Good gives market analysis at KLA convention

For many beef producers, 2025 has been one for the record books.

Kevin Good, vice president of industry relations and analysis at CattleFax, told attendees during the Beef Industry University at the Kansas Livestock Association convention, Nov. 20, in Manhattan, that 2025 also had volatility.

“If you go back to the first of the year, think about tariffs on, tariffs off. Mexican border open, Mexican border shut,” he said.

In the beginning of 2025, Good and his CattleFax cohorts were suggesting the market would be higher because of where domestic supply and demand were at.

“Obviously we’ve been higher, but it’s been a compilation this year, in our opinion,” he said.

He warned to be prepared for a softer market in 2026, and Good said to look back at 2014, the last cycle high or in 2003 when the border was shut down because of bovine spongiform encephalopathy and compare it to now. This year is a much different beast than anyone could have predicted.

“This is one hybrid big market that has gotten a lot higher than any of us would have suggested as we started the year and now as we came over the last four weeks, The market is anticipating some of those things that propel the market highs to come on,” Good said. “In other words, tariffs being reduced, as well as Mexican border (possibly) being reopened.”

Doing more with less

Good said the beef industry is doing more with less, and producers should be proud of this. He noted there’s more to it than first appears.

“We are getting more beef out of the dairy industry than we ever have in the past,” he said. “We have to recognize what we’re doing there, and obviously we’re just doing a better job animal husbandry.”

During the past 20 or 25 years, production has annually been around 26 billion pounds, and Good said to keep that number in mind, especially when discussing trade and how there’s been a prolonged liquidation cycle because of Mother Nature.

“We are suggesting this year when it’s all said and done, you can see a tick of expansion as we go forward,” he said. “With that said, obviously this has been a year with record high prices and record high profitability, particularly on the cow-calf side.”

He said to think about what prices have been year over year and year to date. Markets are higher than anyone would have expected.

“Now we’re in the process of coming back, in our opinion, at least one here that more matches the supply and demand, assuming some of the unknowns, because there’s profitability, there’s incentive to expand today,” Good said.

Looking forward

When it comes to supply and demand, Good said demand growth needs to be put in perspective, and he suggests looking not only in the rearview mirror but also looking forward.

“We’re nervous, concerned about our product being too high priced because we have a president telling our consumer that we’re too high every other day,” Good said. “Sooner or later, they’re going to believe it. Sooner or later, we are going to get some pushback to demand.”

Quality shines

Beef producers have been bringing more high-quality product to the market—top Choice and Prime cuts, and for the first time in history there’s been more prime carcasses than select.

“On average, the Prime spread over Choice is wider this year than it was a year ago,” Good said. “Despite the fact we’re producing more profit, more prime product, that still holds well on the topic of our product, we need to recognize that.”

He said to also think about the dollars coming into the beef system. In the 1980s and 1990s and beef demand was “headed south at a fast rate,” he said.

“Think about real dollars in the system. Think about our prices, the relationship to our competition, our relationship to inflation,” he said. “Since the turn of the century—absolutely, it’s exploded last five years, as far as our dollars in our system. That’s really been in place since the turnaround in beef demand.”

The quality and consistency of beef wasn’t nearly as good as it is now compared to in the late 1990s.

“If you just think about the dollars in the system, our prices have gone up at least 2% on an annual basis, faster than inflation for 25 years,” Good said. “Those are real dollars that are now landing in your pocket no matter what segment of business you’re in.”

Profitability drives the herd

Profitability is really the driving force in building the cowherd going forward, Good said. When you think about the cow-calf sector, you think about Mother Nature.

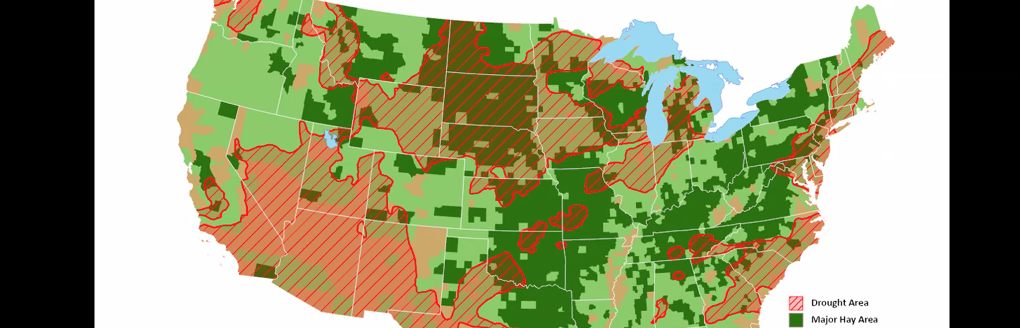

“Over the last 25 years, generally speaking, you’ve had a high percentage of the cowherd in drier ground conditions in the U.S.,” he said. “Why aren’t the cow-calf producers turning and replacing as quickly as we did in the last cycle?”

According to Good in the last three-year period, replacements weren’t being retained. Weather experts at CattleFax suggest a dry winter could be in the offing for early 2026.

“As you transition go through the spring and summer and the second half of next year in particular, the probability improves, the weather patterns will shift into a wetter pattern,” he said.

That should be good news for grain production, he said.

Beef cow slaughter numbers are down too, and Good said he expects final numbers to be 30% smaller than peak numbers. Expansion is occurring in the dairy sector, too.

“Five or six years ago, they turned them over—three lactations and they’re gone,” he said. “They’re looking at the maximum. Now they want that fourth calf, because that calf is so valuable.”

The dairy segment has been able to keep its herd at a high level. But Good does believe there will be a bigger cowherd at least into early 2026.

“We’ve bred more heifers (for) ‘26 on the beef side, we’ve bred more dairy cows in ‘25 and also more dairy heifers in ‘25 so to think about the calf crop that we’re going to produce going forward, obviously we’re going to start talking about larger supplies,” he said. “I think it’s interesting to know this is the largest dairy herd that we’ve fed in about 25 years.”

What’s ahead for beef

That does beg the question is the beef herd going in that direction? Good thinks so, with an eye on the dairy herd. At the turn of the century, every eight cows was a dairy cow. There’s been a change across the country, and in Kansas.

“We’ve got more dairy in the system, particularly as you think about beef on dairy cross,” he said. “If we look at it today, almost one out of five head we’re going to harvest is either dairy or beef on dairy cross. And in our opinion, long term, it will be cycles—long term will continue to lean on the dairy industry for more and more beef production.”

With that said, according to Good, while 2025 was one of the smallest calf crops on record, heading into 2026 to 2028 he sees an expansion. The closure of the Mexican border isn’t helping though.

“Our expectation is that as you go into 2026 the border will be reopened sometime in the first half,” Good said.

He was confident on that timeframe because the sterile fly plant is expected to be in operation to help combat the New World screwworm. Once flies are released, Good expects the border opening will soon follow.

“We’ve been watching it for a long enough time. We think we’ll see it open. The market thinks it’s open,” he said. “We have to sort the reality out as we go forward. We would assume it’s a slow roll out, just like it was this last spring. But we would also assume there’s probably somewhere to go back up across.”

Going forward, Good does see from a production standpoint, 2026 will be one of the tightest many producers have experienced thus far, and it could get interesting.

“By time we get out into 2027-28 we’re going to see production above where we’re at today,” he said. “We will come back with a combination of weights and also head count. We’ll get back to some bigger supplies, maybe a little bit quicker than we would have envisioned if we thought about it six months ago.”

Kylene Scott can be reached at 620-227-1804 or [email protected].