Cotton prices: Where are they headed?

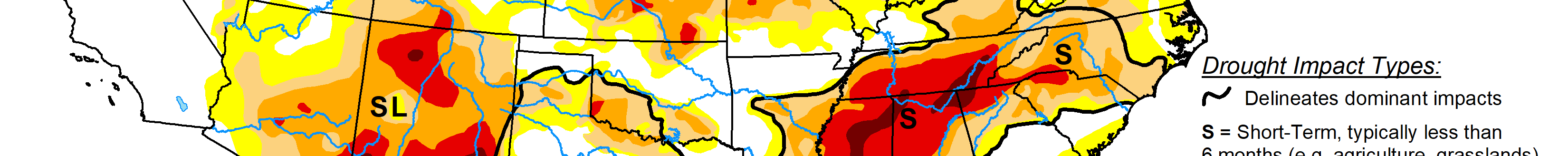

Cotton producers in the High Plains have not been living in high cotton as of late, and with the weather and economy a toss-up, the future is unknown. John Robinson, professor and Extension specialist for cotton marketing at Texas A&M University, said the cotton industry, specifically in Texas, took a nose-dive after a challenging drought began in the fall of 2021, and it has not recovered since.

“Last year, production was OK in some spots, but for some people, it was just another tough year,” Robinson explained. “But everybody took it on the chin with the price slide. We’re way overdue for a good year and when you have a bad year and then you have subsequent years that don’t make up for it, that means there’s carryover debt from all the operating loans that aren’t getting paid back. That can only go on so long.”

What is holding prices down?

Robinson said cotton prices are intricately tied to the overall health of the economy and product demand. Unlike other commodities, such as corn, beef and wheat, cotton does not always follow trends of rise and fall with supply.

“They make cotton into home furnishings and apparel, which are discretionary-type, end-products,” Robinson explained. “You don’t eat them, and you don’t put them in your gas tank. If you’re worried about the economy or your job, it’s easy to cut back on a new wardrobe.”

Although the dry weather has been a consistent thorn in the side of the industry, cotton prices haven’t stayed at the bottom of the barrel since the 2021 drought began. Robinson said prices have fluctuated in the last four years and even peaked in February and March of 2024.

“The futures market was making a run at that time, and it bounced off 85 cents per pound a couple times,” he said. “Then it went into this major slide from about March until now. I think the lows on the current ICE cotton futures are probably 63 cents, but they basically have been hovering in the mid to upper 60s.”

Robinson said it is difficult to pin down the exact reason prices are where they are today without a rally in the last year. The economy plays a significant role in buying power, but the influence of investors in the market is another element Robinson believes is manipulating values.

“Based on the supply and demand rationale for prices, I’m not surprised that prices were weaker, but I don’t see why they slid 20 cents from 85 to 65, except that there has been a record amount of speculative short selling of ICE cotton futures,” Robinson said. “The number of hedge fund-type speculators who are outright shorting the market has never been this large. They’re selling futures with the anticipation that they are going to lower, and they’ll make a profit on the downtrend.”

Robinson said the situation is unique because long bets are usually made during the growing season, yet these speculators have held a large, net-short position for over a year.

“You never know how many acres are going to get planted for months or whether Texas is two weeks from a disaster,” he said. “There’re all kinds of reasons for the crop to be smaller and therefore prices to go higher. But if I had to make a bet during the growing season for a crop like cotton, heck, I would bet that prices would go up. I imagine the only thing that’s keeping them so bearish is the expectations about poor demand and a slowing economy resulting from the trade impacts.”

What role have tariffs played in cotton prices?

According to Robinson, right after the 2024 election, the value of the dollar started declining.

“Sometimes the falling dollar is bullish to exported U.S. ag products like cotton, wheat and soybeans,” he explained. “I think the falling dollar is more like a reflection of the sentiments of people around the world that maybe don’t think the U.S. is the safe bet that it was, and maybe that’s a reaction from the tariff policy and how it was unfolded with just the uncertainty.”

The impact of tariffs in 2025 has been substantial for agriculture and trade relations in general, and although Robinson said the tariffs levied by the Trump administration have affected cotton markets, it has not been directly felt.

“The first tariffs were on steel, automobiles, Canada, Mexico, and China,” he explained. “The only two that could be cotton-related would be China and Mexico. Mexico didn’t put reciprocal tariffs on our cotton imports or exports to them. China did retaliate on some ag products, including cotton, but it just so happens that this year there hasn’t been much U.S. cotton sold to China.”

Robinson said one reason for the decline in exports to China has been Brazil’s dominance in cotton production as well as the tension between the Trump administration and China. The U.S. ended up selling more cotton to Vietnam, Indonesia and Bangladesh, instead of China.

Although trade relations with China have been icy since Trump returned to the White House in January, on May 14, the two countries entered a 90-day, temporary trade truce, which will reduce most reciprocal tariffs during that period while they try to reach a permanent trade agreement. During the hiatus, tariffs on Chinese imports to the U.S. will be 30%, while China agreed to a 10% tariff on goods coming from the U.S.

While this sounds like a move in the right direction, Robinson said the cotton prices will only improve if a deal is struck and the overall economy rallies and the unpredictability alleviates.

“Anything that slows GDP or economic growth, is historically bad for cotton demand,” Robinson said. “It makes the prospects for a growing economy and good consumer sentiment uncertain.”

Lower planted acres?

Inputs keep rising and cotton prices have hovered in the 60s, so the question is will cotton acres decline in response? According to the National Cotton Council’s 44th annual early season planting intentions survey, the overall U.S. cotton planting expectations are 9.6 million acres in 2025, down 14.5% from 2024. Texas farmers are projected to plant 5 million acres in 2025, down 15.8% from 5.95 million acres last year.

The U.S. Department of Agriculture’s June World Agricultural Supply and Demand Estimates show lower production, beginning and ending stocks, with consumption, imports and exports unchanged from May. According to the report, the production forecast is reduced to 14 million bales, compared to 14.4 million produced last year, with the second smallest crop in the past decade.

Robinson believes the planting acres are a toss-up until all producers finish planting and turn in their acres, especially with the unexpected moisture the High Plains has received in the late spring. He believes many producers could change their mind at the last minute and decide to go ahead and plant cotton even though they had not originally planned for it.

“It wouldn’t surprise me if there were 200,000 acres more cotton planted than what they measured on March 31,” he said. “If there really was a year-over-year reduction in production, I would expect it would probably pencil out to have either the same or a lower level of ending stocks compared to the 2024 crop, and that’s fundamental support for a bit stronger price.”

The question on many cotton farmers’ minds is if it is a wise decision to put cotton in the ground this year with extreme uncertainty.

“I’ve heard more reactions this year, like, ‘hey, this can’t go on, or we’re switching more to sorghum.’ There’s a lot of financial stress. The sensible thing would be not to plant cotton this year,” Robinson admitted. “The markets are telling you a signal and it’s not a happy one. But there are long-term ramifications for doing that. If cotton goes out of an area, then you start losing the infrastructure, once that’s gone then the gins and warehouses go.”

However, Robinson said there are always surprises, and he does expect 85-cent cotton at some point in the next three years. The question is, how many producers can continue growing cotton at the current price after several years of low profitability?

“If prices are going to range from 65 to 75 cents at the most and if there’s less production, then that whole range might get shifted 3 or 4 or 5 cents higher,” he said. “If there is, in fact, less production than what USDA has currently penciled out in the WASDE, I would expect what we call a supply response in the prices. But is it going to give us profitable, 85-cent prices? Probably not.”

However, Robinson does see possibilities of a price rally this year—without a decrease in planted acres—that could revive markets.

“If some good, bullish news—maybe an announcement of the end of the tariff policy—comes along to scare investors into buying back their positions, cutting their losses or preserving their profits, that could inject a little fireworks right now.”

For now, only time will tell, and cotton farmers must be resilient, wise and thrifty in the management and planting choices they make this year.

Lacey Vilhauer can be reached at 620-227-1871 or [email protected].