Desert Farmer Meet Up offered insight into 2024

Farmers and ranchers from four states traveled to the Jan. 26 to 27 Desert Farmer Meet Up in Liberal, Kansas, to hear from speakers about the challenges producers may face in 2024.

Attendees on Jan. 27 asked questions about crop insurance and potential outcomes in the farm bill that Congress hopes to pass in 2024.

Kellen Liebsch, with the Kansas Farm Management Association, said farmers and ranchers in the six associations appear to be in good financial shape. “Currently liquidity sits very nicely.” As of now the asset to debt ratio is 3.44 to 1 and that bodes well for paying current and long-term bills. She is pictured in the above photo.

The past two years have been tougher with higher inflation and interest rates and the drought has limited yields and reduced cow-calf herds, she said. Plus, family living expenses for farm families have also increased, just like their urban counterparts.

Farmers and ranchers in the association are always concerned about tax management strategies, Liebsch said. They are often faced with a decision of whether to minimize income taxes or optimize after-tax income.

Liebsch said, “The hardest thing in the world to understand is income tax.” Congress has made a push to extend some Section 179 bonus depreciation incentives but until a bill is approved and signed by President Joe Biden farmers and ranchers will have to wait and see how it applies to them.

Liebsch also went through some of the mechanics of deferred contracts and strategies.

Matt Hines, a commodity broker with Loewen and Associates, Manhattan, said producers will need to focus on their bottom lines because of a decline in grain prices, most notably with corn, which had a record crop in 2023.

Hines said corn, soybeans and wheat have all faced a downturn in prices in recent months. While corn and soybean production have made the most news, he said the price of wheat has been impacted by a strong dollar. United States wheat only has about a 6 to 7% share of the global market. Russian wheat production in the Black Sea region drives the global wheat trade.

Hines said successfully marketing through this down period of prices requires producers to look at all options and first they must know their breakeven. They must also have the flexibility to take advantage of a market rally.

Justin Schrag, agency manager and owner of Strategic Farm Solutions, Moundridge, and Chock Hefner, Lindsborg, district sales manager with Farmers Mutual Hail Insurance, said crop insurance has much support in Congress, because that can help stabilitze income.

Both said since the 2018 farm bill, much has changed, including much higher interest rates, fertilizer and fuel expenses. The 2018 farm bill was extended to this year. The 2024 farm bill is likely to have an overall long-term cost of $1 trillion. The bill is all- encompassing and the bulk of its costs are tied to nutritional programs.

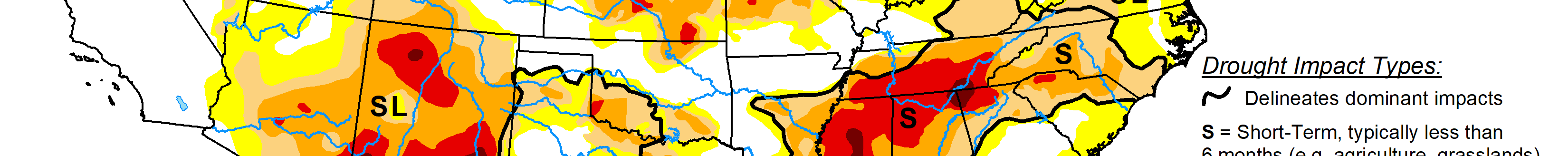

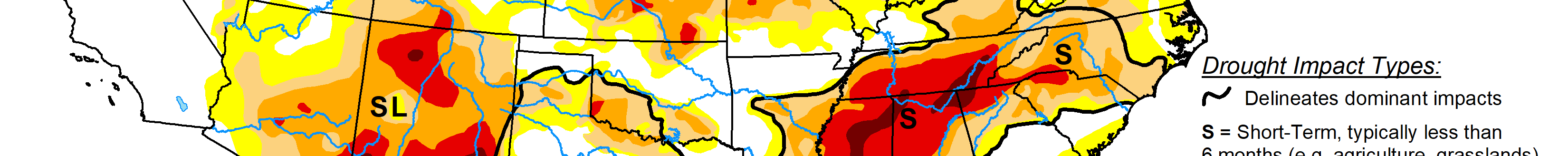

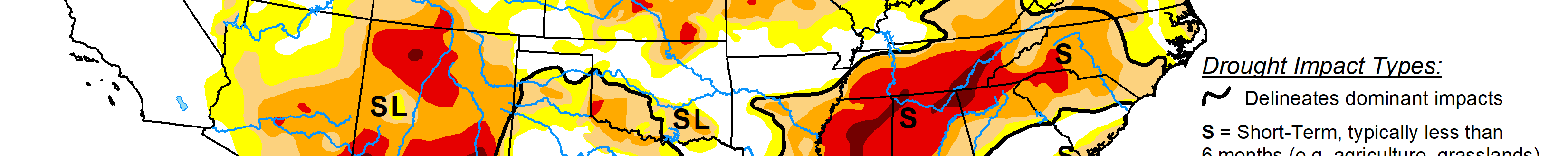

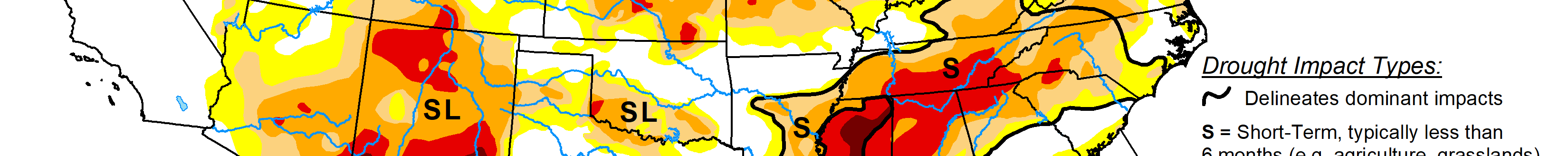

Other presentations were on crop production techniques, difficult weeds to fight, an update on the cotton market, farm labor, and plant nutrition. The evening concluded with a presentation about weather from Brian Bledsoe of Brian Bledsoe WX LLC, Colorado Springs, Colorado. A trade show gave farmers and ranchers an opportunity to learn about services available in the region.

Dave Bergmeier can be reached at 620-227-1822 or [email protected].