The U.S. Department of Agriculture released its January 2020 World Agricultural Supply and Demand Estimates report on Jan. 10.

Corn

This month’s 2019-20 United States corn outlook is for greater beginning stocks based on slightly higher production; reduced food, seed and industrial use but larger feed and residual use; lower exports; and thus smaller ending stocks.

The report raised beginning stocks by 107 million bushels based on upward revisions to both on-farm and off-farm stocks as of Sept. 1, as reported in the Grain Stocks report. Additionally, higher yields more than offset the drastic reduction in harvested area, and thus corn production was raised 31 million bushels to 13.692 billion bushels.

“Total corn use is up 155 million bushels to 14.07 billion,” according to the report. “Exports are reduced 75 million bushels to 1.775 billion, reflecting the slow pace of shipments through December, and the lowest level of outstanding sales as of early January since the 2012-13 marketing year.”

The food, seed and industrial use is lowered 20 million bushels, with lower projected corn used for starch, glucose and dextrose, and high fructose corn syrup. Feed and residual use, however, is raised 250 million bushels to 5.525 billion, based on indicated disappearance during the September-November quarter and the 2018-19 marketing year as reflected by the Grain Stocks report.

Based on use rising more than supply, the 2019-20 corn stocks were reduced by 18 million bushels, and the season-average corn price producers could expect was unchanged at $3.85 per bushel.

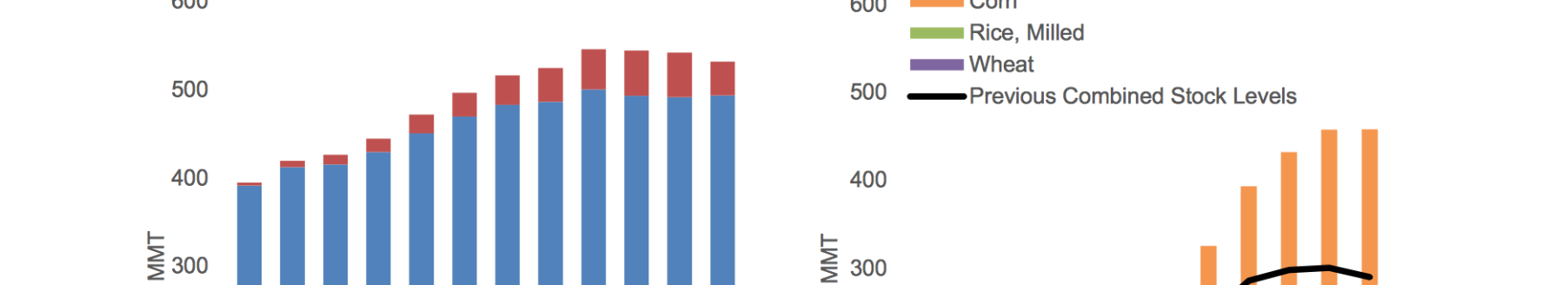

On the global front, Bangladesh, Russia and the European Union lead with higher corn production figures. While China and Australia had significant reductions in barley production those were not offset by the higher barley production out of the EU. This month’s outlook was for slightly lower coarse grain production and consumption, reducing stocks. The WASDE report estimated global coarse grain production for 2019-20 at 1.401 billion tons. Global corn stocks, at 297.8 million tons, are down 2.8 million.

Wheat

The outlook for 2019-20 U.S. wheat is for stable supplies based on increased feed and residual use, and lower stocks, according to the WASDE report. Ending stocks are now projected at 965 million bushels, down 9 million from December.

Feed and residual use is raised 10 million bushels on lower-than-expected second-quarter stocks reported in today’s NASS Grain Stocks report. Seed use is down 1 million bushels based on the ac2020-21 wheat planted area figures released Jan. 10 in the NASS Winter Wheat and Canola Seedings report. The season-average farm price is unchanged at $4.55 per bushel.

On the global side, foreign production for 2019-20 was dropped 1 million tons. Russia’s updated government production data raised its wheat production by 1 million tons. Australia’s severe drought dropped its production by 500,000 tons. The EU, though, saw a 500,000-ton increase in production that offset Australia’s report.

Foreign consumption is expected to rise fractionally, the report stated, with global exports raised 1.3 million tons. That increase is led by EU’s price competitiveness that helped move 2 million more tons of wheat, and Ukraine moving 500,000 tons more to date.

“With foreign supplies falling and total use increasing, foreign ending stocks are lowered 1.2 million tons to 261.8 million,” the report stated.

Oilseeds

The report dropped U.S. oilseed production for 2019-20 by 0.2 million tons to 107.4 million tons. A larger soybean crop partly offset the smaller canola, sunflowerseed, peanut and cottonseed crops.

“Soybean production is estimated at 3.56 billion bushels, up 8 million on a higher yield,” the report stated. The report estimates 75 million harvested acres, which is down 0.6 million from December’s forecast. The largest reductions in harvested acres came out of the Dakotas. Illinois and Indiana yields increased, which improved the report’s yield estimate by half a bushel per acre to 47.4 bushels per acre.

Even so, with lower beginning stocks and imports, soybean supplies were relatively unchanged and ending stocks are projected to be 475 million bushels.

“The U.S. season-average soybean price for 2019-20 is forecast at $9 per bushel, up 15 cents in part reflecting stronger soybean oil prices,” the report stated. “The soybean oil price forecast is raised 3 cents to 34 cents per pound. The soybean meal price forecast is reduced $5 to $305 per short ton.”

On the export side, U.S. soybean accumulated exports (shipments) to China, as of Jan. 2, totaled 9.4 million tons, and 9.7 million tons were exported to the rest of the world. Last year at this time, accumulated exports to China were 474,000 tons and 12.7 million to the rest of the world, according to the report.

“U.S. soybean export commitments (outstanding sales plus accumulated exports) to China totaled 11.2 million tons, compared to 3.5 million a year ago,” the report stated. “Total commitments to the world were 29.8 million tons, compared to 30.4 million for the same period last year.”

Cotton

The report lowered production by 100,000 bales, mainly due to a decline in Texas. That dropped ending stocks to 5.4 million bales. The upland cotton season-average price received by farmers was projected to be 63 cents per pound, up 2 cents from December, based on stronger-than-expected early season prices.

Globally the 2019-20 cotton forecasts were for lower production, trade and ending stocks. The production forecasted lowered by 630,000 bales, and included decreases for Turkey, Australia, Mali and Pakistan. Meanwhile, world consumption was virtually unchanged. Increased in use in Uzbekistan led the country to announce export restrictions based on government encouragement to implement a fully integrated supply chain that would improve lint production efficiency and implement machine harvesting and expanded million capacity.

Meanwhile, Bangladesh and Vietnam saw declines in cotton imports based on weakening apparel exports and less consumption.

World trade was projected to be 550,000 bales lower, mostly due to China reducing its expected imports by 500,000 bales.

“At 79.6 million bales, total ending stocks are projected about unchanged from 2018-19, but stocks outside of China are expected 3 million bales above the year before,” the report stated.

To read the full report, visit www.usda.gov/oce/commodity/wasde.

Jennifer M. Latzke can be reached at 620-227-2807 or [email protected].