5 tips to protect farmers against inflation

Amid higher costs and rising interest rates, here are ways to lessen the impact on your farm’s financial health

2022 has brought us the highest inflation in four decades. Now interest rates are rising too.

You can blame price jumps on supply-chain problems, labor shortages and even geopolitical turmoil. But the result is that farmers and ranchers are paying more for everything from fuel to fertilizers to parts and equipment.

While the Federal Reserve has said it’s determined to bring down inflation however possible, that won’t happen overnight. Some analysts believe higher costs will be with us well past summer and even into year’s end.

What can you do to protect your business from higher costs? How can you navigate through the coming months? Here are some ways to mitigate the impact on your farm’s financial health:

• Think about refinancing. The Fed has signaled it will continue raising interest rates through this year and into next. So it’s a good idea to talk with your lender to see if you can refinance your variable interest-rate loan to a fixed rate. That would be a smart step toward lowering your payments and protecting you from increasing interest rates.

• Seek out opportunity to prepay inputs. Locking in prices now for products and services can help lower your risk of continuing inflation. It’s possible to shave off some costs by negotiating with your vendor. Maybe he or she would be willing to take $45,000 if you pay now rather than $50,000 later. Perhaps your vendor needs to offload some lingering warehouse inventory and is willing to discount the product cost to you. Make a few extra calls to see if you can save money through a different suppler. A 10% saving here, a 1% cut there, can add up.

• Develop a flexible marketing plan. Talk with your risk-management advisor to make sure your plan has the ability to take advantage of price movements and swings in the market. Agriculture is no stranger to market volatility and pricing uncertainty, and this year is no different. It’s always a good idea to review your marketing strategies periodically and refine them if needed.

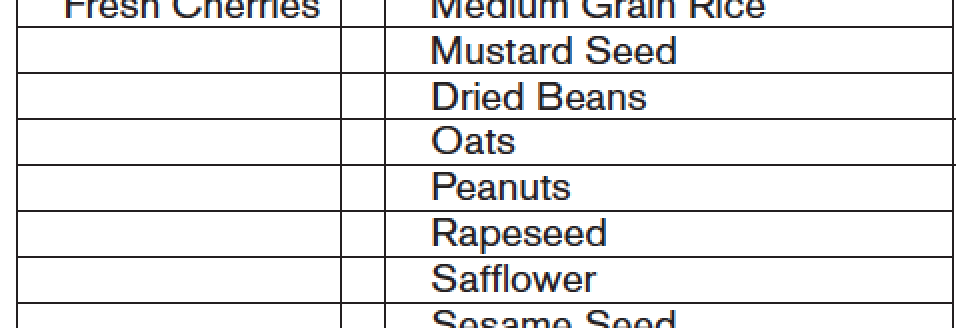

• Consider paying your employees “wages in kind.” That means paying your employees with a certain percentage of commodities, like grain or livestock, rather than in cash. For example, you could either pay cash wages of $10,000 or 1,000 bushels of soybeans worth $10,000. Not only can this save inflationary costs by not having to make cash disbursements. In-kind wages can also reduce your taxes. Wages paid in commodities are exempt from Social Security and Medicare tax for both employee and employer. In addition, wages paid in commodities are not subject to the federal income tax-withholding rules generally required. There are specific rules on this so you’ll want to discuss this option with your tax preparer.

• Stay on top of your numbers. Know your true cost of production. Keep track of the money that flows in and out of your business every month. Make sure you’re tracking all receipts, records and other financial information to remain organized and accurate. Precise information will reveal what’s actually happening on your farm or in your livestock operation. That will not only help you make better business decisions but allow you to take advantage of any profitable pricing opportunities.

Editor’s note: Maxson Irsik, a certified public accountant, advises owners of professionally managed agribusinesses and family-owned ranches on ways to achieve their goals. Whether an owner’s goal is to expand and grow the business, discover and leverage core competencies, or protect the current owners’ legacy through careful structuring and estate planning, Max applies his experience working on and running his own family’s farm to find innovative ways to make it a reality. Contact him at [email protected].