Managing risk in livestock production

Cattle producers are basking in the glow of high prices right now, but the one constant in farming is that high prices lead to lower prices.

The United States Department of Agriculture’s Livestock Risk Protection program may not be on your radar right now, but growers need to familiarize themselves with the myriad of LRP options and rules, says Clay Burtrum, who operates Burtrum Cattle and Farm Data Services, Inc. from Stillwater, Oklahoma. Burtrum was one of the breakout speakers at CattleU, hosted by High Plains Journal in June.

He says that for cattle producers, a host of traditional marketing programs–like forward contracting and basis contracts–are available tools. But there are many more federally subsidized programs that can help producers manage risk:

- Noninsured Crop Disaster Assistance Program, provides assistance to growers of non-insurable crops.

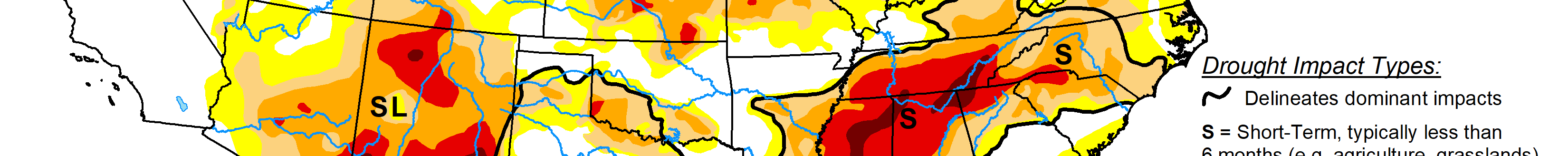

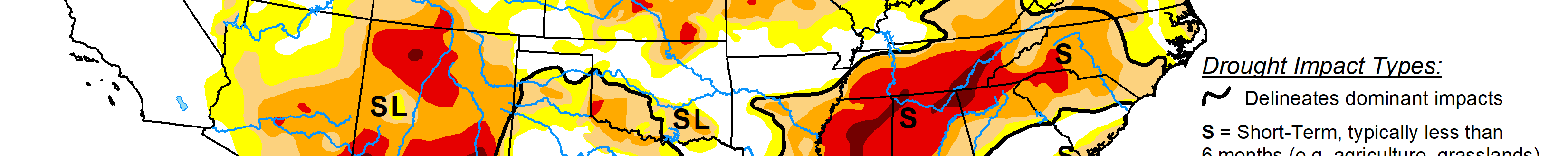

- Livestock Forage Disaster Program, provides payments to eligible livestock producers who suffer grazing losses on native or improved pastures due to drought.

- Pasture Rangeland, Forage Insurance Program, covers perennial pasture, rangeland or forage used to feed livestock and serves as a tool to cover precipitation needed to produce forage. It is area-based, meaning payments are based on an area’s deviation from normal experience.

- Annual Forage Insurance, protects policyholders if the annual forage crops yield poorly due to lack of precipitation. It is designed for operators whose crops aren’t covered by Multi-Peril Crop Insurance.

While those programs cover livestock feed, Livestock Risk Protection protects livestock producers against declines in market prices for cattle, swine and lambs, according to the USDA.

It is designed to protect from declining market prices, Burtrum said.

“Does it protect you from death loss? No. But it will cover losses due to wildfires, for example, if they are reported to your agent within 48 hours,” he explained.

“Not for the death loss,” he added, “but for the claim on the market.”

To participate, producers need to buy a Specific Coverage Endorsement, which is offered over 10 time periods, ranging from 13 to 52 weeks in length. The policy is settled on the SCE End Date. Coverage prices range from 70 to 100% of the “expected” ending value of the Chicago Mercantile Exchange’s Feeder Cattle Index.

LRP covers feeder cattle under 600 pounds (Weight 1) and from 600 to 1,000 pounds (Weight 2), but policy holders must specify between steers and heifers. There are options for cow/calf, stockers, feeders, grower yards and fed cattle and swine.

For cattle, producers can insure a minimum of one, and as many as 25,000 head annually per entity, but the limit is 12,000 at one time, he said. For swine, growers can insure as many as 750,000 head.

The premium payment provision changed a few years ago; a producer who has an indemnity or claim can have the premium withheld from the check, similar to how federally subsidized crop insurance works.

“Coverage is based on the number of head, the sex of the cattle, predicted sale weight and the contract expiration date. Coverage can be transferred to new owners upon sale,” Burtrum said. The coverage value is based on national or regional average indices, depending on which option is selected.

Like most of these insurance programs, it is paramount to stay in touch with your insurance agent, Burtrum stressed.

“You must have communication with that agent,” he said. “That way you can know exactly what you’re doing.”

Bill Spiegel can be reached at [email protected].