Ag officials tout Phase 1 progress

Despite widely advertised tensions, progress is happening in agricultural trade relations between the United States and China. U.S. beef exports to China are expected to increase by 100% from last year, and pork exports by 80%. That was the message of agriculture export officials in a Sept. 16 webinar sponsored by the Iowa Economic Development Authority.

Iowa Secretary of Agriculture Mike Naig was the keynote speaker. He has served in that role since 2018, and before that was deputy secretary of agriculture since 2013. He noted that Iowa exports are about $16.8 billion in total ag exports to China, more than any other state except California. Naig listed the benefits of Phase 1, including an additional $77 billion in goods and services exported to China; restrictions lifted on U.S. poultry products, including pet food; an increase in the number of facilities approved to export animal protein to China, to about 3,500, including those producing dairy products and pet food; and the removal of 50 out of 57 non-tariff regulatory barriers that had been targeted by U.S. ag interests.

“Chinese food imports are constantly increasing,” Naig said. U.S. pork exports to China in the first half of 2019 are already equal to those in all of 2020. Naig did admit that Chinese ag purchase commitments are behind schedule, with only 25% met by June. Corn exports are also down for reasons related to the coronavirus and slashed demand in Japan and Canada. Total soybean exports up until June of this year had collapsed by 54% compared with the same period last year.

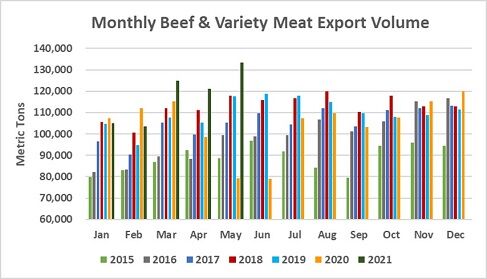

Compared with that mixed picture, Dan Halstrom, president and CEO of the U.S. Meat Export Federation, painted a somewhat rosier image of U.S. beef and pork exports, especially to a China that is rapidly rebuilding its swine herd after the devastations of African swine flu. Halstrom began by noting that much of Africa and South America remain in total lockdown to combat the coronavirus. China and Vietnam, on the other hand, are allowing partial re-openings, including of food outlets. “In a fluid environment of re-breakouts, food service is in the epicenter of outbreaks,” he said.

He also noted achievements of the Phase 1 deal, including China’s adoption of the CODEX standard for maximum hormone residues in pork. He noted that livestock, meat and poultry agricultural categories are the only Chinese categories that are ahead of 2020 budgeted schedules. By June, he said, “We [were] halfway toward our goals [with China] for all ag products, but meat and livestock are leading the way.” He said pork prices remain high, up 60% year-over-year.

The sale of ocean-chilled U.S. beef was recently re-launched at China’s Sam’s Clubs. There are still relatively few large-scale chains like Sam’s in China, he said, with much meat still being sold in small mom-and-pop shops.

A recent ag agreement with Japan, which he called a “huge ground shift,” is even bigger news than the Phase 1 deal, said Halstrom. Total U.S. beef exports to Japan are up to 41.4% from 39.2% at this time last year, and total pork exports are up to 28.4% from 23.9%. Processed U.S. meats are also doing well in Japan, he said.

Finally, Jim Sutter, CEO of the U.S. Soybean Export Council, traced the long history of U.S. soy exports to China, a 40-year effort involving patient nurturing of relationships and demand. He said increased imports by China of U.S. soybeans is “driven by actual need,” although he acknowledged that Brazil has been able to capitalize on the U.S.-China trade disputes, with the help of Chinese investment in Brazilian agriculture and infrastructure.

Like Halstrom, though, Sutter cautioned that although soy and meat producers welcome China’s renewed import activity, U.S. producers do not want to become over-reliant on any one market. He highlighted recent market openings for U.S. soybeans in Egypt, Bangladesh and Pakistan, and said global import demand for soybeans was expected to grow by about 4% a year.

David Murray can be reached at [email protected].