Farmers are sustainable protectors of their land and the resources they use to produce abundant crops. Among the arsenal of tools available to them, nothing is as important as their equipment. Farm equipment is a crucial pillar supporting agricultural productivity.

The size and technological advancements of the equipment allow farmers to cover more ground in less time, using less fuel and minimizing the impact to the ground while seeing crop yield improve. Farmers have demonstrated they are adapters of technology in their operations that provide food, fuel and fiber for the world’s population.

However, the extent of a farmer’s investment in technology is tied to the financial performance of their farm. When crop prices are high and farm incomes are improving, farmers are better able to invest in technology. Conversely, as crop prices fall and farmer income tightens, so does their willingness to make substantial investments. This is certainly the case with equipment. As farmer incomes weaken, equipment sales soften.

Farm equipment manufacturers, including publicly traded companies such as AGCO, John Deere and dealer group Titan, know the farm income and equipment sales relationship all too well. They watch crop prices closely as a proxy to farm income.

Ballooning farm equipment and machinery costs

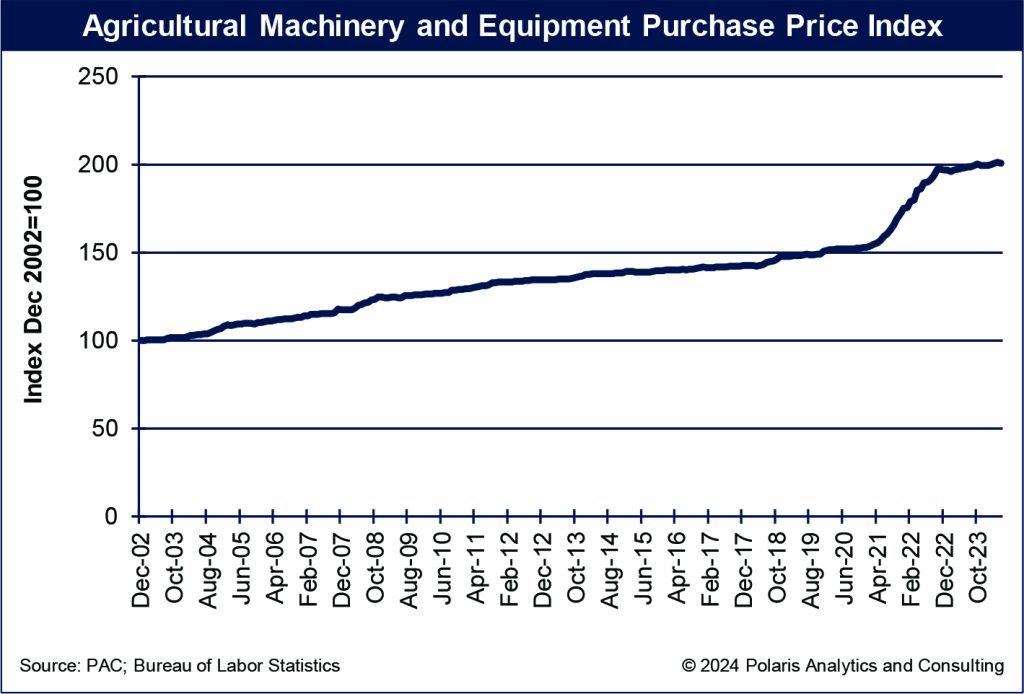

Farm equipment and machinery costs have been rising rampantly and have been a damper of a farmer’s willingness to invest in equipment. The producer price index for agricultural machinery and equipment increased at an annualized double-digit pace for 16 consecutive months from October 2021 through January 2023.

Over that time, the index increased 19% to 196.8 in January 2023. Through the COVID-19 years, this index required 47 months to increase 50 points to exceed 200. Before that, moving 50 points took 17 years as shown in the accompanying chart. Prices have not retreated. Rather, they continue to rise, posting an index of 200.7 for May based on the PPI report released by the Bureau of Labor Statistics on June 13.

According to the manufacturers, equipment prices have increased for a host of reasons, including supply chain disruptions coming out of COVID-19, higher steel costs, tight labor markets, and a backlog of electronic parts, sensors and chips, among other reasons.

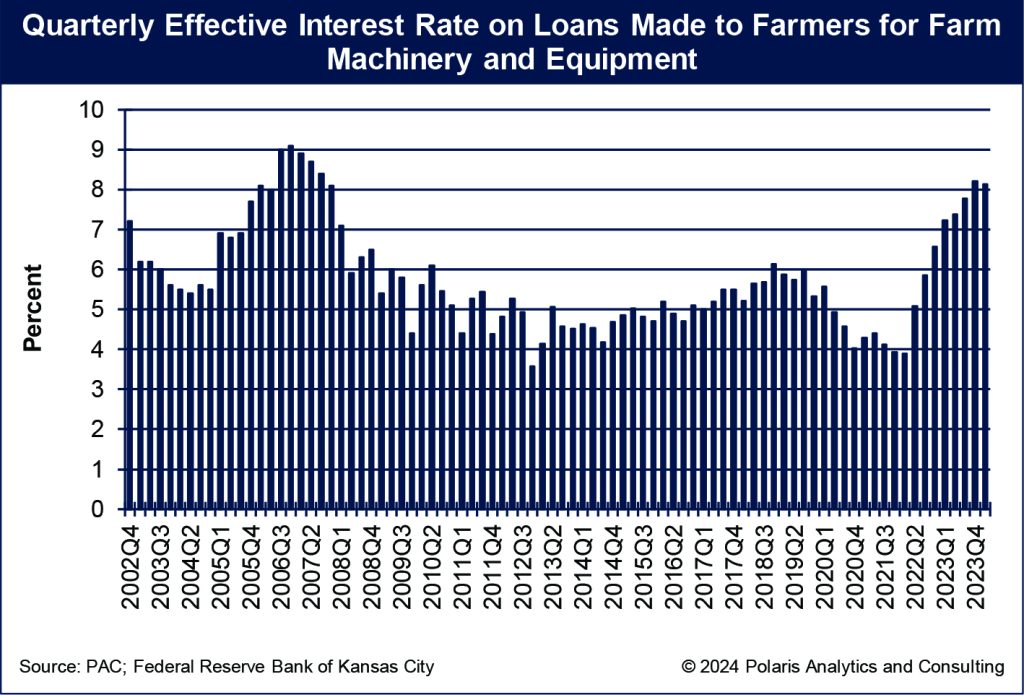

This says nothing about the cost of capital, with the average effective interest rate for farm machinery and equipment over 8%. This interest rate is the highest it has been since 2008 based on the “Survey of Terms of Lending to Farmers” available through the Kansas City Fed as shown in the following chart.

Lower farmer income thwarts equipment sales

Farmer net income, on the other hand, peaked at $185.5 billion in 2022, according to the Economic Research Service at the U.S. Department of Agriculture. For 2023 it is forecast to be 16% lower to $155.9 billion, and drop like a rock through 2024, falling another 25.5% to $116.1 billion, which will be the lowest net farm income since 2020.

U.S. farmers are feeling the pinch as crop prices have weakened, and the price outlook does not bode well. According to the USDA’s World Agricultural Outlook Board, the farmer corn price is forecast to be $4.40 per bushel for the 2024-25 crop year, down from $4.85 per bushel during 2023-24 and well below the $6.54 per bushel price for the 2022-23 crop year. The farmer soybean price for 2024-25 is forecast to be $11.20 per bushel, down from $12.55 estimated for 2023-24 and $14.20 during 2022-23.

With farmer incomes forecast to be lower and crop prices not showing any uplift, equipment sales will be thwarted. The evidence is already showing up. Based on the American Equipment Manufacturers retail sales of tractors and combines in the United States, sales are lagging well behind average, totaling 91,987 tractors in May, down 10.4% from May 2023. Farm tractor sales typically peak in April, and those were below average and at the lowest level of the previous three years.

Sales of used equipment are faring no better. The inventory of used tractors with 100 horsepower and higher totaled about 18,000 units during April, a 58.3% increase from one year ago, according to the Sandhills Global market report released on May 7. According to the report, more than one-half of the equipment is between zero and five years old. The upside to more inventory is that auction prices are falling, but pride in equipment keeps the asking price considerably higher, creating a disconnect with market reality.

The auction of used farm equipment for 2024 through June 19 across the U.S. totaled 34,498 units based on data compiled through the Machinery Pete website. Equipment sold at auction across the Northern Plains totaled 10,023 units. Auction sales peaked in 2022 across the U.S., totaling 94,831 pieces of equipment sold and across the Northern Plains with 36,698 units.

While six months remain in the calendar year, average daily sales for 2024 are behind average. Across U.S., equipment sold at auction has averaged 203 per day, compared to 213 on average, but ahead of the 194 daily sales during 2023. The pieces of equipment sold at auction across the Northern Plains have averaged 49 per day for 2024, nearly 100 units behind average and about 90 behind last year’s pace. There will be many more auctions down the road, but until asking prices and auction prices move closer together, the sales of equipment at auction will be sluggish, if now downright disappointing in a weakened farm economy.

Efficiency and resilience lead innovation and adaptation

As the farm equipment sector faces a complex array of economic conditions, opportunities abound for those farmers willing to innovate and adapt. The journey ahead will require balancing efficiency with sustainability and resilience with growth. As the sector navigates these challenges, it stands at the edge of a transformative era to reshape the future of agriculture.

Ken Eriksen can be reached at [email protected].