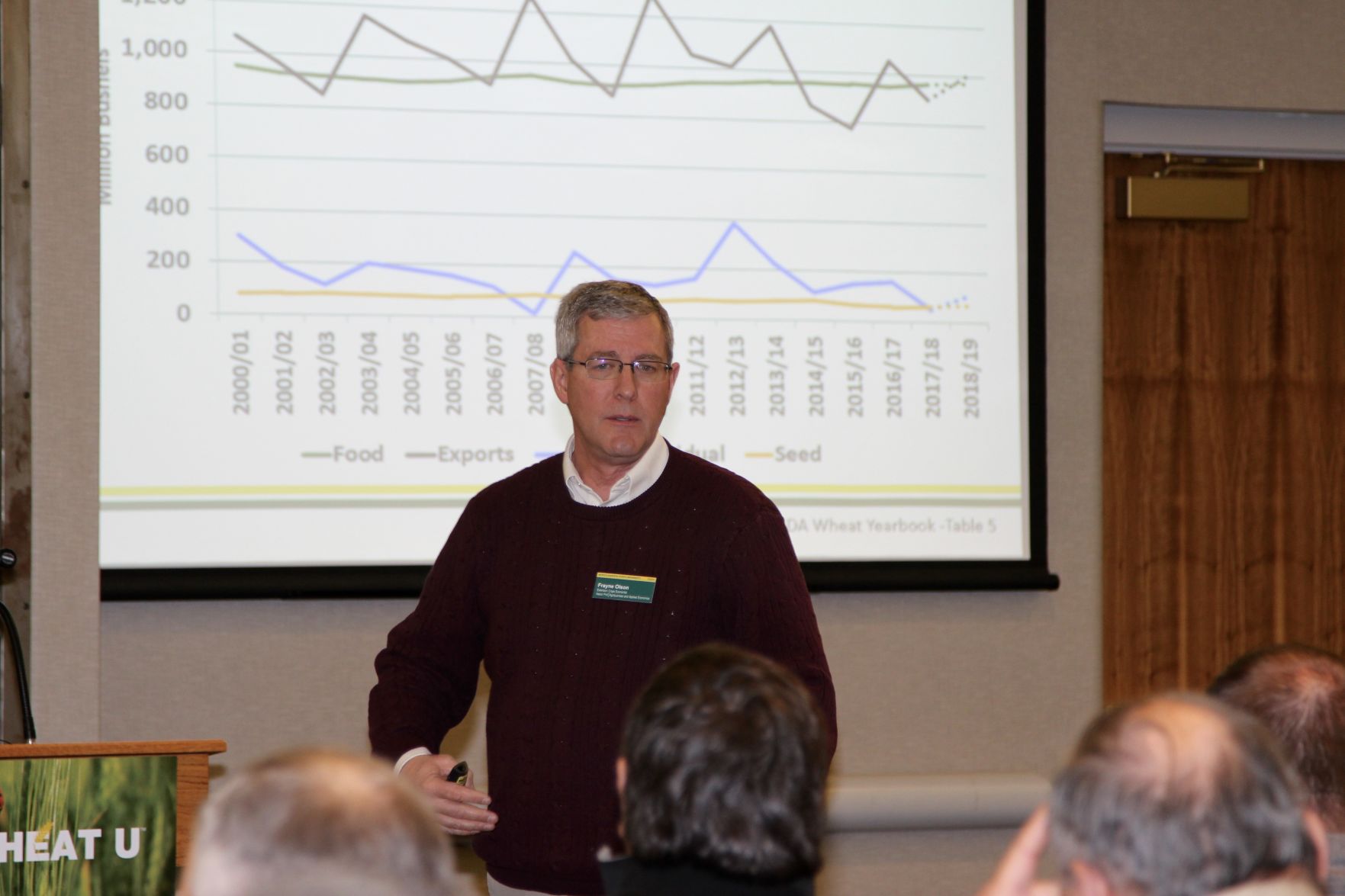

Current trade negotiations and retaliations could very well wind up having lasting effects on the future wheat trade, cautioned Frayne Olson, director of the Quentin Burdick Center for Cooperatives at North Dakota State University. Olson encouraged growers to pay heed to these issues and keep a seat at the negotiations table as part of his presentation at the 2019 Wheat U, sponsored by BASF and High Plains Journal Jan. 17, in Bismarck, North Dakota.

“For the last several months, when I’ve been talking about trade and tariffs and crop marketing, the focus has been on soybeans since they’re most directly impacted by this tariff stuff,” Olson said. “But as to trade issues with wheat, there are some immediate things that may happen in the next few months that will impact wheat markets. But most are longer term issues that will unfold over the next few years.”

American wheat growers have two options for using up the vast amounts of wheat that are produced—domestic use and export trade. Domestic use for milling and other outlets is predictable to a point, Olson said.

“The demand for milling in the U.S. is fairly predictable,” he said. “Every month, every week, the U.S. milling industry chews through a lot of our wheat.”

But, the situation gets complicated when you consider the export side of wheat demand. There are numerous countries that import wheat, several countries that compete with the United States for export markets, six different wheat classes and politics has a greater part to play in export market development and retention, he explained. And while growing domestic demand is an admirable goal, it still accounts for just half of the wheat grown in the U.S.

“We grow too much and we have to either go into the world market or cut our wheat acres in half and I don’t recommend that,” Olson said.

Wheat and other commodities rely upon trade agreements to keep the markets open for farmers. But trade is a fickle topic that relies as much upon politics as it does traditional supply and demand markers. Olson gave the example of the recent negotiations between China and the U.S. and agriculture’s prominence in the talks.

“Did we get into this trade war because of agriculture? No,” Olson said. “Agriculture got sucked into the tornado of the other stuff that’s going on.” That list includes topics such as forced technology transfer; intellectual property protections; and cyber security measures.

China is in the top four of our largest spring wheat buyers, Olson said. And with a middle class (400 million) that is larger than the total U.S. population (330 million) the country is primed to be a large agricultural product consumer on the world market.

“They don’t have enough arable land to be totally self-sufficient,” Olson said.

Right now the trade wars are over soybeans, but what happens if the U.S. and China can’t come to a compromise of terms and tensions ratchet up politically and economically, Olson asked growers.

“My concern, is will they come back if we really upset them?” he asked. “The negotiations over the next few years will set the stages.” It used to be that the U.S. was the first country you called on the world market if you were sourcing soybeans. But now with trade tensions as they are, we have become a residual supplier, the last call, Olson warned.

“That has implications long-term,” he said. “Hopefully we can mend fences and put our customers at ease that we are a reliable supplier.

“It’s just how business works,” he continued. “If I’m a businessman and I make you mad, it will take hard work to build that relationship back again. And I may even go to the next guy even if you’re lower cost just because you’re a jerk to work with.”

The Trans Pacific Partnership moved on without the United States, and that has great implications for U.S. spring wheat moving into our most reliable customer, Japan, he said.

“When it’s fully implemented in nine years, Australia and Canada will see about a $65 per million metric ton reduction in tariffs on their wheat going into Japan,” he said. “That means Australia and Canada can sell wheat into Japan for about $1.77 a bushel cheaper than we can.” Now, the U.S. and Japan have a solid relationship that’s been built over the last 30 years, but goodwill only lasts so long, Olson said.

“We are just starting to negotiate a bilateral agreement with Japan, but how long will it take us?” he asked. “It took us seven years to get NAFTA completed and six years to get the TPP negotiated.” The only reason it took a year to get the USMCA finalized was that only 2 of the 20 chapters were actually renegotiated, the rest came from the old NAFTA agreement and out of the recent TPP negotiations that the three countries already participated in, he said. The point is, that negotiations take time, and that’s time the world markets may slip further and further out of U.S. farmers’ control. That’s why it’s worth their time to monitor and give their input when it comes to agricultural trade and policy.

“We in agriculture must be very careful about watching what’s going on and participating,” Olson warned growers. “We have to have that seat at the table and a voice at the table.”

Sign up for HPJ Insights

Our weekly newsletter delivers the latest news straight to your inbox including breaking news, our exclusive columns and much more.

Jennifer M. Latzke can be reached at 620-227-1807 or [email protected].