New climate-action legislation provides historic funding for ag producers

The Inflation Reduction Act incentivizes farmers, ranchers, ag processors and landowners to adopt climate-change practices, including biofuels and renewable energy expansion

Agriculture’s role in tackling climate change has taken on even greater importance with the new Inflation Reduction Act.

Approved by Congress and signed by President Joe Biden in August, the IRA is the most significant climate legislation ever enacted. It includes substantial efforts to reduce greenhouse gas emissions and sequester carbon. By providing roughly $770 billion for various industry sectors across the nation, including food and agriculture, renewable energy and manufacturing, the IRA’s reach will impact United States agriculture for the foreseeable future.

“In the coming two to four years, as these IRA programs ramp up, there’s going to be a lot of funding available for farmers and ranchers who are looking to undertake activities that can benefit climate by capturing carbon or reducing greenhouse gas emissions,” says my colleague Brian Kuehl, an ag and sustainability advisor with Pinion. “That’s where USDA will be looking to spend its money.”

The IRA provides $19.5 billion in new U.S. Department of Agriculture conservation funding to support climate-smart agriculture. The legislation also allocates $40 billion into existing USDA programs, including the Agricultural Conservation Easement Program; Conservation Stewardship Program; Environmental Quality Incentives Program; and Regional Conservation Partnership Program.

The sweeping package also includes $4 billion to mitigate drought impacts in the western states, with priority given to the Colorado River Basin and other basins with comparable long-term drought. Funding can be used by the U.S. Bureau of Reclamation to compensate farmers who voluntarily reduce their water deliveries under short-term or multi-year agreements.

Big biofuels impact

The IRA represents one of the largest-ever boosts to U.S. biofuels production. The total package includes $14 billion for rural development to expand renewable energy and biofuels infrastructure. It extends existing tax credits and includes new and expanded tax credits for biofuels, renewable energy and carbon capture and storage. There’s $500 million alone for new biofuels infrastructure—enough to deploy an additional 10,000 E15 gas pumps nationwide, Kuehl says.

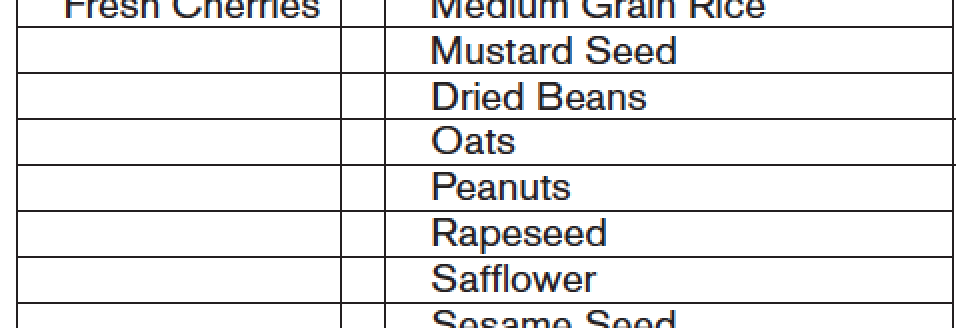

The IRA’s biofuel emphasis will benefit agricultural producers by expanding markets and increasing demand for corn, soybeans and other crops that make their way into biofuels. It also signals the continued availability of dried distillers grain for animal feed.

“The IRA, hands-down, will be one of the biggest drivers of continued biofuels production in the U.S. since the Renewable Fuels Standard,” Kuehl says. “The IRA’s Clean Fuel Production Tax Credit is truly astounding in terms of the amount of money that will flow into biofuels and in what it will mean for farmers and businesses throughout rural America.”

The IRA’s focus on biofuels is important for agricultural producers and processors because it represents long-term security for your operations. Even as the U.S. shifts to electric vehicles, biofuels will continue to be a significant piece of America’s agricultural picture. Kuehl points out that farmers who are producing crops for biofuels will increasingly be called upon to develop climate-smart action as part of an overall biofuel strategy.

“Further, the way the Clean Fuel Production Tax Credit is structured, biofuel companies will get a greater tax credit the more they lower the carbon intensity of their fuel,” Kuehl said. “One way they’ll do that will be to pay farmers for climate-smart practices. Corn farmers in particular are going to be hearing this discussion a lot in the next three years.”

Weigh the possibilities

The IRA legislation is a clear signal that climate will be a key focus of the Biden administration going forward and a significant driver for agriculture over the next decade. If you’re not already focusing on climate-smart strategies, the time to start is now. There are many IRA provisions that can benefit farmers, ranchers, processors and landowners over the next several years. Whether it’s with USDA funding, or premiums from biofuel companies or your own entry into renewable energy, opportunities are available.

If you’re considering implementing conservation measures on your farm, now is the time. Reach out to an expert to help you evaluate how this major legislation can add value and help you grow your operation.

“IRA’s provisions may not be for everyone,” Kuehl says, “but you should look into them and decide whether or not some aspect of it could be right for you.”

Editor’s note: Maxson Irsik, a certified public accountant, advises owners of professionally managed agribusinesses and family-owned ranches on ways to achieve their goals. Whether an owner’s goal is to expand and grow the business, discover and leverage core competencies, or protect the current owners’ legacy through careful structuring and estate planning, Max applies his experience working on and running his own family’s farm to find innovative ways to make it a reality. Contact him at [email protected].

Sign up for HPJ Insights

Our weekly newsletter delivers the latest news straight to your inbox including breaking news, our exclusive columns and much more.