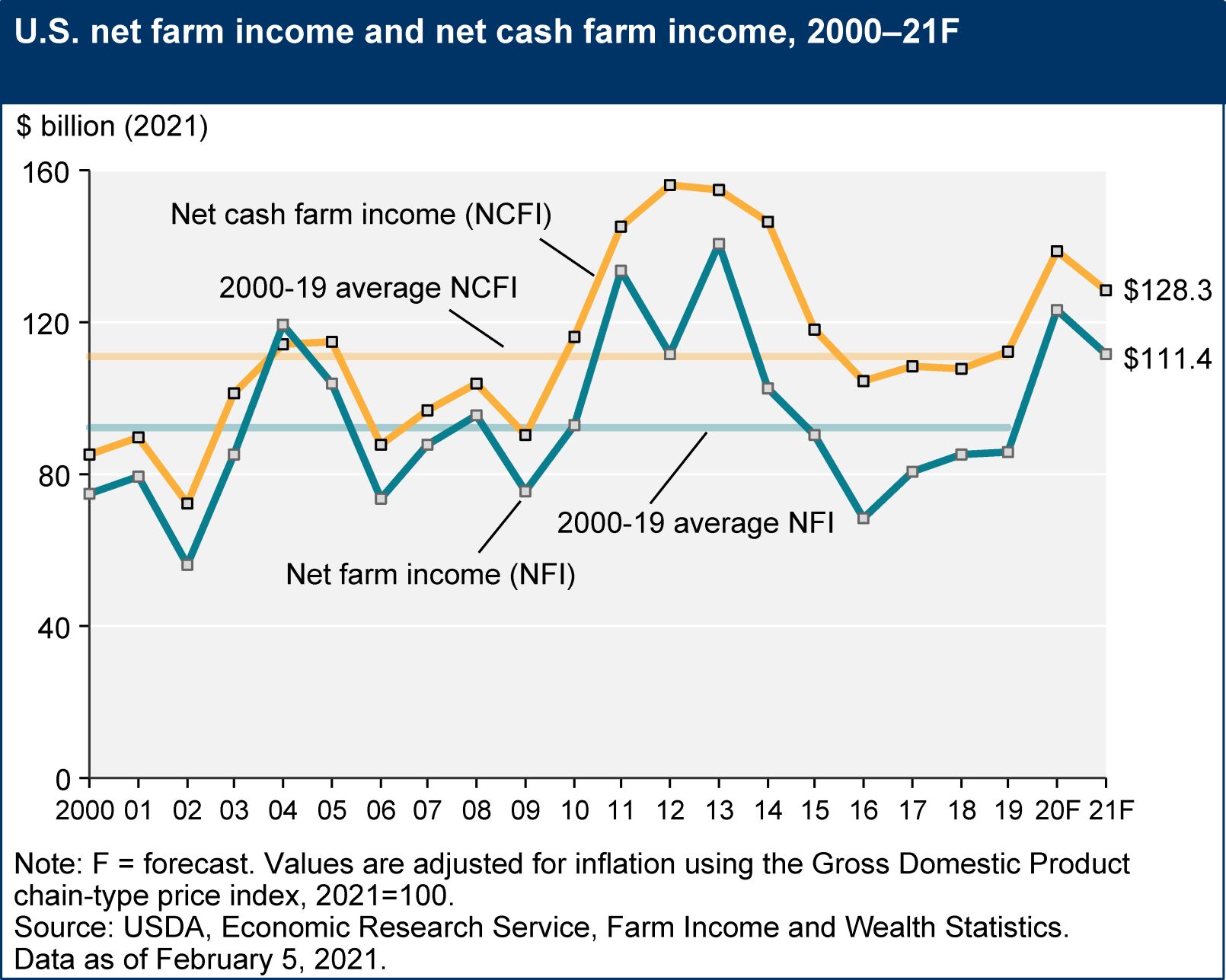

Higher expenses, lower government payments mean farm sector profits in 2021 to decline

Farmers are forecast to receive $21 billion less in direct government payments in 2021. This, combined with higher production expenses, will contribute to a drop in net farm income of $9.8 billion this year, according to the U.S. Department of Agriculture’s Economic Research Service.

USDA-ERS released its February 2021 Farm Income Forecast Feb. 5. According to the report, net farm income may reach $114.4 billion in 2021. Even with this drop, 2021 net farm income is forecast to be above the 10-year average of $92.1 billion.

If there’s any good news, it’s that the report predicts that cash receipts for all commodities will increase by $20.4 billion this year, to $390.8 billion in nominal terms. Higher prices for corn and soybeans are expected to increase total crop receipts by 5.8%, or $11.8 billion from last year. While higher prices for cattle, calves, hogs and broilers are expected to increase total animal and animal product receipts by 5.2%, or $8.6 billion.

However, higher production expenses outweigh that glimmer of light. The report predicts total production expenses, including operator dwelling expenses, will increase by $8.6 billion, or 2.5%, to $353.7 billion in nominal terms. Most of that is spending on feed, fertilizer and labor.

According to the report, farm business average net cash farm income per farm in 2021, will be $91,800, a decrease of $6,100. When categorized by commodity, most will see average net farm income fall this year, except those specializing in wheat, corn, soybeans and hogs.

Farm sector equity is expected to reach $2.74 trillion in nominal terms in 2021. The report expects increases in the value of real estate assets held by the farm sector, increasing total farm assets to $3.18 trillion.

On the other hand farm debt is also expected to rise by $9.6 billion, or 2.2%, to $441.7 billion, reflecting a 3.1% increase in real estate debt. The farm sector debt-to-asset ratio is just expected to rise slightly, from 13.84% in 2020 to 13.89% in 2021. And, working capital, or the cash available to fund operating expenses after paying off debt due in 12 months, is expected to drop 12% from 2020.

Jennifer M. Latzke can be reached at 620-227-1807 or [email protected].