Colorado—In the March 10 report, compared to last report, trade activity light to moderate on good demand for horse hay markets. Trade activity light on moderate to good demand for feedlot hay markets. Bulk of trades went to stable and retail markets. Horse hay sold mostly unchanged this week on comparable hay trades. Increasing fuel costs are detrimentally impacting bottom lines for both sellers and buyers. According to the U.S. Drought Monitor’s West Summary for March 8, extreme drought was improved over northwest Colorado as both short- and long-term conditions were improving.

Missouri—In the March 10 report, compared to last report, hay supplies are moderate, demand is light to moderate and hay prices mostly steady. Despite the fact daffodils can be found blooming and many areas set a record high last week, Mother Nature was quick to remind it is still winter for a while. Snow and colder temperatures came back over the state this week with northwest Missouri seeing the highest totals. Although the cold and snow isn’t much fun to deal with the moisture was welcomed as that area is still unable to get out of drought status. There were a few reports of fertilizer buggies out last week, spreading the highest priced fertilizer in history. Fuel cost although with many other things have set new record prices as well leading to much speculation about what price levels maybe for new crop hay.

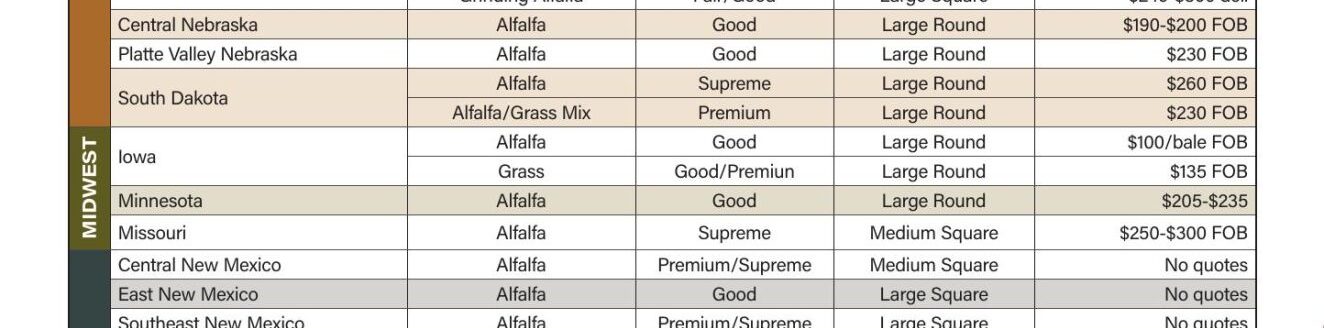

Nebraska—In the March 10 report, compared to last week baled hay sold fully steady. Dehydrated and sun-cured pellet, ground and delivered hay sold steady. Demand and buyer inquiry picked up especially in the central area of the state. There is a light amount of hay available for sale. Several sellers are on the fence if they want to sell any more of their 2021 hay crop since Mother Nature has given us limited moisture this year. As of today, it appears grass will get a slow start to the 2022 growing season. Which is a concern to a large group of livestock owners. Several livestock owners are perplexed on what or where they might get their baled hay, other forages they usually feed and how long they might be able to graze native pastures. Especially, if they don’t have a lot of irrigation.

Oklahoma—In the March 4 report, compared to the last report, due to the lack of moisture even with the winter weather storm it has allowed the hay market to increase in the amount of trades. Oklahoma is still in an abnormally dry or worse condition. Some moisture was received but not enough to allow change in the drought conditions. The Oklahoma Mesonet shows just over half of the state in an extreme drought condition or worse and much of this being primarily in the western part of Oklahoma. Next report will be released March 25.

Texas—In the March 4 report, compared to the last report,hay prices are mostly firm to $5 higher in all regions. Hay demand has picked up, but truck shortages and increased freight costs by as much as 25% have put a strain on moving hay and increased prices. That cost will continue to be passed on to the buyers, with operating costs are projected to keep rising through 2022. As producers get ready to prep fields and begin planting for next year, inflation is on there minds both in the form of trucking and inputs needed to put up a quality crop. ERS estimates an annual price increase of 235 percent for anhydrous ammonia, 149 percent for urea, and 192 percent for liquid nitrogen as of December 2021. As a result, some producers are considering growing less forages for this upcoming year to try to manage the increase in input prices, and the difficulty finding trucking on the back side of the production. There is still a lot of higher quality hay moving into the state from Colorado, Kansas, and Nebraska. Next report will be released March 18.

New Mexico—The hay growing season is over. Last report for the season was issued Nov. 5, 2021. Reports will resume in April 2022.

South Dakota—In the March 11 report, compared to last week, all classes of hay remain steady. Good demand remains for all types and qualities of forage yet the market activity has slowed considerably. Seasonal weather this week, a small snow storm moved across the region but brought very little snow. The region is still very dry as snow cover is limited to the north east corner of the state. Hay supplies are very limited across the state, which is supporting the market. A large supply of corn stalks bales are available.

Wyoming—In the March 4 report, compared to last week, all reported forge products sold steady. Demand and buyer inquiry was good. All reporting contacts in the Western side of the state are sold out of hay and continue to wait for trucks to pick up hay. All contacts in this area continue to get calls as livestock owners continue to look for hay to procure. Few, contacts in the eastern side of the state have some big squares to sell and these loads are going to Montana, western Wyoming, and some into Colorado. All continue to hope Mother Nature will deliver a heavy wet snow or rain this spring to aid in forage green up and growth. Per NRCS in Wyoming this week average snowpack is at 82% for the state. Same week last year was at 91% and in 2020 was at 113%. Next report will be released March 17.

Montana—In the March 11 report, compared to last week, hay sold fully steady. Hay movement was slow this week. Available supplies remain tight, however some producers are finding they have limited excess loads to sell after they have delivered all their contract obligations. These loads move quickly and usually without producers having to advertise. More and more hay producers are discussing 2022 hay contracts as some want to lock in a price for the upcoming hay season. $200 a ton was a common price producers and ranchers threw out again this week, however no confirmed contract sales have been establish at this point. Many producers are contemplating switching from alfalfa to wheat as wheat prices have seen huge price increases over the last few weeks. High fertilizer costs are another issue many producers are dealing with as many weigh the cost of putting on fertilizer with the expected increased yield and price. Some producers are opting to forgo putting out fertilizer this year as the increased yield may not be enough to offset the cost of application. This will lead to lower yields this upcoming year.