It is the darkest time of the year, with the least hours of light. Thankfully, the lights of the season and miracle of Christmas shine brightly to bring tidings of comfort and joy.

While it is the darkest time of the year, it is also a suitable time to shed light on what has happened during the past year. This column looks at exports of two key commodity and product groupings that form an important backbone of U.S. agriculture, grain and soybeans and livestock and protein products.

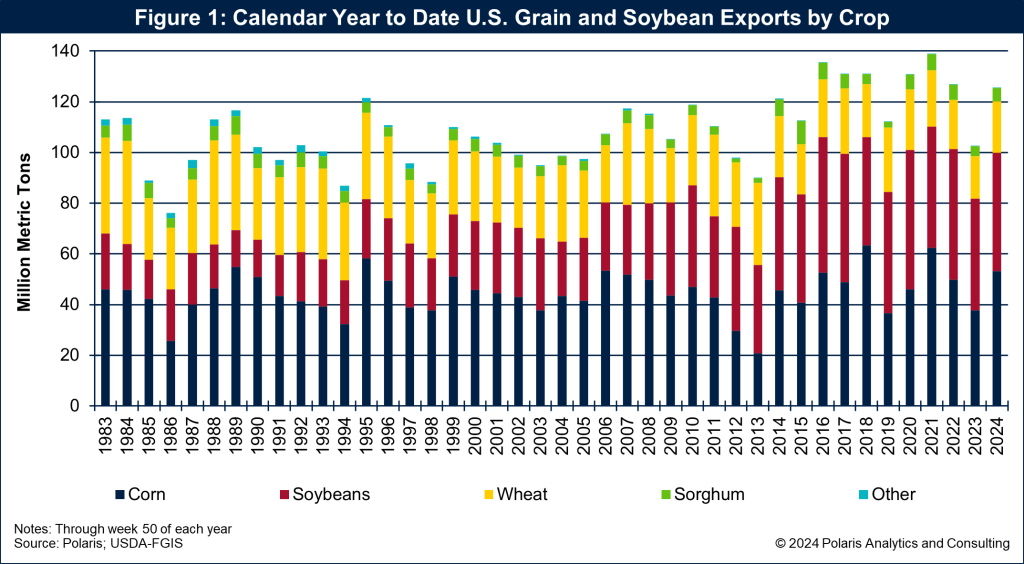

Crop exports rebound, set to end 2024 sixth largest in U.S. history

Export inspections of United States grains and soybeans have totaled 125.6 million metric tons through Dec. 12 or the 50th week of 2024. Compared to the same period during last year’s pitiful export program, 2024 exports are 22.9 million metric tons or 22% higher, while 2.8 million or 2% above the average for the past three years.

This year will likely be the sixth largest on record and the seventh time to exceed 125 million metric tons in U.S. history. Those levels of exports were conducted over the past decade, achieving a new plateau for U.S. grains and soybeans.

Corn has led the way higher, jumping 41% or 15.6 million metric tons from 2023 to 53.3 million so far for 2024. The current corn export pace is likely to be the fifth largest on record.

Soybean exports are up 5% or 2.4 million metric tons from 2023 to 46.5 million through Dec. 12. However, they are 3% behind the average for the past three years. Soybean exports are on track to being the sixth largest on record.

Exports of wheat are up 22% or 3.7 million metric tons from 2023 to 20.4 million. Compared to exports in the past three years, they are 2% above average. However, since 1984, they will likely finish 2024 as the 38th largest on record.

While China has been the top destination for U.S. grains and soybeans, totaling 32.3 million metric tons so far for 2024, compared to last year, exports are down 2.6 million metric tons or 8% from 2023. Despite the fall off to China, the export growth rate from 2023 to Mexico, Japan, Colombia, South Korea, Taiwan, Indonesia and the Philippines (sorted as largest market to smallest) is up more than double digits. Exports to these seven countries combined are up 19.3 million metric tons through Dec. 12 from 2023 for the same period.

The U.S. has been competitive exporting corn as Brazil endured a drought affecting crop potential and timing to market. However, Brazil continues to gain an upper hand against the strong U.S. dollar that makes its crops more competitive.

Places like Mexico have been strong buyers of U.S. crops to meet their consumption requirements, and the U.S. is the competitive place to source supplies. Meanwhile, the new administration is promoting tariffs as a carrot and stick for trade negotiations, perhaps leading to heightened exports before those tariffs are enforced. U.S. grain and soybean exports by crop are shown in Figure 1.

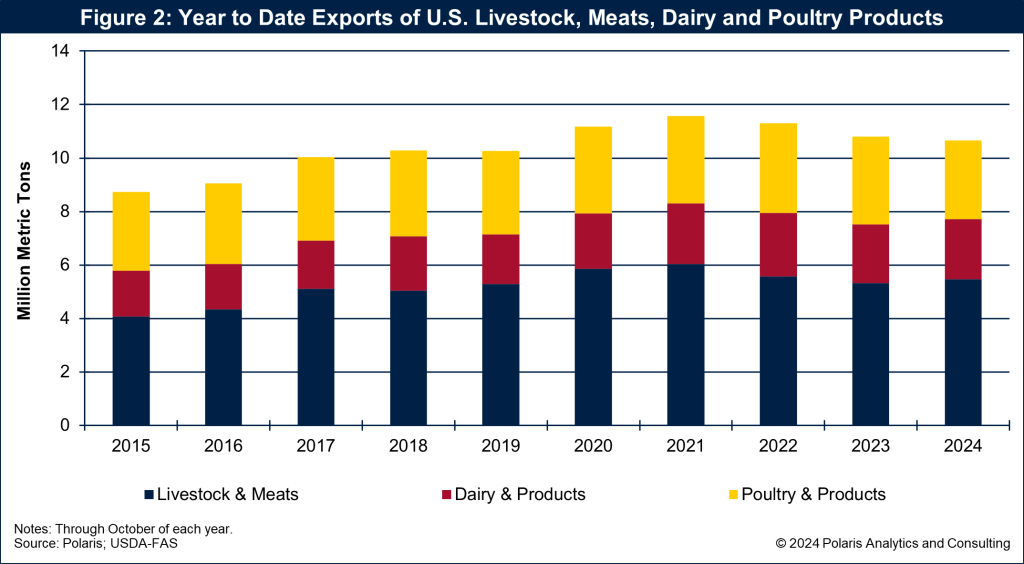

Gains in U.S. livestock, meats and dairy exports more than offset declines in poultry exports

U.S. exports of livestock, meats, dairy and poultry have totaled 10.7 million metric tons through October 2024 (the last date that current data is available). Compared to 2023, exports are down 1.2% or 131,000 metric tons while 5% or 559,000 tons below the average of the previous three years.

Exports of livestock and meat during 2024 totaled 5.5 million metric tons through October, running nearly 3% ahead of 2023, but 3% below the three-year average. Livestock and meat exports are one-half of the combined exports with dairy and poultry. Roughly one-third of the livestock and meat exports are fresh, chilled or frozen pork that have totaled 1.8 million metric tons so far for 2024 and are on pace to be the third largest level since 2015.

Dairy exports during 2024 totaled 2.2 million metric tons through October, 2% ahead of 2023 while 2% below the three-year average.

Poultry exports of 3 million metric tons for 2024 are running nearly 10% or 315,000 metric tons behind 2023, and more than 10% behind the three-year average.

Exports of U.S. livestock, dairy and poultry are shown in Figure 2.

Safety and security importing from the U.S.

That 2024 exports are outpacing 2023 volumes says more about the U.S. position as a provider to the world. The U.S. can continue to claim being an important supplier of agricultural commodities and products that the world economy needs to feed, fuel and provide the fiber for consumers around the globe.

While importers are heavily influenced by price, the U.S. offers a ray of hope with economic prowess, the rule of law and political stability that is attractive to importers when buying the commodities, products and needs for their economies.

There are forthcoming challenges on how and where the U.S. will compete in the global commodity markets. Farmers, producers, merchandisers, exporters, transport providers, governments, associations and other organizations will do well to focus on how to keep the U.S. competitive in a global market while telling the good tidings of U.S. agriculture.

Ken Eriksen can be reached at [email protected].