Since late February, corn futures for May 2024 have enjoyed a nearly 40-cent rally. The May 2024 futures contract was able to trade all the way up to the $4.45 a bushel technical resistance levels on daily charts.

In the coming weeks, corn futures prices may struggle to find reason to climb through this short-term price ceiling as the reality of 2.1 billion bushel carryout weighs on prices. However, there are three factors for corn that I’m watching closely, that may provide for price rally incentives later this spring into early summer.

From a marketing perspective

Weather watching for the second crop corn in Brazil will be the first factor that might come into play quite quickly in the coming weeks. Remember, approximately 75% of Brazil’s total corn crop is produced in this second crop (also known as Safrinha crop).

The pollination time window begins in mid-April, and there is no room for error in production. The most current U.S. Department of Agriculture’s World Agricultural Supply and Demand Estimates report for total corn production in Brazil is 124 million metric tons. Brazil demand for corn is pegged at a whopping 130.5 mmt (78.5 mmt for domestic demand with exports at 52 mmt).

Looking ahead to the April 11 WASDE report, traders will eagerly watch to see if the USDA adjusts Brazilian corn production lower. Interesting to note is that recently, Brazil’s Conab lowered its estimate of the 2023-2024 total corn crop forecast to 112.7 mmt, well below the current USDA figure of 124 mmt.

The next factor I’m watching is fund trading activity. In February, managed money in corn futures traded at a record short level reaching nearly 340,000 contracts. Since then, they have exited (bought back) approximately 95,000 contracts. Therefore, there may be plenty more room for them to continue exiting short positions in the coming weeks, but a friendly fundamental catalyst will be needed. Will that fundamental catalyst be something from weather in Brazil?

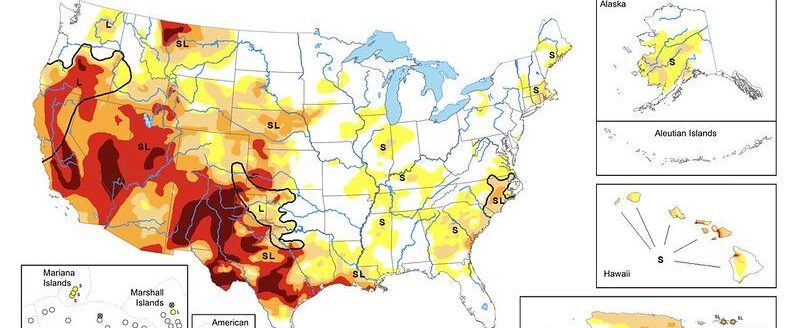

Lastly, my thoughts turn again toward the weather. Currently, many portions of the U.S. Midwest are facing parched soil conditions due to a lack of precipitation this winter. U.S. Drought maps suggest that much of the Midwest is already in a mild drought, (with Iowa in severe drought). Weather can change on a dime, but we are heading into spring with dry subsoils, which has many farmers on edge, anxiously watching longer-term weather forecasts.

Prepare yourself

Be ready for anything. The funds do hold a hefty net short position, and current market perception continues to be mildly negative due to current hefty corn ending stocks in the U.S. This reality may keep corn prices in a monotone price pattern in the coming weeks.

If you have questions, you can reach Naomi at [email protected] or find her on twitter @naomiblohm.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Carefully consider whether such trading is suitable for you in light of your financial condition. Total Farm Marketing refers to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency and an equal opportunity provider. A customer may have relationships with any of the three companies.