How OBBB has changed FSA program requirements

The One Big Beautiful Bill may have extended the 2018 farm bill, but it also introduced several adjustments that leave producers wondering what comes next. From adjusted gross income qualifications to expanded program rules, there’s still a fair amount of uncertainty—yet also opportunity—for those willing to stay proactive.

I recently sat down with Pinion Farm Program leaders to discuss what farmers and ranchers should keep in mind as they prepare for the year ahead. Staying informed and keeping Farm Service Agency records up to date will be key to making the most of upcoming program changes under the OBBB. As we talked, one message came through loud and clear—don’t make big moves until the rules are finalized.

Now’s the time to plan, not pivot

One of the most important takeaways is simple: Hold steady until official guidelines are released.

Producers should avoid making major structural changes until the U.S. Department of Agriculture issues final regulations. There’s too much uncertainty to justify changes that could have unintended tax or eligibility consequences.

The OBBB extended many farm programs, but stopped short of creating a completely new farm bill. That means producers should continue working within existing structures and focus on keeping records accurate and up to date.

Keep your FSA records current

It’s important to keep information current with the FSA office, even if you don’t expect any payments from the current programs—you never know what ad hoc program may pop up. In recent years, producers have lost benefits simply because ownership changes or operational details weren’t correctly reported. While FSA rules allow time to update information, making changes after the fact can be cumbersome, delay payments, and even draw extra scrutiny.

Keeping your records current is a simple step that can protect your eligibility and maximize potential benefits.

“Producers with livestock often overlook reporting all their grazing acres, but they should. Those acres are part of the operation and have generated significant payments in recent years,” said Jennifer Huttinga, farm program services adviser with Pinion.

“Now’s the time to start reviewing your farm operating plan and ensuring assignments of active labor and management are reflective of what the members of the operation are actually doing—and that ownership shares are reported correctly,” adds Phil Newendyke, Pinion’s lead farm program services adviser. “Find a trusted adviser to help you understand if your operation meets ‘actively engaged in farming’ and ‘cash rent tenant’ rules. It will be critical to understand the implications following the publication of the new requirements for qualified pass-through entities according to the OBBB.”

Understanding the AGI rules and CPA verification

There are now three AGI tests used by FSA programs—and each has a different formula:

- The historical $900,000 AGI cap (CCC-941)

- More than 75% average gross income test from farming/ranching (a new “second chance” option in OBBB and used for ECAP expanded limits) (CCC-943)

- More than 75% of adjusted gross income test from farming/ranching—used for programs like SDRP (FSA-510)

“It’s important that you have an expert who understands the nuances of these calculations,” Newendyke said. “They’re subject to spot check, and if selected, you have to provide documentation proving eligibility to retain the program payment.”

Certified public accountants are required to sign and include their license number on some AGI certifications to confirm that a producer meets the qualifications. Because these are detailed calculations, 3-year averages, and the FSA definitions often vary from IRS, some unintended tax strategies have caused producers to not meet these thresholds. Your tax planning should include consideration of meeting these AGI requirements if you hope to participate.

Expanded limitations and program differences

A common misunderstanding is that the $900,000 AGI limit applies to all programs—that’s not the case.

“Neither ECAP nor SDRP had a less than $900K AGI requirement,” Newendyke explains. “A lot of producers, those with a 3-year average over $900k or a one-time event that pushed them over the threshold, didn’t think they could participate. Another example of a differing requirement is that ECAP required participants to be actively engaged in farming, but SDRP does not. Most programs have a slightly different twist, and making assumptions could cost you.”

Future programs and payments

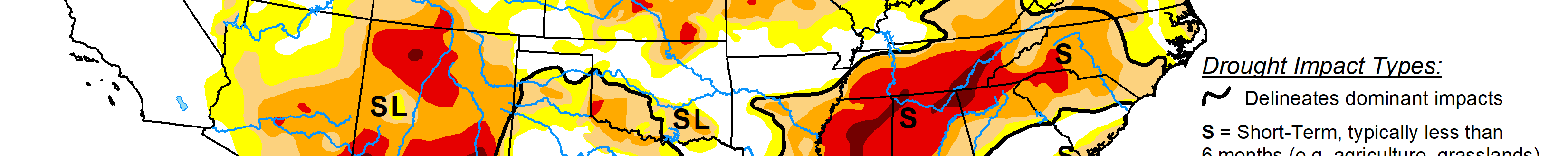

Producers should prepare for increased activity and potential payments in the next 18 months because of increases to reference prices, lower commodity prices, and changes implemented through the OBBB.

“We expect continued support for agricultural producers. It’s a shame that SDRP Stage 2, which was passed into law in December 2024, was delayed because of the government shutdown; farmers need that assistance,” Newendyke said.

SDRP Stage 2 focuses on “shallow losses” not covered by crop insurance, and its release by the USDA has been delayed due to the shutdown.

Preparation steps producers can take now

Even with many details still developing, producers can take practical steps to stay ready:

· Register and update all acres, including grazing land.

“Ensure you report your fall-seeded or perennial crops before the deadline—typically shortly after planting season,” Newendyke said. “Even if you miss the initial date, you can still go in and late file for a small fee.”

· Keep FSA documentation current.

· Review the farm operating plan to ensure ownership and contribution details are correct.

· Work with a CPA familiar with FSA’s evolving AGI and income calculation rules.

The bottom line

Producers don’t have all the answers around the changes in OBBB, but preparation and accurate recordkeeping go a long way. The rules may still be shifting, but the fundamentals of eligibility and transparency remain the same.

As Newendyke cautions, “Don’t assume you’re eligible just because you have been in the past. The programs are evolving—and so should your approach.”

Editor’s note: Keaton Dugan, a certified public accountant, advises farmers and agribusiness owners on strategic tax planning, succession strategies, and long-term financial sustainability for Pinion, LLC. Whether the goal is to expand operations, transition ownership, or optimize tax structures, Dugan draws on his experience as a trusted advisor and his background working on his family’s multi-generational farm to deliver practical, tailored solutions. Contact him at [email protected].