S. advantage to global grain and soybean trade is its transportation network.

Keeping exports flowing

The strategic importance of U.S. grain and soybean exports cannot be overstated. As a global agricultural powerhouse, the United States has long been a key player in feeding and fueling the world’s population. The export of grains and soybeans plays a critical role in the U.S. economy, agricultural industry and the broader global food, feed and fuel supply chains.

While it might seem early to consider new crop exports before the crops are fully planted, having a target to aim at does allow for planning. For shippers and transport providers, it means understanding what storage, handling and equipment requirements might be to keep exports flowing.

Ken Eriksen can be reached at [email protected].