2026 looks promising for livestock producers

The cow-calf sector shined in 2025 and those who study the industry expect similar results, but note that is not a given.

One expert said trying to compare one year to the next in terms of “normal” or “in normal or average years” can be difficult.

“I do think there will be some similarities though. One is, prices are still going to be high,” said David Anderson, a livestock economist with Texas A&M. I expect prices to be higher in 2026 than 2025, especially during the first half of the year. Will we be higher in August-September? I don’t know, but I think so. My question about that time period it just relates to the high prices and correction we had. “

However, supplies will be smaller with fewer calves for sale, he said.

“I hope we have a lot less volatility caused by political comments that introduced a lot of volatility this fall,” Anderson said. “But that stuff will probably still be with us.”

The wait is on

One year ago, the United States cattle inventories were at their lowest level since the 1950s with 86.7 million head, said James Mitchell, associate director of Extension at the Fryar Price Risk Management Center of Excellence at the University of Arkansas Division of Agriculture.

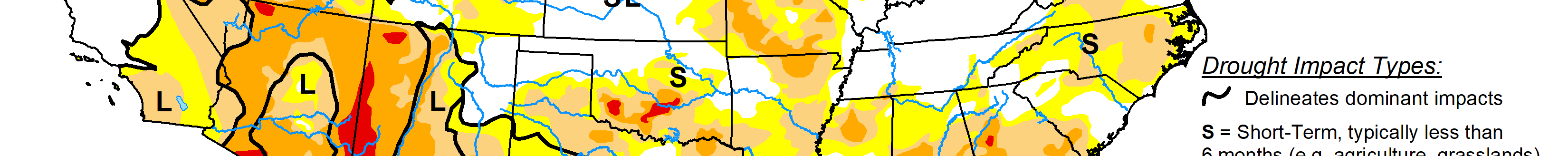

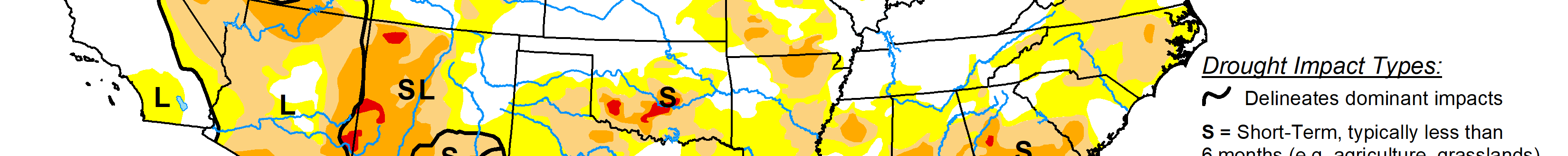

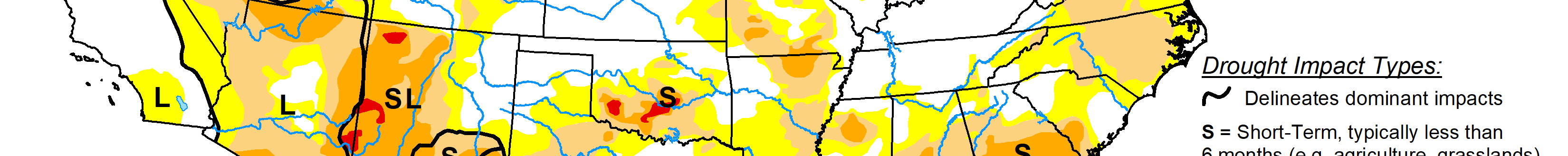

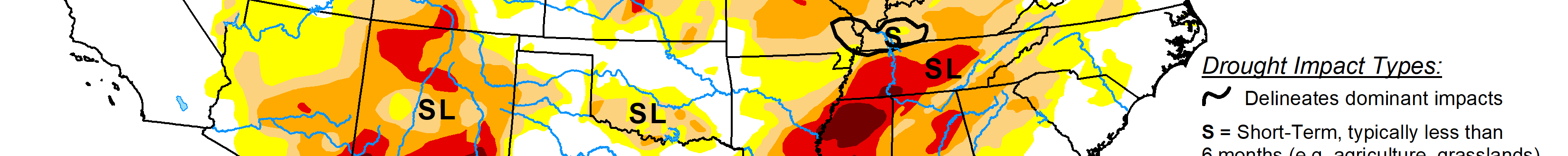

The U.S. cattle inventory has been in liquidation phase since inventories peaked at 94.7 million head in 2019. Drought in key cow-calf producing states has been the primary culprit although heading into 2026 there are signs that drought conditions have eased as have interest rates.

Anderson said he won’t be surprised to see more beef cows this Jan. 1, compared to Jan. 1, 2025.

“I think that growth, if it occurred, would come from beef cows due to the sharp reduction in beef cow slaughter,” Anderson said. “We’ve cut culling back enough that it might be enough to have more cows. There is not much evidence at all about heifer retention. There is plenty of anecdotal talk about holding a few more heifers back to grow herds, but it appears to be pretty slow.”

Arkansas steer prices for 500- to 600-pound calves have averaged $371 per hundredweight year-to-date through November, up 29% from the same period in 2024 and more than double the 2019-2023 average, Mitchell said. Arkansas feeder cattle prices for 700- to 800-pound animals are averaging $314 per hundredweight, a 32% year-over-year average.

“Even as market fundamentals suggest there are incentives to begin rebuilding the U.S. cow herd, the signals for expansion remain muted,” Mitchell said. “While beef cow slaughter has come down 17%, there is little evidence a beef heifer retention is occurring at a scale that would imply that expansion is occurring.”

Structural constraints, input costs and financial considerations will likely delay a broad-based recovery in beef cow numbers, Mitchell said. “This rebuild, when it does occur, will be slow and intentional, supporting cattle prices through 2027-28.”

What to consider doing

High prices will create some opportunities for ranchers in terms of how they might use that money to set up a more profitable future, Anderson said, adding that includes asking yourself are there some investments in the ranch that might reduce future production costs or increase efficiencies.

“High prices might enable some investment in yourself to recharge or learn some new ideas that will pay off down the road,” he said. “There are always a lot of challenges and it is everyday work that might leave little time for other things. It might be a good opportunity to give yourself a boost.”

Cow-calf shines

Chad Hart, a professor and Extension economist at Iowa State University, said for cow-calf producers, “It’s great if you’re creating calves, but it’s always been tempered if you have to buy them.”

“That’s the challenge. People think everybody in the cattle industry is making money given these prices right now. Most people in the cattle industry have to buy animals. And if you’re buying them, margins are much thinner than most people think.”

The cow-calf side is promising in 2026 and should continue as a success story that other ag sectors don’t have right now, he said.

“Beef is one of the few places where I would argue our demand is outstripping our supply,” Hart said. “That’s, the place every market wants to be.”

Other challenges

One underlining sector, feeder operations in the Southern Plains and Southwest are watching to see when Mexican cattle will return. Anderson was hopeful at some point in 2026 it will open up again, but it is uncertain yet when, or if, that will occur. Mexican cattle have not been allowed to cross the border since late 2024 because of the New World screwworm.

“That would be a huge boost to feeders in the Southern Plains and Southwest, if it’s not too late for them,” Anderson said. “The border along with a bunch of other trade policies have introduced a lot more market variability in recent months.”

Packing plant capacity

After Tyson’s decision to close their Lexington, Nebraska plant, and adjust operations in Amarillo, Texas, feedlot operators will have to adjust their marketing strategies, Anderson said.

“It’s certainly one less buyer—while the company is still going and buying cattle for other plants it does reduce buying by eliminating that plant,” Anderson said.

Multiple buyers help feeder to reduce risk and losing one does hurt with that management strategy.

“I don’t know how it changes marketing decisions though,” Anderson said. “There are some new plants with already going or in the works that will further change where cattle go. There remains plenty of packing capacity for the numbers of cattle we have today.”

Although volatility remains a part of the beef equation, there are reasons for beef producers to be optimistic in 2026, he said.

“For all the talk about price volatility and the futures market severe decline this fall, nothing really fundamentally has changed,” Anderson said. “We still have the smallest cow herd since 1961, beef production is falling overall, and we continue to have good demand for beef. That is a recipe for continued high and profitable prices.”

Dave Bergmeier can be reached at 620-227-1822 or [email protected].