FCS of America returns $357 million in dividends in 4 states

Farmers and ranchers in Iowa, Nebraska, South Dakota and Wyoming will be receiving an estimated $357 million in cash-back dividends returned by Farm Credit Services of America, Omaha, Nebraska, as part of the financial cooperative’s patronage program. Eligible customer-owners will be issued cash-back dividend checks the last week of January.

“Our ability to consistently pay a cash-back dividend for 20 years and counting is a testament to FCS of America’s commitment to the cooperative business model,” says Mark Jensen, the association’s president and CEO. “The financial strength we have built is for the benefit of customer-owners and agriculture.

“Cash-back dividends are one of the many ways we strive to add value to the lending relationship with FCS of America. But there is also an exponential impact to putting money into the pockets of farmers and ranchers to invest in their operations, families and rural communities,” Jensen said.

2024 cash-back dividends distribution

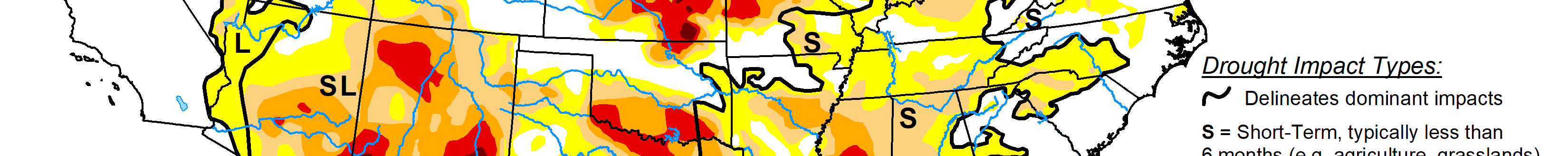

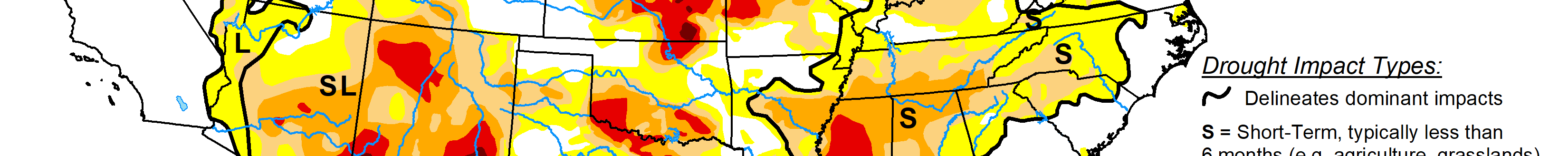

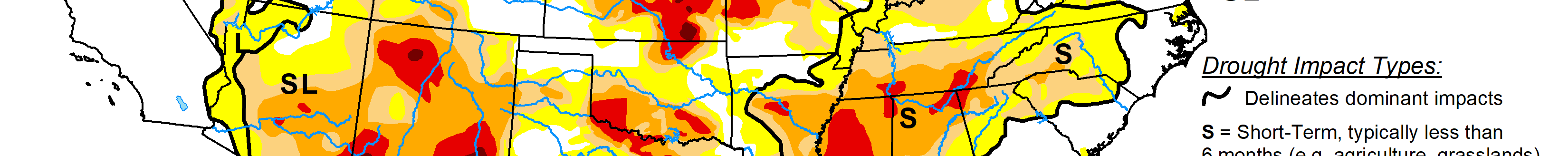

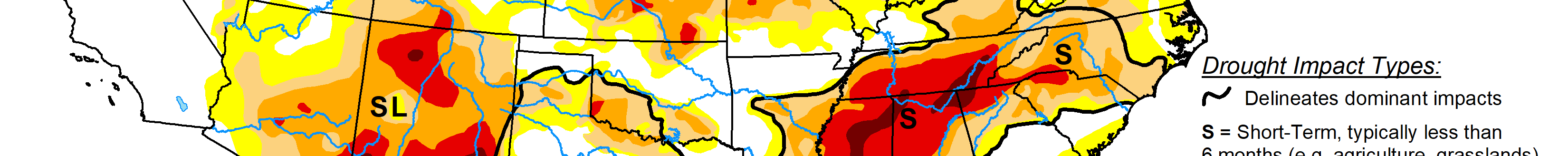

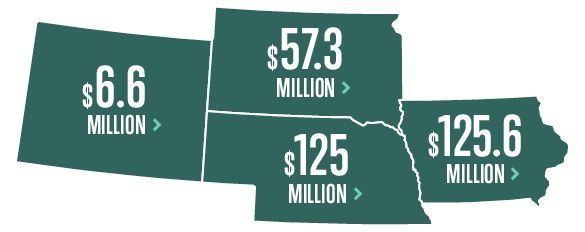

This year’s cash-back dividend is equal to 100 basis points—or a return of 1% of a customer’s eligible average daily loan balance with FCS of America. The 2024 payout equates to the following state distributions and total net income returned since 2004.

The total in 2024 and the total since 2004 are shown in Iowa, Nebraska, South Dakota, and Wyoming:

- Iowa, $125.6 million for 2024, and more than $1.3 billion since 2004;

- Nebraska, $125 million for 2024 and more than $1 billion since 2004;

- South Dakota, $57.3 million in 2024 and more than $618 million since 2004; and

- Wyoming, $6.6 million in 2024 and more than $74 million since 2004.

Customers whose cash-back dividends are distributed to locations outside FCS of America’s service territory are not included in the state-by-state totals. County-level payout data is available online at https://www.fcsamerica.com/about/cooperative-model/cash-back-dividends on the interactive 2024 Cash-Back Dividends Distribution Map.

The board of directors for FCS of America has also approved a cash-back dividend to be paid from the cooperative’s 2024 net earnings, the amount of which will be determined in December. Since 2004, FCS America has offered a patronage program and shared its success in the form of cash-back dividends. The cooperative has now returned more than $3.3 billion to farmers, ranchers and agribusinesses across its four-state territory.

Farm Credit Services of America is a customer-owned financial cooperative that helps finance the growth of rural America, including the special needs of young and beginning producers. It has nearly $43.3 billion in assets and $7.6 billion in members’ equity.