Southwest cotton acres abandoned as dryness affects production

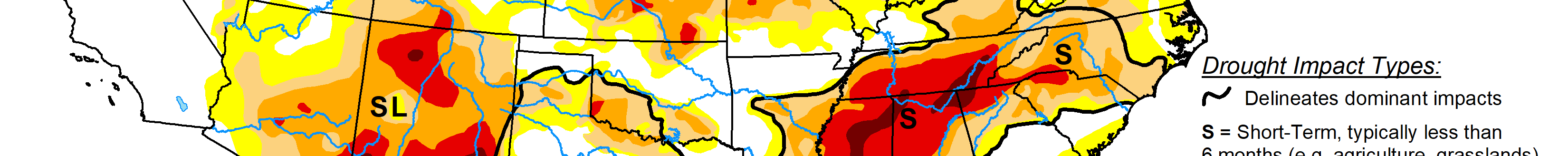

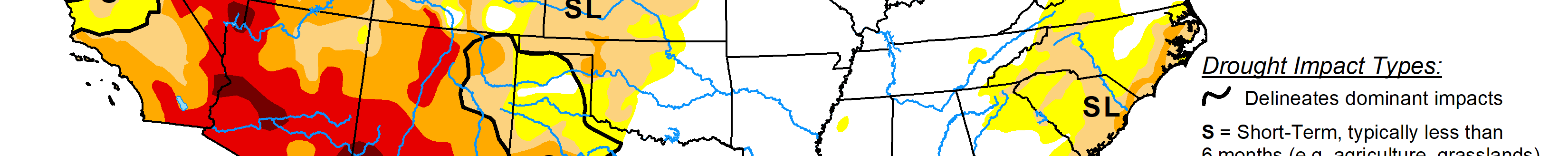

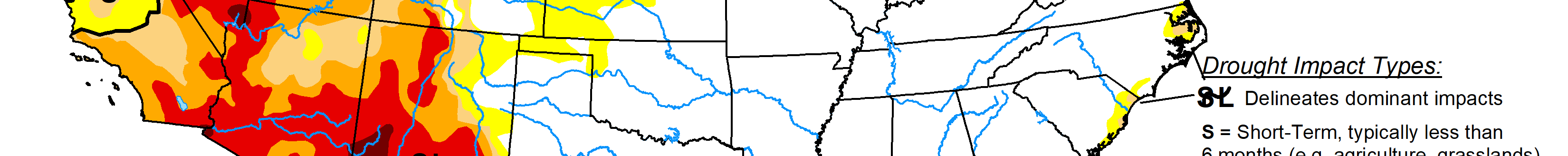

On cotton, the story in the Aug. 12 World Agricultural Supply and Demand estimates was drought in the Southwest leading to increased abandonment of dryland acres—but boosting yield estimates in remaining acres.

The 2025-26 United States cotton balance sheet for August reflected lower production, exports and beginning and ending stocks, along with unchanged consumption and imports compared to the previous month.

Planted area was lowered by 8% to 9.3 million acres, based on the National Agricultural Statistics Service’s August Crop Production report. Harvested area was reduced by 15% to 7.4 million acres as dryness in the Southwest raised the expected national dryland acreage abandonment rate from 14 to 21%.

The national average yield for 2025-26 was raised more than 6% to 862 pounds per harvested acre. The production forecast was reduced to 13.2 million bales, almost 1.4 million bales below the July forecast and 1.2 million bales lower than 2024-25. Exports were reduced 500,000 bales because of the smaller crop.

Beginning stocks for 2025-26 were reduced 100,000 bales following a corresponding increase in exports for 2024-25. As a result of these revisions, ending stocks for 2025-26 were projected at 3.6 million bales, down 1 million from last month, for a stocks-to-use ratio of 26.3%.

With tighter domestic supplies, the projected season-average upland price for 2025-26 was raised this month to 64 cents per pound.

In the 2025-26 world cotton balance sheet, production, consumption, trade, and beginning and ending stocks were all lowered compared to last month. World production was forecast to be 1.8 million bales lower as a result of reductions for the U.S., Sudan, Uzbekistan, and Mali that more than offset a larger crop in China. The forecast for world consumption was reduced by more than 100,000 bales as lower mill use in India, Bangladesh, and Turkey more than offsets an increase for China.

World trade was reduced by 1.1 million bales with projected exports lowered for the U.S., Sudan, Mali, and small changes elsewhere. Beginning stocks for 2025-26 were reduced by more than 1.7 million bales, largely reflecting higher 2024-25 consumption in China and Brazil. With lower beginning stocks and production, ending stocks for 2025-26 were reduced by more than 3.4 million bales.

David Murray can be reached at [email protected].