Kansas farmers felt drought on bottom line, association reports

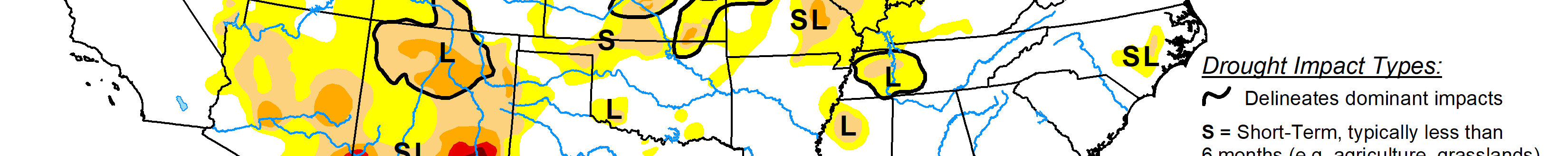

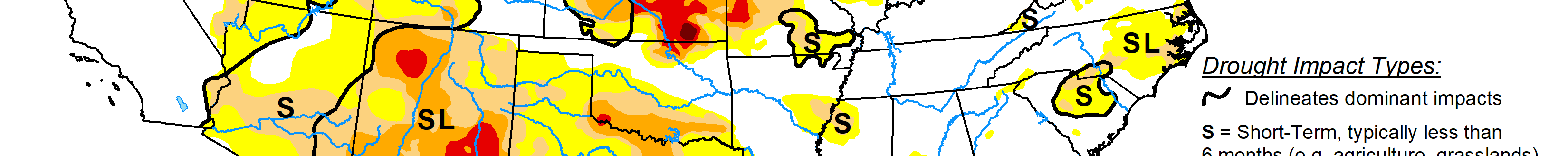

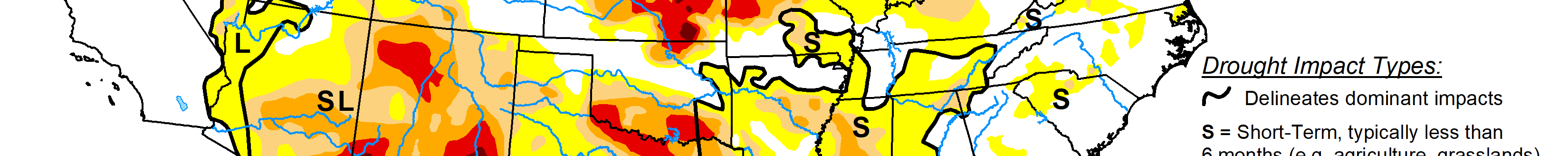

Kansas farmers felt the impact of drought statewide in 2023, and it showed on their bottom line.

Crop insurance and government payments were essential to farm income, noted Mark Dikeman, executive director of the Kansas Farm Management Association.

Drought led to lesser production, while falling grain prices occurred as a result of grain that was carried over from 2022 that was not prepriced. That was one of his assessments from a KFMA overview on net farm income in June.

Accrual basis

In 2023, net farm income, which was calculated on an accrual basis, was about $98,300 and the lowest in five years in a snapshot of the KFMA membership. The peak of $319,180 occurred in 2021, then fell to about $177,700 in 2022. Net farm income in 2019 was about $109,000 in 2019 and $174,000 in 2020.

If crop insurance and government payments were removed from the equation, the accrued net farm income would have showed a loss of $18,149, he said. The reason was net crop insurance amounted to $82,636 and government payments accounted for $33,812.

“It shows the need of some sort of support, whether government payments or crop insurance, and that has made a difference in tough years,” he said. Farmers in the western two-thirds of the state rely more on crop insurance and governments payments than their counterparts in eastern Kansas.

In 2023, dryland crop yields for corn were 106 bushels per acre; soybeans, 26 bpa; sorghum, 54 bpa; and wheat, 41 bpa. Those were all down significantly from the five-year average.

Net farm income in the northwest Kansas district was $127,300. Other Kansas districts were southwest, $103,000; northcentral, $83,700; southcentral, $62,600; northeast, $97,300; and southeast, $116,400.

Expenses for seed and fertilizer, which went up significantly beginning in 2022, have continued to stay at higher levels as the cost production per acre went from $292 in 2021 to $374 in 2023. Also, the cost of machinery investment has gone from $281 an acre in 2021 to $352 an acre in 2023. Dikeman said that was about a $100 an acre increase since 2019.

Cattle production

A positive note in 2023 was the increase in cattle prices in all sectors, Dikeman said.

One chart on the cattle enterprise data that showed return over variable cost per head showed beef cowherd-calves at $454; feeders, $530; backgrounding $111; and finish, $289.

Those numbers were significantly above 2022 figures.

Among the predictions eyed by the economists for 2024 were:

• Will Mother Nature be kind?

• Can crop production make up for lower farm-gate prices?

• Will cattle producers still see a favorable year though it may not be as potentially strong as 2023?

Also, they noted the possibility that government payments could be significantly less across the board, including for agriculture risk and profit loss coverage and ad hoc/supplemental disaster aid, although that is a big unknown.

“Without the government payments, the net farm income (farmers) would not have had the year they had,” said Kellen Liebsch, KFMA associate director.

Jennifer Ifft, an associate professor and Extension specialist in agricultural policy at Kansas State University, said based on what she has observed from Congress she expects another one-year extension of the current 2018 legislation.

Balance sheets

Overall balance sheets remained strong, Dikeman said, but he noted the impact of financial stress. About half of the farms in 2023 had an accrual net farm income of $50,000 or less. The top 25% of farms saw net farm incomes over $369,000, while the least profitable 25% had an NFI of negative $93,548.

Other trends were an increase in family living expenses, which increased to more than $120,000 for the first time on an annual basis as income taxes and self-employment taxes were up, as was food and household expenses, personal recreation and health insurance. Family expenses could be driven by higher inflation than in recent years. Also, as profits increased in the previous years, that may have spurred families to spend more on other items.

“The flip side will see lower (family living) expenses in 2024,” Dikeman said.

About KFMA

KFMA has six districts and 11 offices. KFMA economists collaborate with producers with services including accounting, recordkeeping enterprise analysis plus benchmark analysis and income tax planning and management tips.

In 2023, an average farm in KFMA had about 2,316 acres with crop acres at 1,634. Harvested acres were at 1,739 as he noted there were instances of double cropping practices.

Dave Bergmeier can be reached at 620-227-1822 or [email protected].