Recovery resources available for those affected by northwest Kansas tornadoes

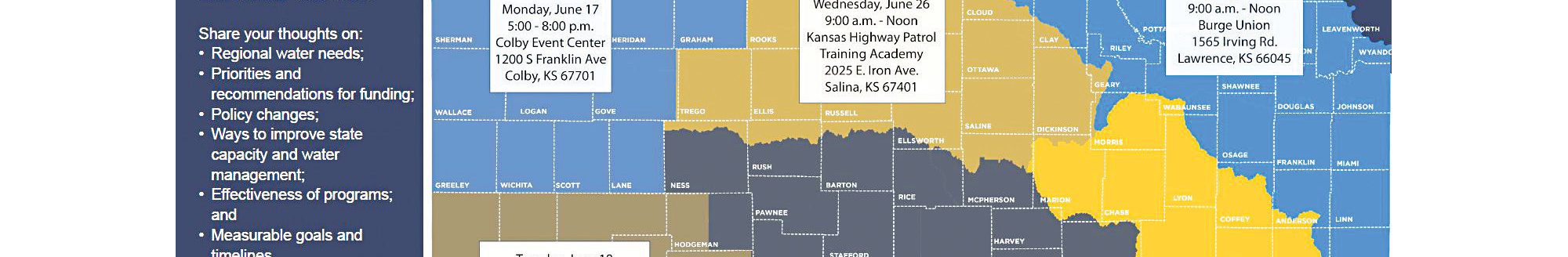

A disaster declaration was issued for Gove County and several contiguous Kansas counties following severe storms and tornadoes on May 18.

Those covered in the declaration in addition to Gove County are Graham, Lane, Logan, Ness, Scott, Sheridan, Thomas, and Trego counties. The Small Business Administration’s Office of Disaster Recovery & Resilience is currently responding in Gove County.

On June 3, the Grinnell Senior Center opened the Disaster Loan Outreach Center to help those affected by the storms to gather information about federal assistance available and survivors will be able to speak with loan officers about SBA disaster loans and receive help with applications. The Grinnell Senior Center is located at 105 S. Adams Street. The center will be open through the close of business June 25.

“Having a Disaster Loan Outreach Center like this in Grinnell brings SBA’s resources directly to the survivors of the recent tornadoes and storms,” said Natalie Longwell, public information officer with the Office of Disaster Recovery and Resilience at the SBA. “Instead of having to navigate through a phone tree or tackle an online application alone in the aftermath of the worst event of their lives, survivors can come into the Disaster Loan Outreach Center and receive one-on-one in-person attention.”

Longwell noted her team is there to help survivors in their recovery journey.

“Whether they have questions about the SBA’s disaster loan program and whether it is right for them, are ready to apply, or have been approved and need help gathering and uploading supporting documentation, our team is there to help,” she said.

Longwell said SBA’s Office of Disaster Recovery and Resilience helps communities prepare for, respond to, recover from and mitigate against all disaster types.

“Our Disaster Loan Outreach Centers are the embodiment of that mission, helping survivors economically recover after disasters and rebuild their lives,” she said.

After floods, earthquakes, hurricanes, wildfires and other disasters, SBA disaster loans are the primary source of federal assistance available to help private property owners pay for losses not covered by insurance or other recoveries, according to a news release.

“Their role in helping repair disaster-ravaged communities and make people whole again is immeasurable,” Longwell, said.

Loans are available to homeowners, renters, businesses of all sizes and private nonprofit organizations to repair or replace damaged or destroyed real estate, machinery, equipment, inventory, and other business assets.

“When disasters strike, SBA’s Disaster Loan Outreach Centers play a vital role in helping small businesses and their communities recover,” Chris Stallings, associate administrator of the Office of Disaster Recovery and Resilience at the SBA said. “At these centers, SBA specialists assist business owners and residents with disaster loan applications and provide information on the full range of recovery programs available.”

Small businesses, small agricultural cooperatives, small businesses engaged in aquaculture and many private nonprofit organizations are eligible for Economic Injury Disaster Loans to help meet working capital needs because of the disaster—even if there is no physical damage. EIDLs may be used to pay fixed debts, payroll, accounts payable, and other expenses that would have been met if not for the disaster. Businesses can apply for loans of up to $2 million.

Loans to help homeowners repair or replace damaged or destroyed real estate up to $500,000 are also available. Other loans for up to $100,000 to repair or replace damaged or destroyed personal property, including personal vehicles, is available to homeowners and renters.

Business interest rates are as low as 4%, private nonprofit organizations are 3.625%, and homeowner and renter rates are 2.563%, with terms up to 30 years for loans from SBA. Loan amounts and terms are set by the SBA and based on each applicant’s financial condition. Interest does not begin to accrue until 12 months from the date of the first disaster loan disbursement, and loan repayment can be deferred 12 months from the date of the first disbursement.

The SBA encourages applicants to submit their loan applications as soon as possible. Applications will be prioritized in the order received, and the SBA remains committed to processing them as efficiently as possible.

SBA customer service representatives will be on hand June 3 to 25 at the outreach center in Gove County to answer questions, explain the application process and help with loan applications. Walk-ins are accepted, but in-person appointments can also be scheduled in advance at appointment.sba.gov. The Gove County office will be open Monday to Friday from 8 a.m. to 4:30 p.m.

Longwell said the deadline to apply for physical damage disaster loans is July 28, and the deadline to apply for economic injury disaster loans is March 2, 2026.

If approved, applicants are not obligated to take a loan. Applicants don’t have to wait for insurance to settle. All loans have a 12-month deferment, and no interest accrues during this time. Applicants may increase their loans by up to 20% of verified physical damages to add mitigation measures to their primary residence or businesses.

Applicants may apply online and receive additional disaster assistance information at SBA.gov/disaster. Applicants may also call SBA’s Customer Service Center at 800-659-2955 or email [email protected] for more information on SBA disaster assistance.

Kylene Scott can be reached at 620-227-1804 or email at [email protected].