What to expect from cattle prices, herd rebuilding in 2024

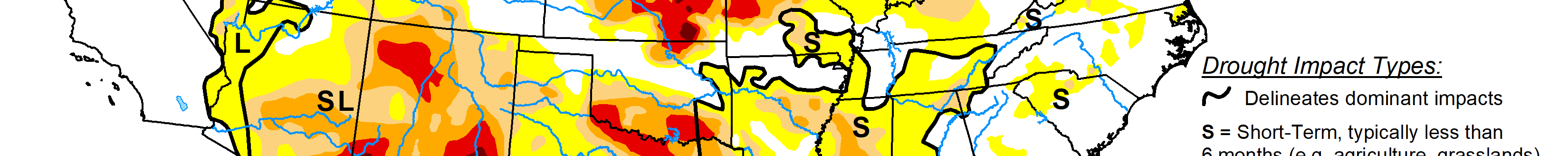

Lasting effects from drought and subsequent herd culling have driven cattle prices to extreme highs and cattle numbers to sustained lows. Oklahoma Cooperative Extension Livestock Marketing Specialist Derrell Peel shared an outlook on the 2024 cattle market and what producers can expect going forward during the recent Central Oklahoma Cattle Conference in Stillwater, Oklahoma.

He said before these high prices plateau, he expects 500-pound steers in Oklahoma to reach $4 a pound, 800-pound steers to hit $3 a pound, cull cow prices to be well over $1 a pound and fed cattle prices to go over $2 a pound.

“Whether that happens in the next month or two or the next six months or the next year and a half, I can’t tell you for sure,” Peel said.

He said the bred female market has not accelerated as fast as some people expected, but it is gearing up for a big take-off. Not surprisingly, the largest driver of cattle processing this year has been tighter cattle supplies. Peel said last year total cattle slaughter went down 4.3% and beef cow slaughter was down 11%.

“It sounds like a lot, but it was about half as much as it needed to be if we were not still liquidating the herd,” he said.

Currently, beef cow slaughter has fallen to 16%. Peel said the markets often fluctuate at the beginning of the year and they usually stabilize after a few months. However, he does believe cow slaughter will be 15 to 20% lower in 2024.

Beef production

Beef production began trending downward when the drought forced cattle producers to liquidate herds due to lack of forage and it is still on a downward trend. Peel said right now it is down 4.5%, but he expects a 5% decrease in production on top of the 4.7% decrease from last year.

“The hay situation broadly speaking, is somewhat better this year, but it’s not necessarily good,” he said. “Hay prices, broadly speaking have come down a little bit from the record highs, but they’re still pretty high and they’re probably going to stay that way.”

Last year was a record year for corn production and the ending stocks came out to over 2 billion bushels. Peel said this means the markets will not do much price rationing. The lower grain prices have spelled relief to feedlots when it came to cost of gain.

“We produced ourselves into a situation on the grain side where we’ve generally got abundant stocks pretty much across the board and lower prices,” he explained.

The annual inventory numbers show all cattle and calves in the United States are down 1.9% from last year, beef cows are down 2.5% and beef replacement heifers are down 1.4%. Peel said the feeder supply was down 4.2% and cattle on feed is still above a year ago for the time being and the calf crop last year was down 2.5%.

Currently, there are 87 million cattle, which is the smallest U.S. inventory since 1951, according to Peel. Feeder supplies are down 4.2% and this is the smallest estimated feeder supply dating back to 1972. Additionally, this is the smallest beef cow herd since 1961.

“If you compare where we are now to two years ago, replacement heifers are down over 11%,” Peel said. “The replacement heifer inventory as of Jan. 1 of this year is the smallest since 1950. We don’t have any cows and we don’t have any heifers to make cows out of.”

Peel said the feedlots have found ways to place cattle and the drought actually helped because it forced them to move cattle quickly, but the low production numbers will begin to affect feedlots.

“They’re going to run out of runway at some point and the reality is that feedlot inventory is going to come down,” he said. “One of the reasons we’ve been able to hold feedlot inventories artificially high is because we have continued to place heifers in the feedlot. As of the latest data, nearly 40% of all the cattle in feedlots were heifers. At some point in time, if we decide we don’t want to keep getting smaller as an industry, we’re going to have to stop eating all these heifers and save them for breeding.”

Females and rebuilding

“In 2022 and 2023 on average for the whole year 51% of all the cattle we slaughter were female,” Peel said. “That has not happened in this country since 1986. We’ve done some unusual things for a variety of reasons, but the bottom line is we have continued to maintain the production on the backs of females. That means we don’t have any pipeline of females really to work with.”

Peel said one of the biggest differences between now and what happened following the previous drought and rebuilding process is that from a price standpoint, producers were able to expand the beef cow herd much more rapidly from 2014 to 2019. He said the issue right now is that producers have not decided to start rebuilding yet and this rebuilding will be slower with the lack of females. In fact, herd culling set a new record in 2022 and it was still over 12% in 2023.

“If you look back to 2015, it dropped down below 8% for one year, and certainly below 9% for two or three years,” Peel said. “That’s the kind of decrease in the power side in terms of net culling that we would see if we were trying to expand the herd so we’re not there yet.”

He said the catalyst that will peak cattle prices is when producers decide to start retaining heifers and pull them from the feeder supply.

“It’s an absolutely unique situation,” Peel explained. “It’s scariest thing for a market analyst to stand in front of you and say we’ve got record high prices essentially across the board and I’m telling you that they’re going to go even higher for at least the next two years.”

Peel said he is concerned about weather predictions of La Niña returning later this year and the possibility of another drought that could set back the rebuilding process.

“We may not be done with drought and liquidation. If we are done, we’ve still got some recovery to do in many cases, but at some point, the market is going to raise prices enough that it will be worth making that long-term investment in heifers. There will be a peak and you will respond to what the market is telling you to do, which is to rebuild cow numbers and we will eventually produce our way back into lower prices.”

Lacey Vilhauer can be reached at 620-227-1871 or [email protected].